Introduction

Over the last few months, Adalytics assisted a Fortune 500 advertiser to analyze the efficiency and efficacy of their ad spend. The Global Head of Media thought their brand was minimally exposed to “Made for Advertising” (MFA) inventory in the second half of 2023. This reflects a general sentiment throughout the industry about MFA exposure, following numerous highly-publicized statements from ad tech vendors and agencies touting their work to block MFA sites and eliminate brands’ exposure to these sites. Adalytics conducted an analysis on behalf of the aforementioned Fortune 500 brand. Adalytics found the brand spent over $10 million on MFA websites through a comprehensive analysis of their programmatic, private marketplace, direct buy, social media, and retail media investments.

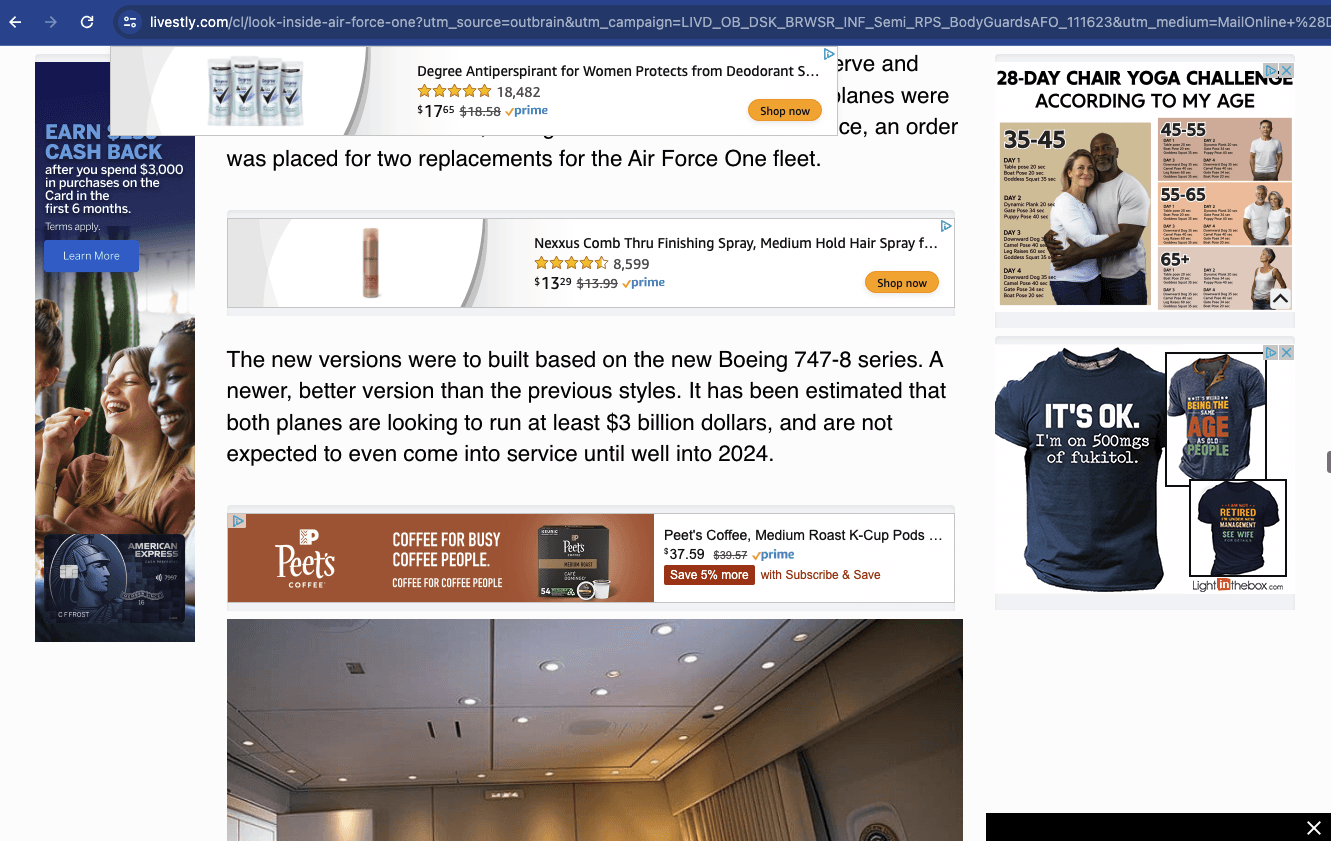

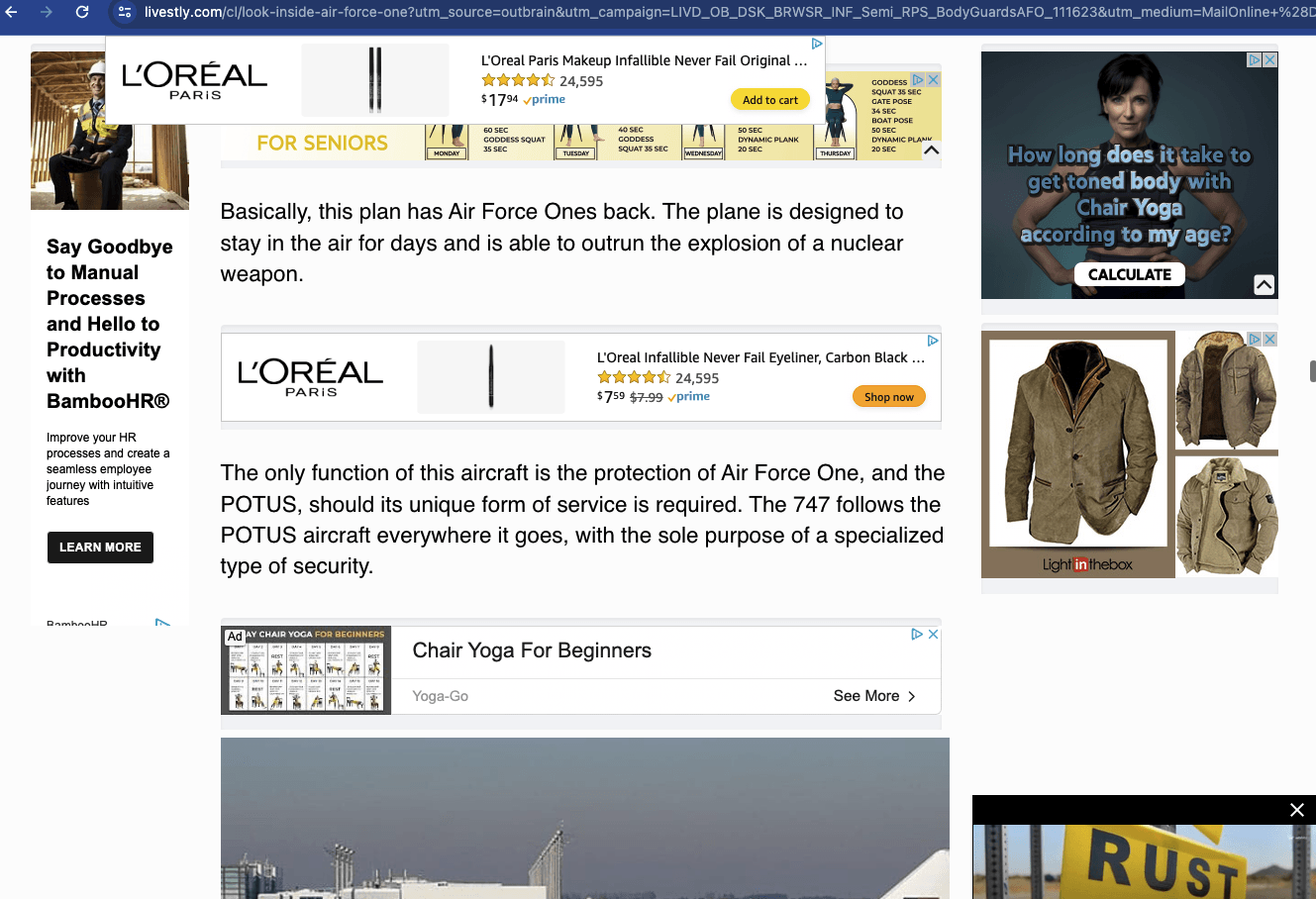

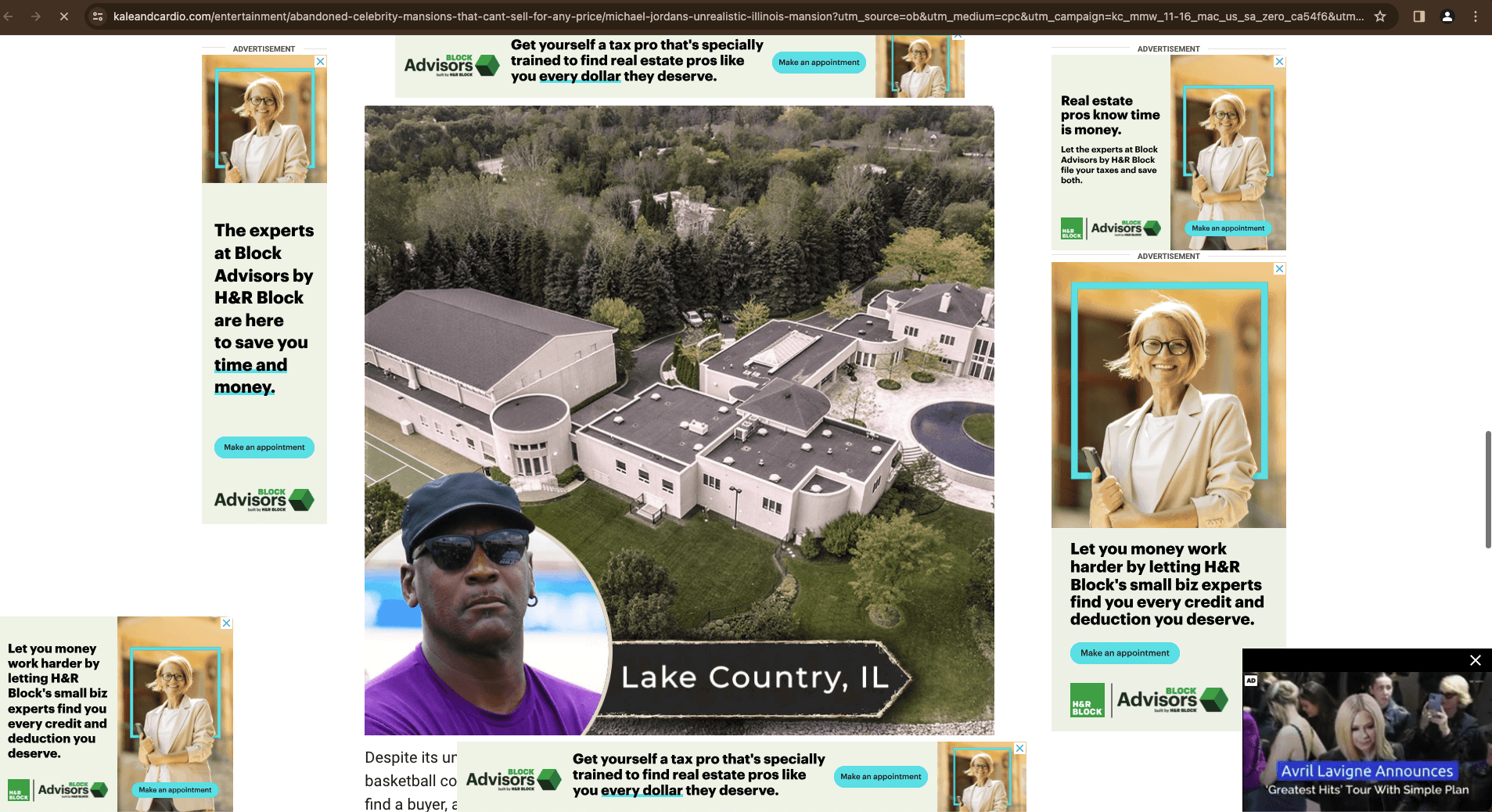

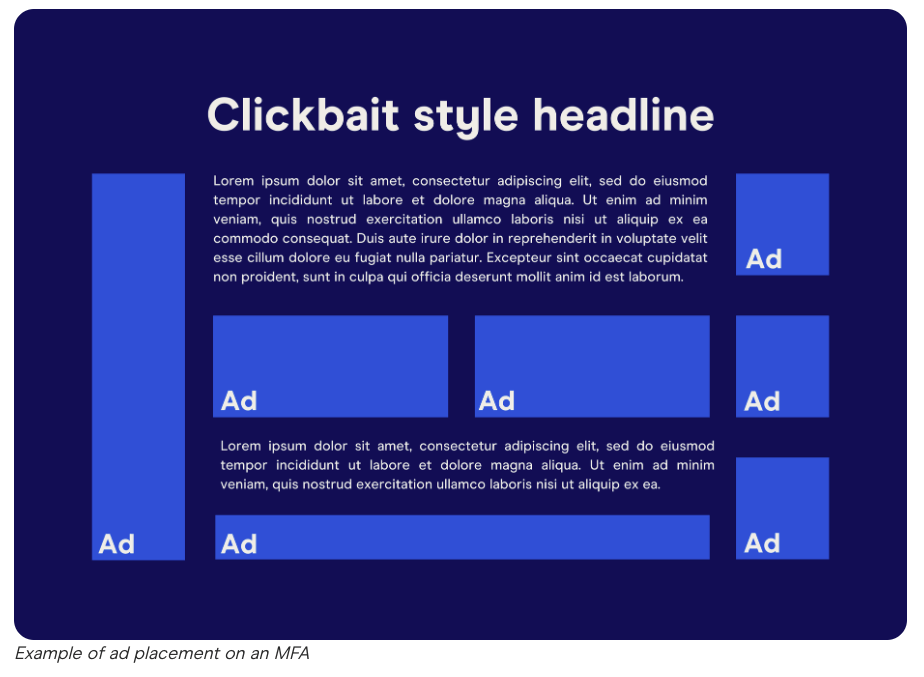

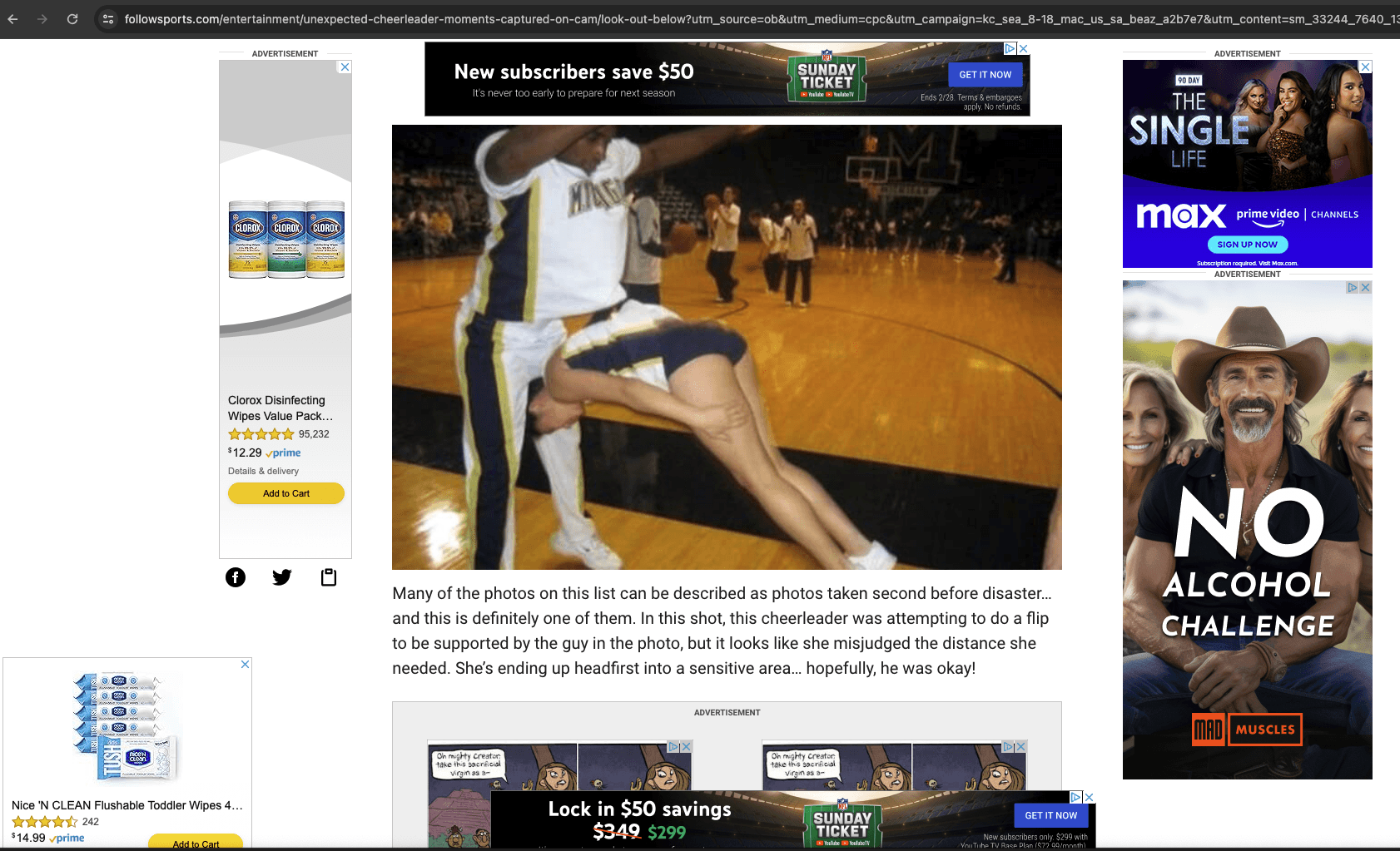

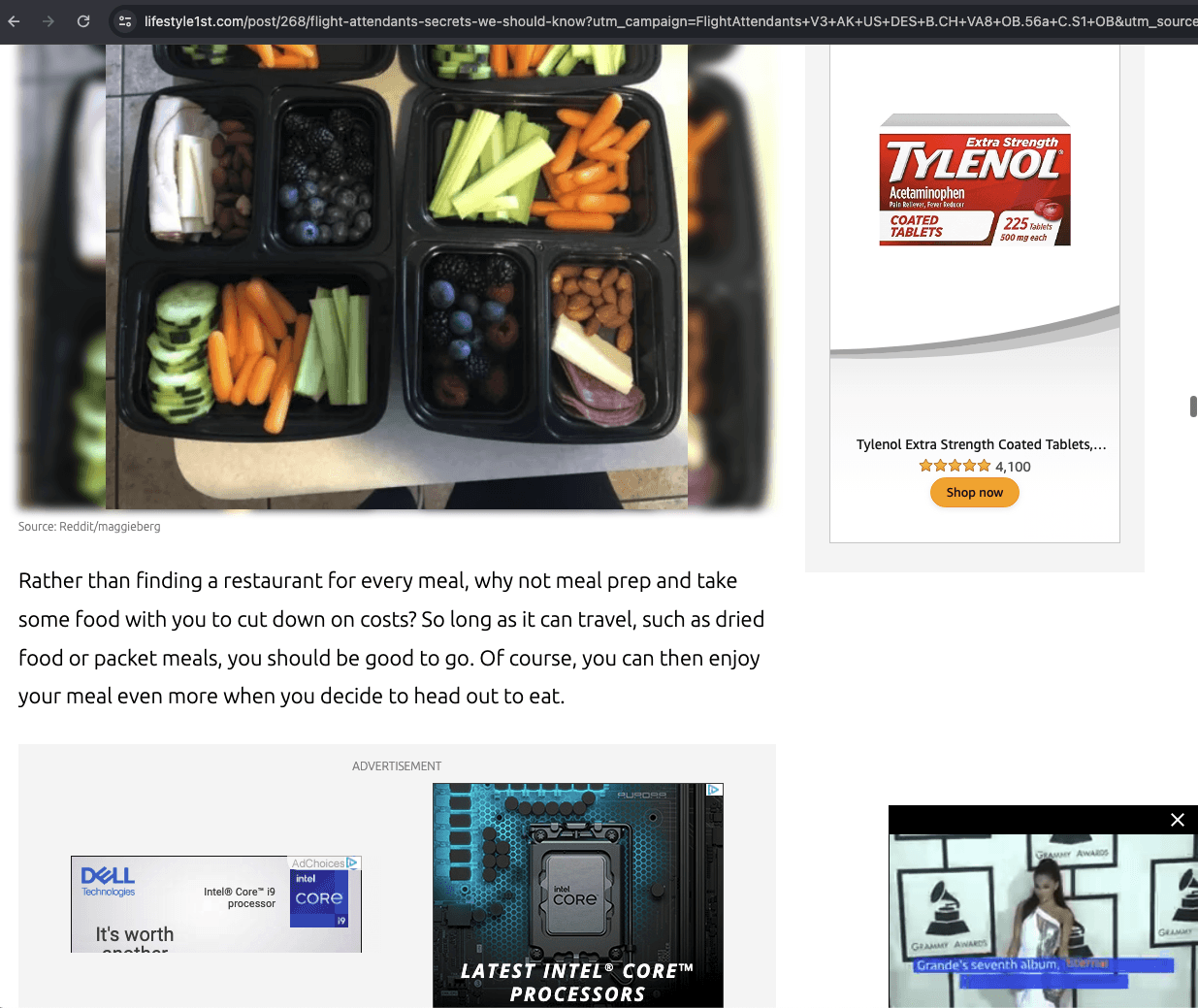

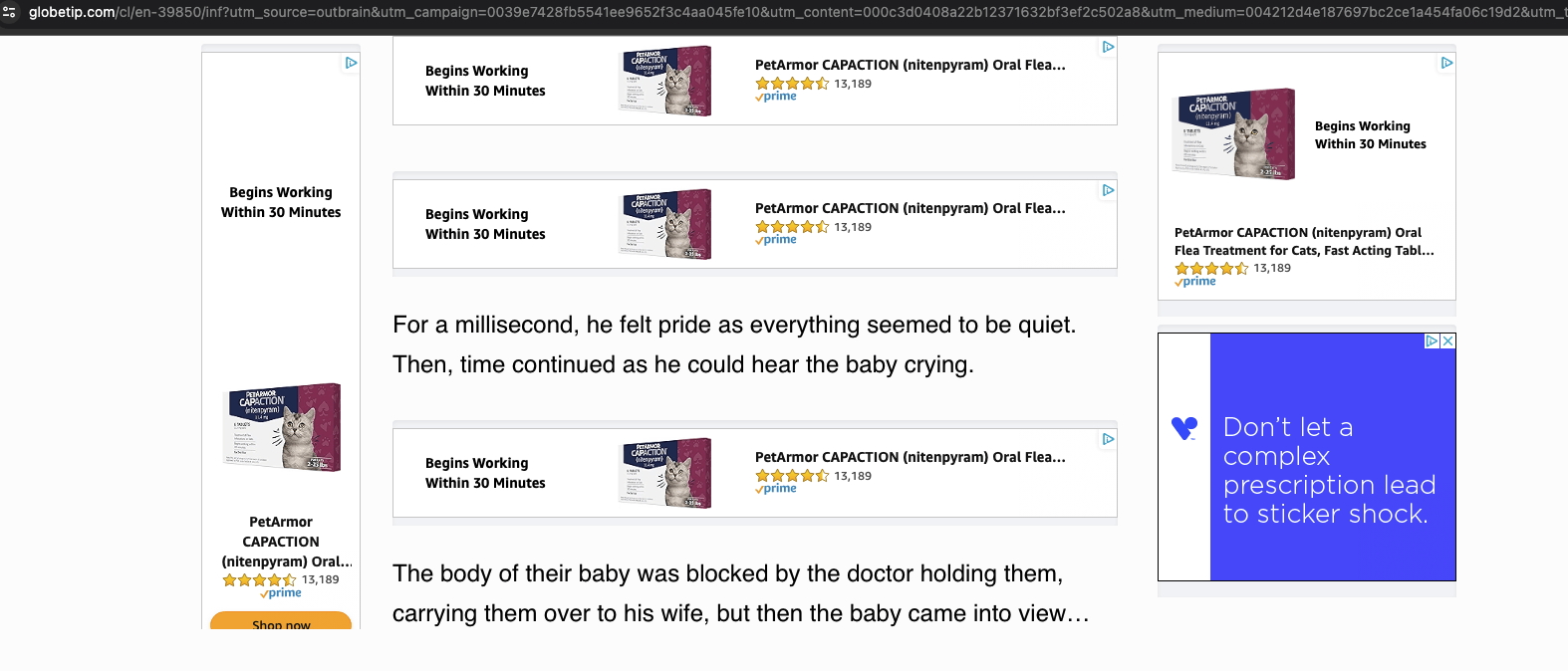

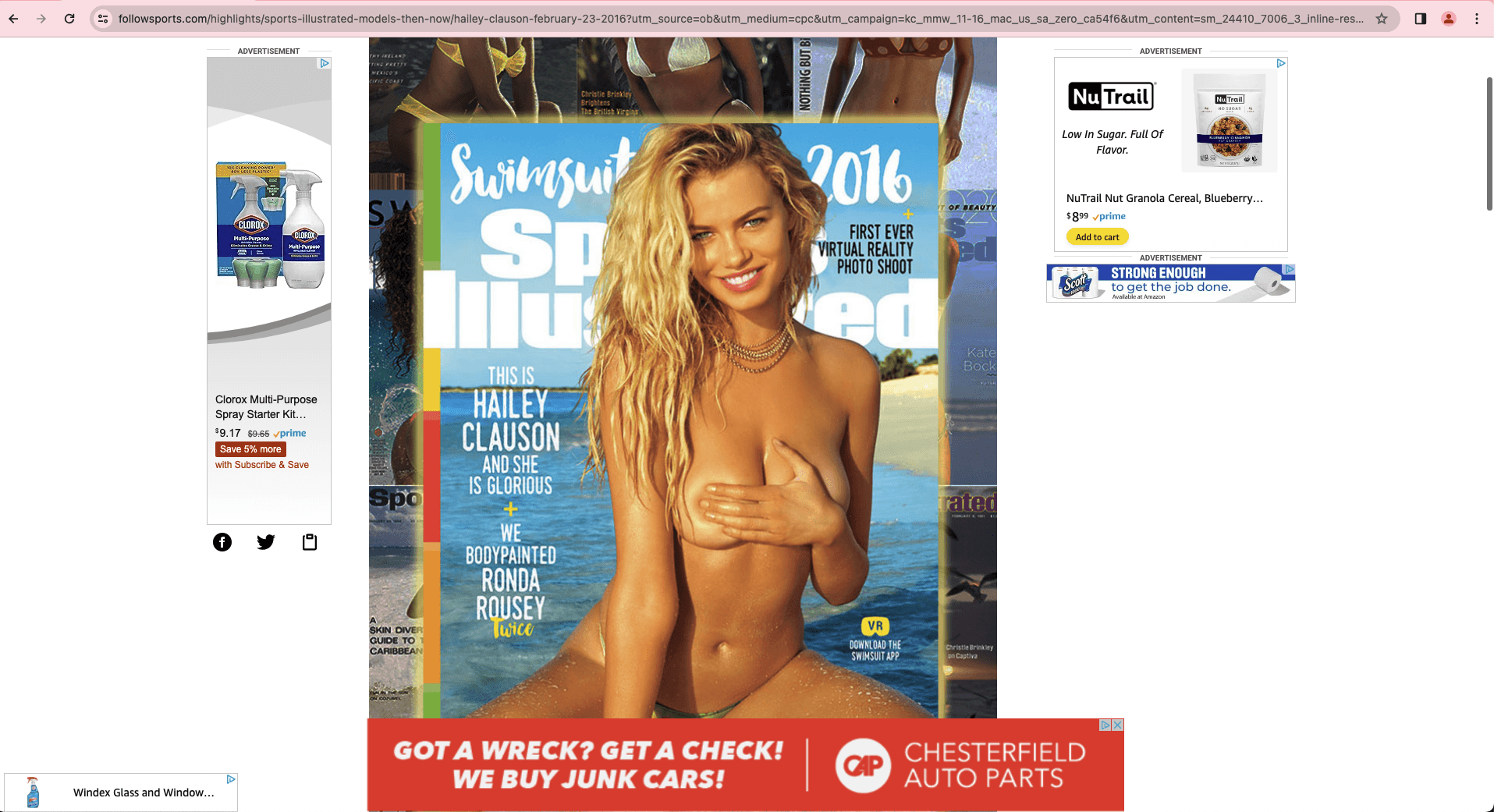

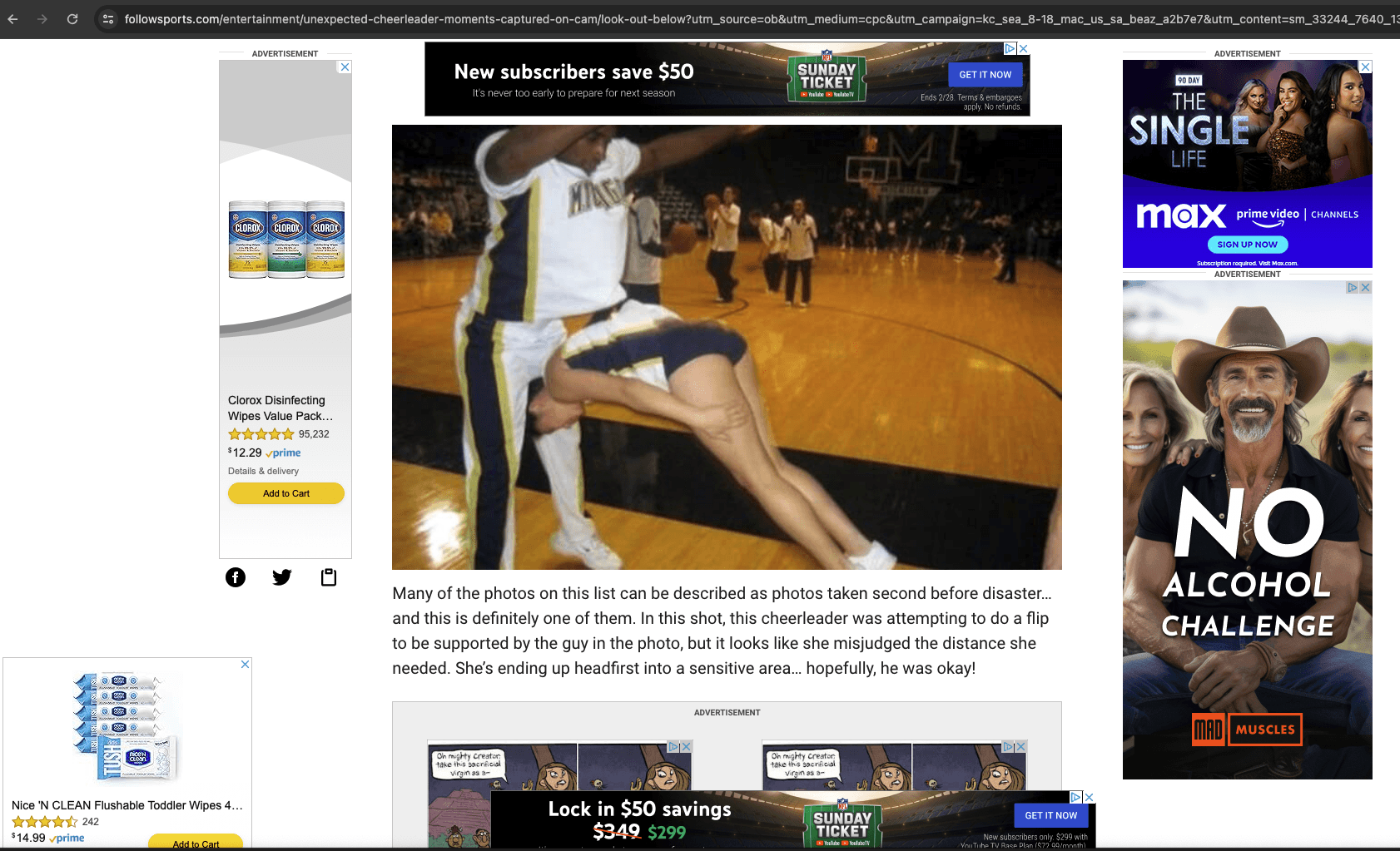

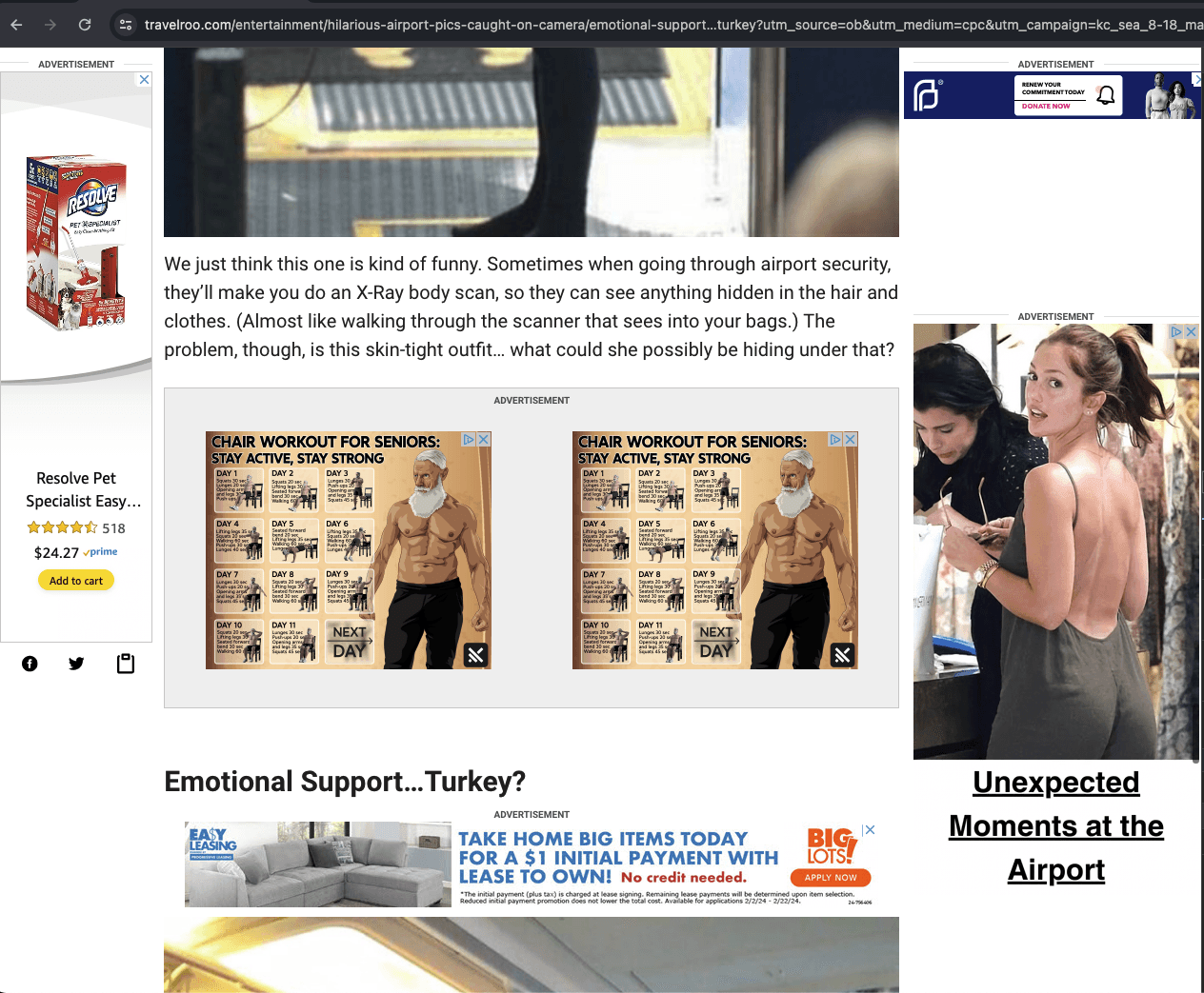

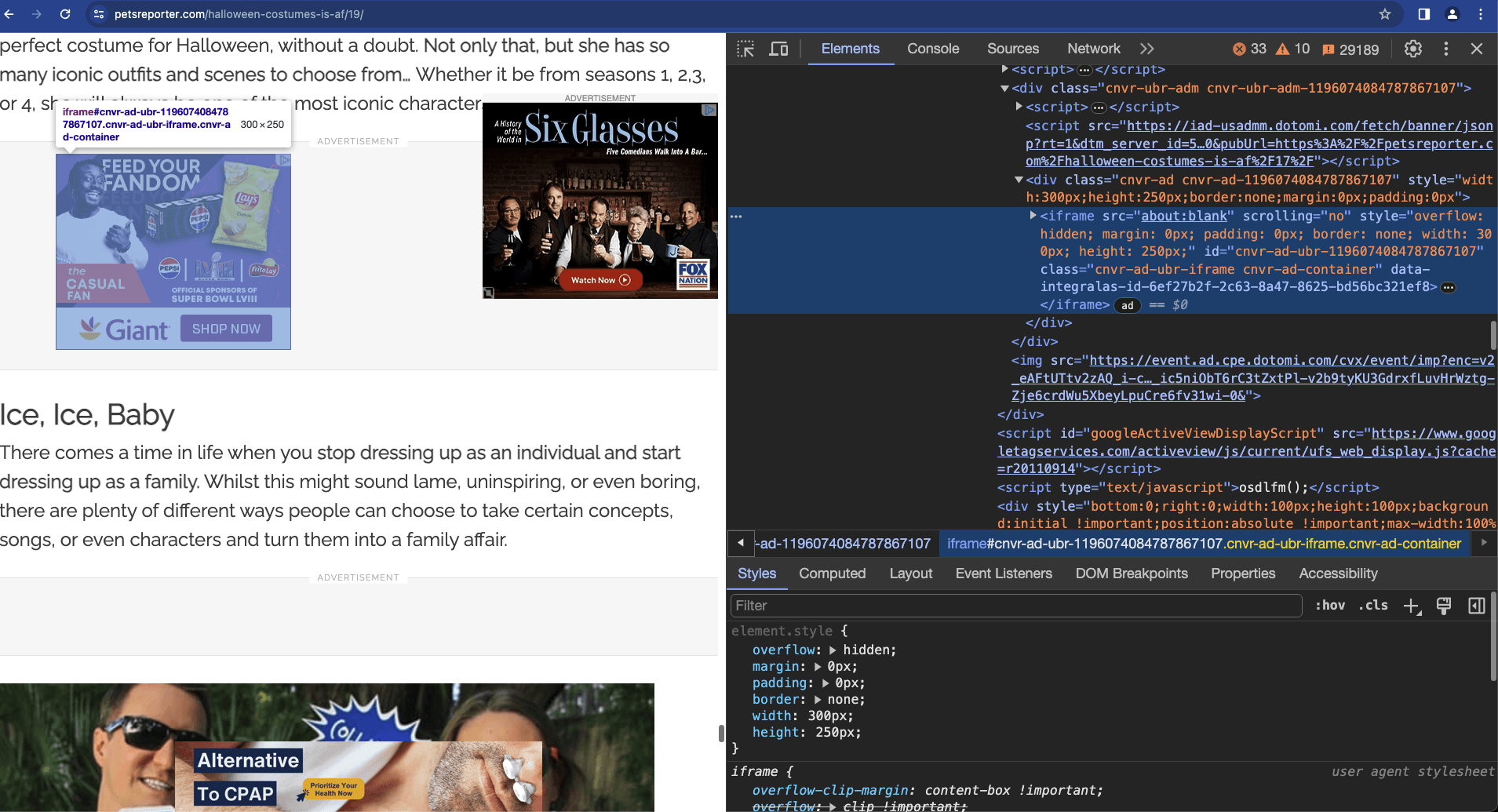

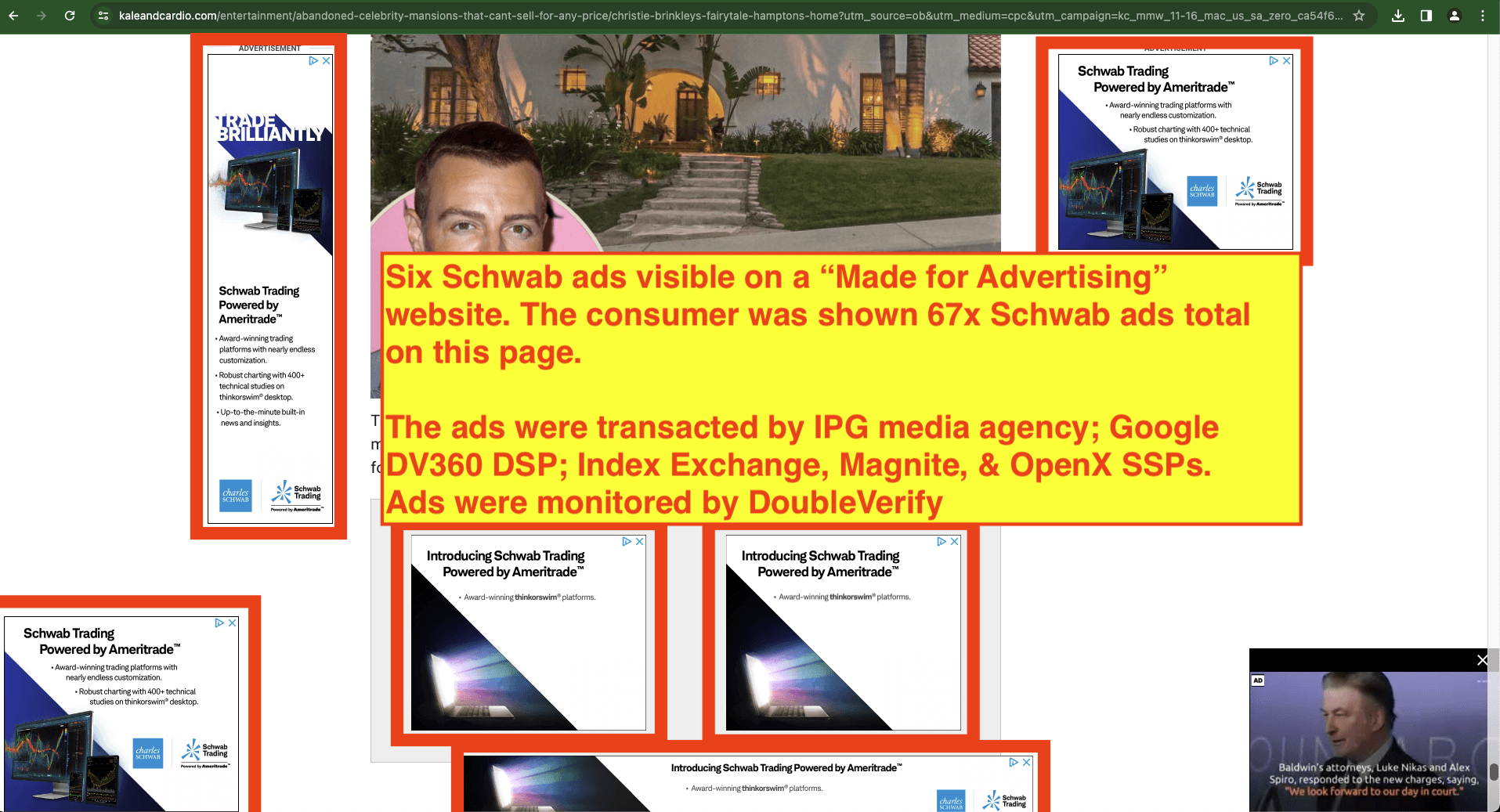

Advertising industry trade groups consensus defines Made for Advertising (MFA) websites as sites that are created primarily for the purpose of arbitrage. These websites typically feature low-quality content with a much higher density of ad placements as depicted in the three figures below. Many companies are under the impression that their ad dollars are protected from being spent on MFA sites. Adalytics observed several other large brands spending substantial amounts on MFA sites, and decided to investigate the extent of this phenomenon and the various avenues through which Fortune 500 brands’ ads can be served on “Made for Advertising” websites— both programmatic and non-programmatic.

This study found that hundreds of major brands continue to have their ads served on websites that meet the industry trade group definition of “Made for Advertising.” The ads were placed both through programmatic and non-programmatic channels.

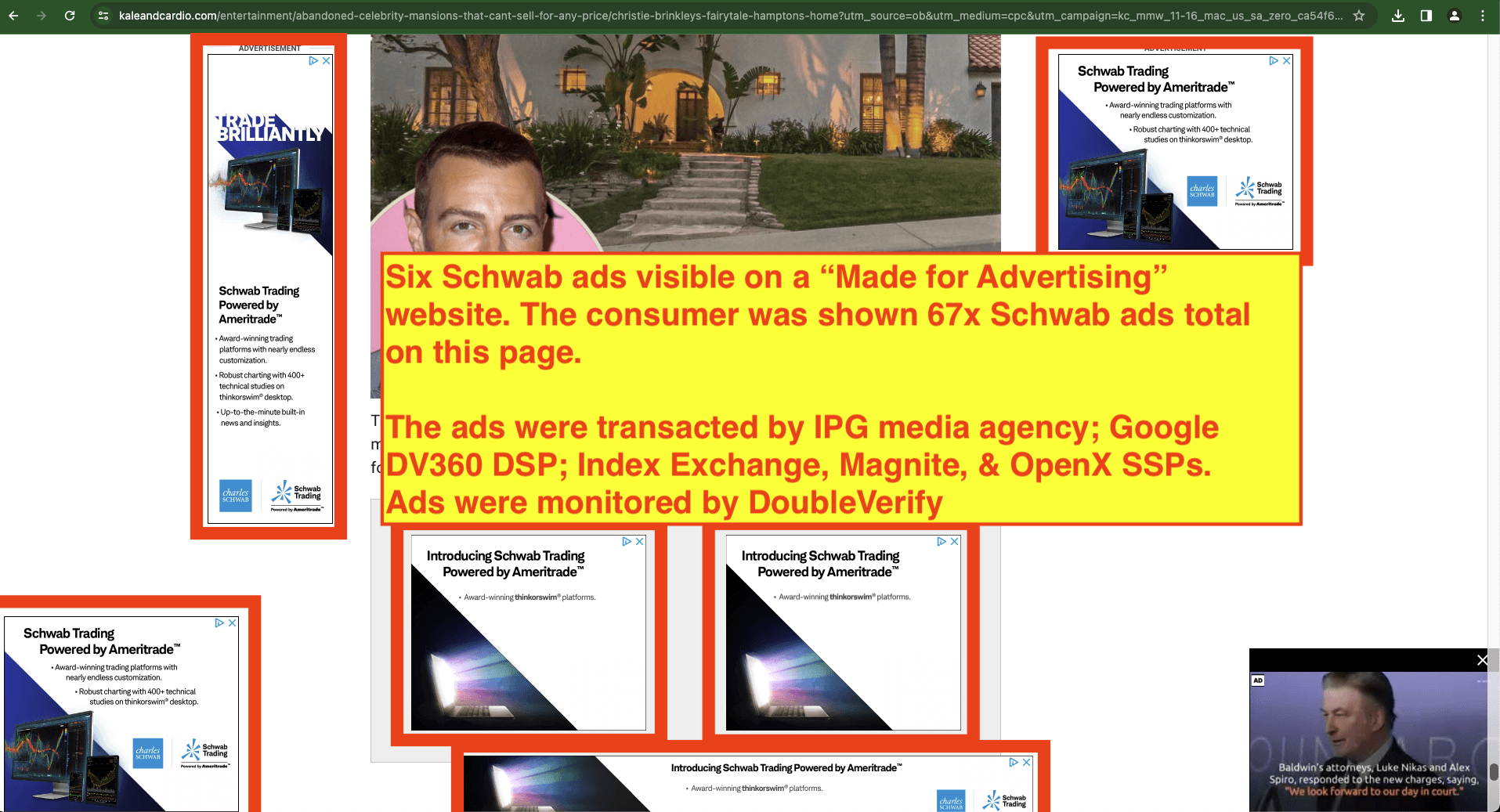

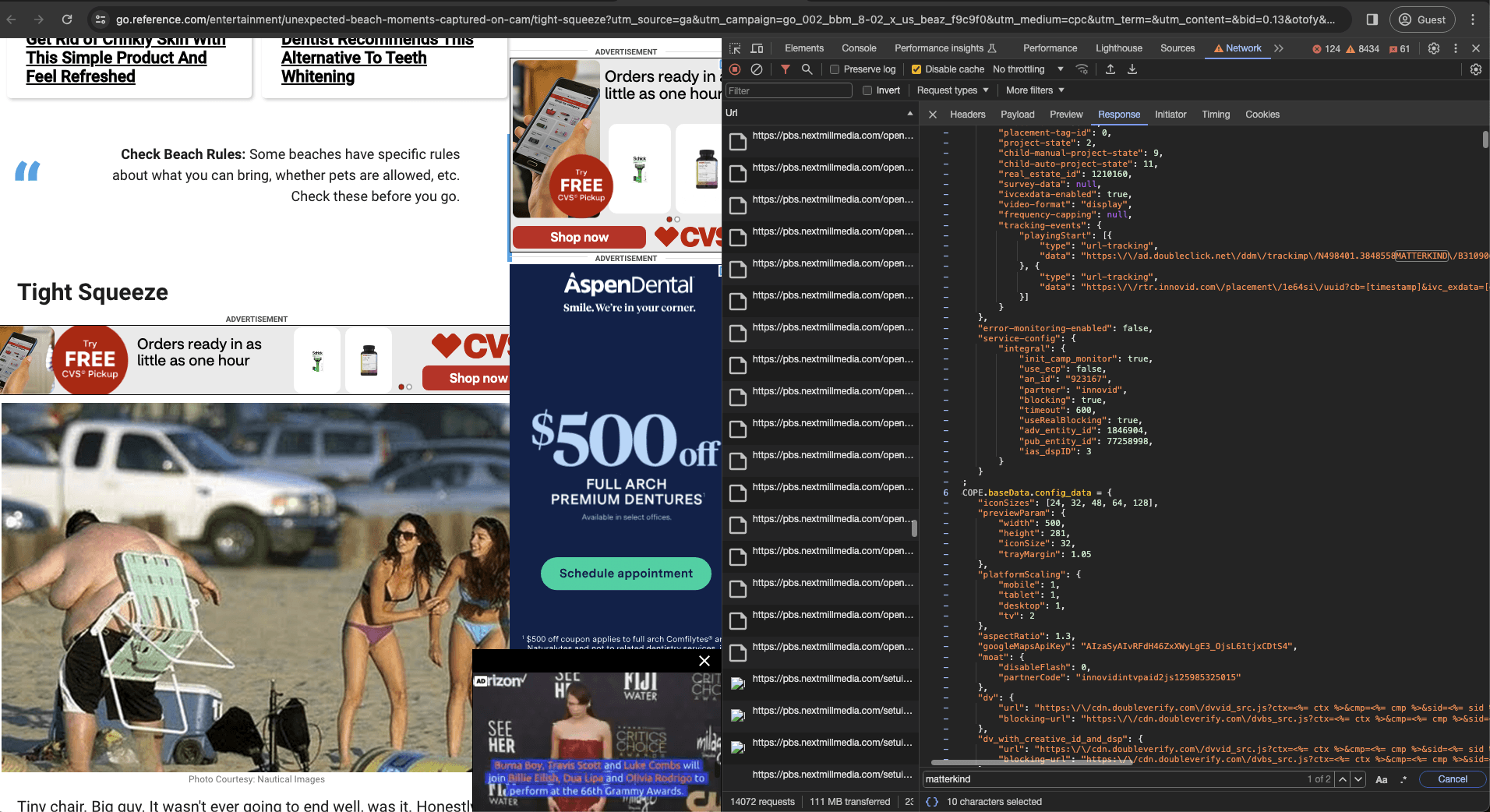

Screenshot of six Charles Schwab ads served on a website which meets the ANA’s, WFA’s, ISBA’s, 4A’s, and DeepSee.io’s definition of “Made for Advertising” website. The ads were transacted by IPG media agency, using Google DV360 DSP, multiple ad exchanges (OpenX, Magnite, Index Exchange), and were monitored by DoubleVerify. The consumer was shown 67x total Schwab ads on this one page in less than 10 minutes, in addition to ads for dozens of other brands.

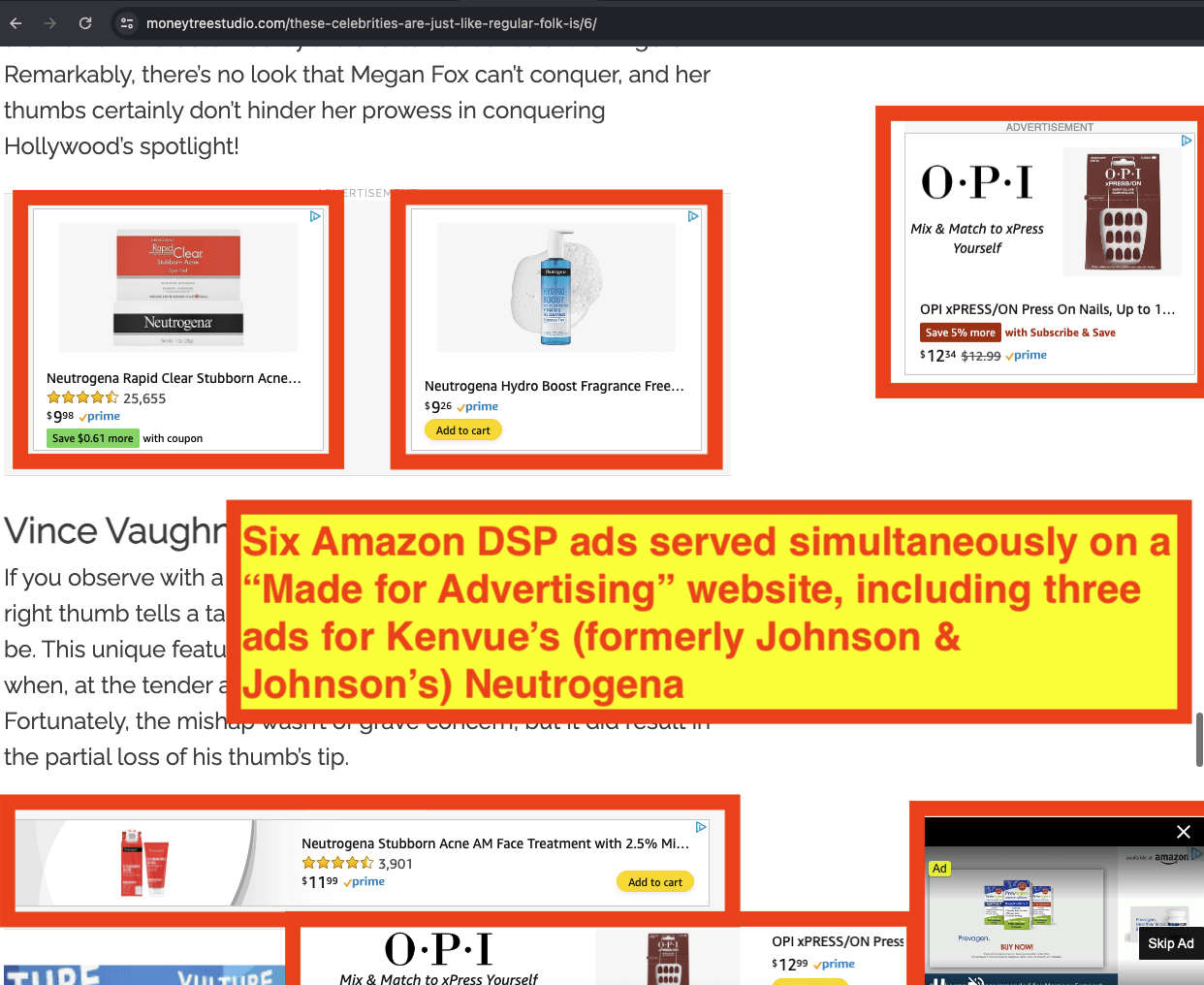

Six Amazon DSP ads observed on a website which meet’s the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website. Visible are three ads for Kenvue’s Neutrogena.

Six Amazon DSP ads observed on a website which meet’s the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website. Visible are three ads for Kenvue’s Neutrogena.

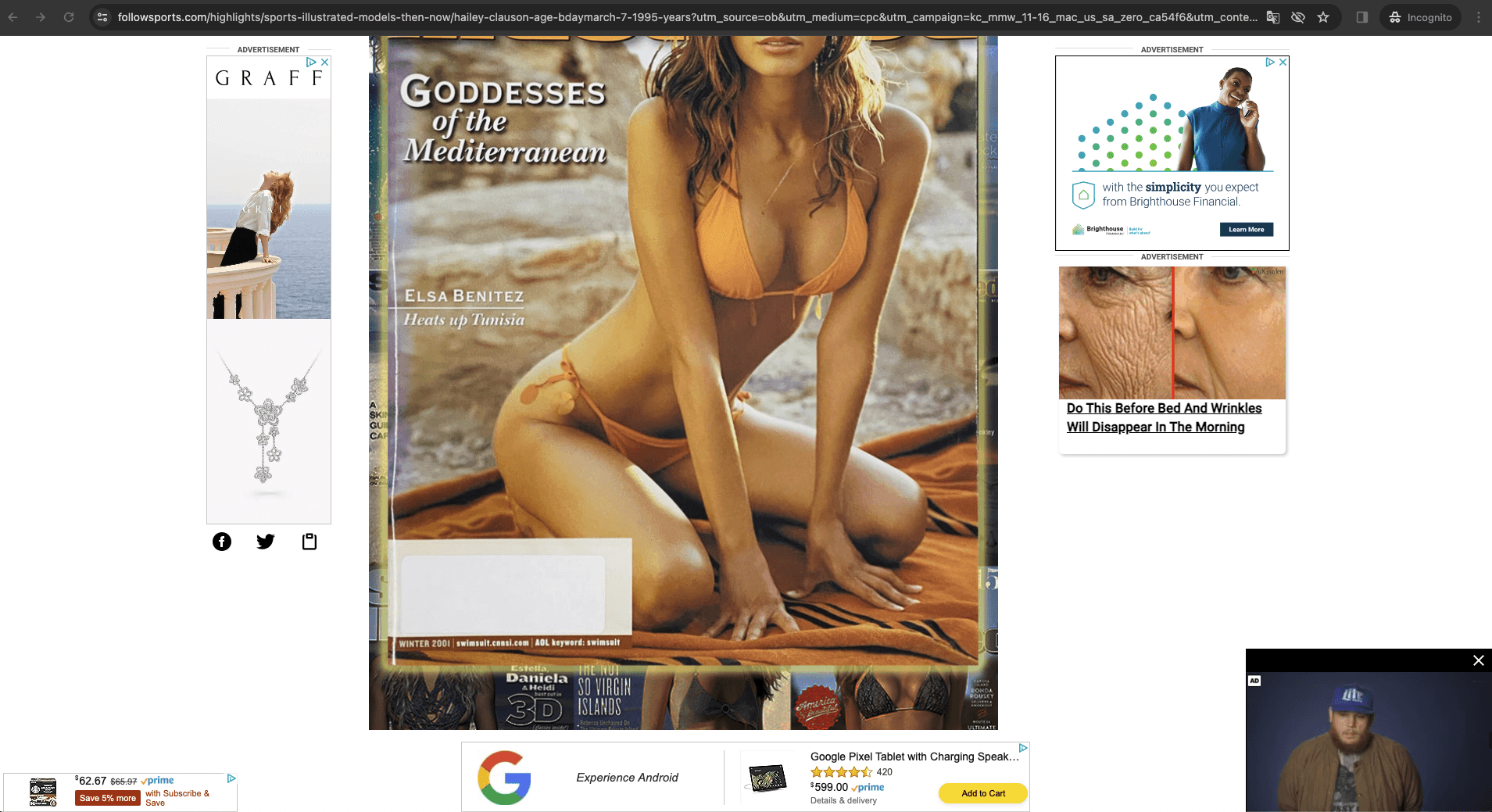

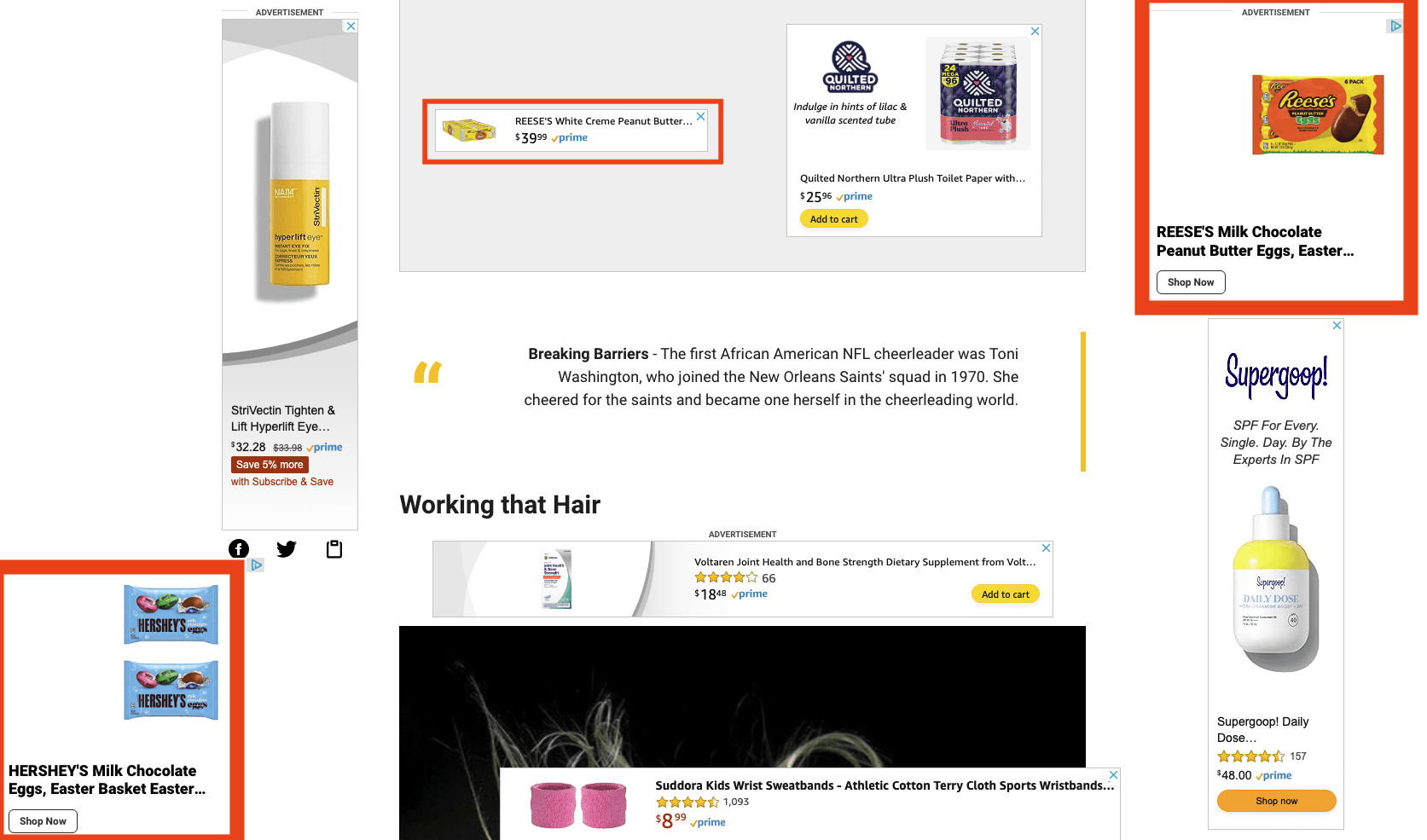

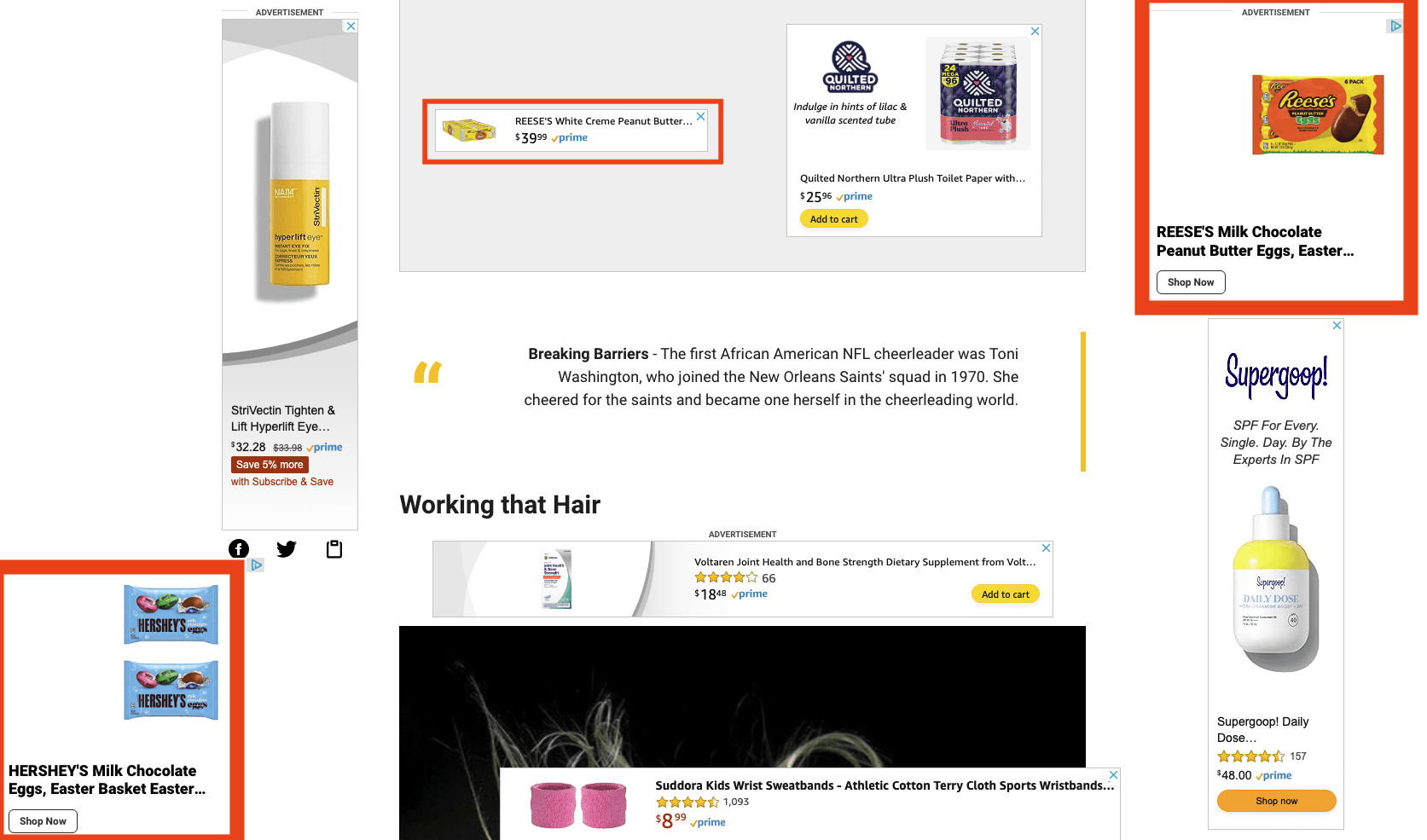

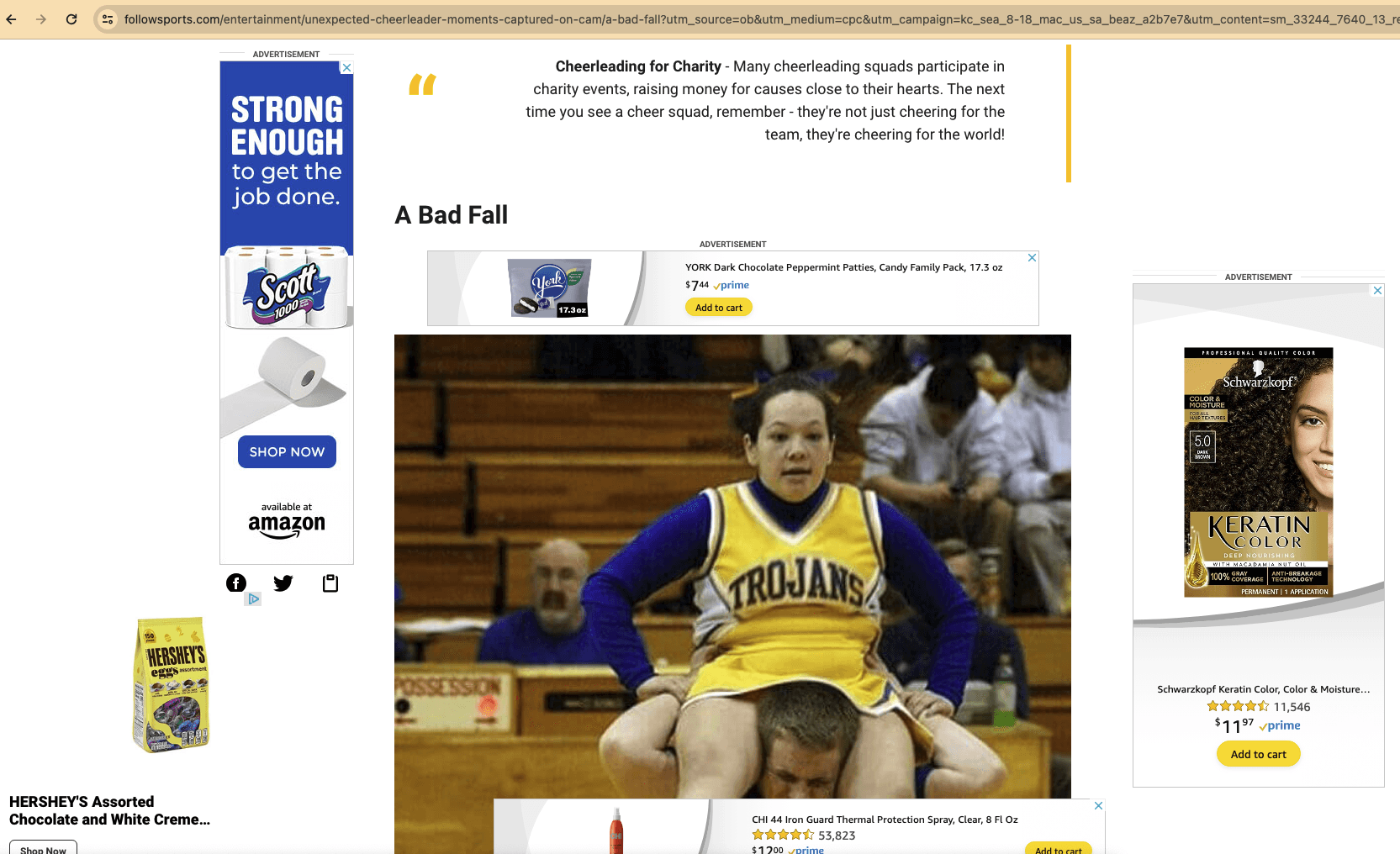

Screenshot showing seven ads transacted via Amazon retail media network and/or Amazon DSP on a “Made for Advertising” website. Three of the ads are for Hershey’s chocolate products.

Background on the industry response to MFA sites

On June 19th, 2023, the Association of National Advertisers (ANA) released a research report titled “ANA Programmatic Media Supply Chain Transparency Study”. This report found that 21% of overall ad impressions occur on MFA sites, and advertisers do not have control over their media placement decisions.

MFA websites “are largely useless for growth-oriented strategies” and that “Made for Advertising websites generally provide a poor user experience and potentially damage the reputation of digital advertising overall,” according to the ANA. MFA sites are also referred to as “Made for Arbitrage” sites by the 4A’s.

In the six months since the ANA published its Transparency Study, many ad tech vendors and media agencies issued public statements on actions they have taken to reduce brands’ ad placements on “Made for Advertising” websites.

For example, Digiday published an article stating the “crackdown on made-for-advertising sites is gaining momentum. Magnite, Sharethrough and PubMatic are blocking these sites, making it increasingly challenging for them to profit from their deceptive practices.”

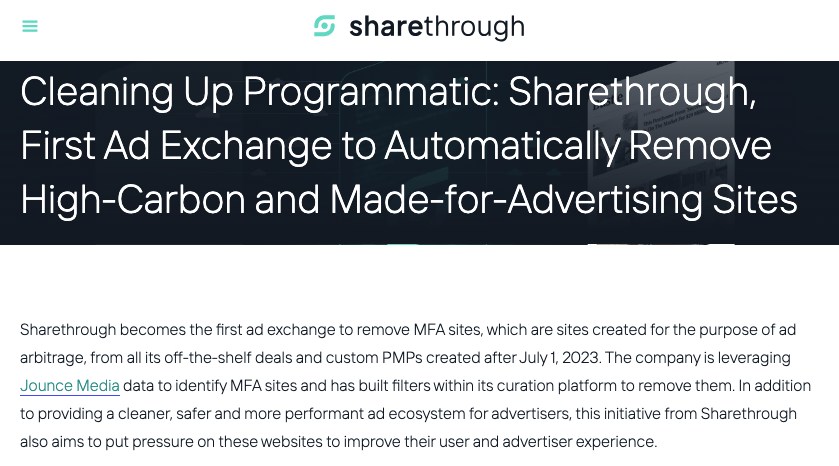

ShareThrough ad exchange released an announcement stating “Sharethrough becomes the first ad exchange to remove MFA sites, which are sites created for the purpose of ad arbitrage, from all its off-the-shelf deals and custom PMPs created after July 1, 2023. The company is leveraging Jounce Media data to identify MFA sites and has built filters within its curation platform to remove them.”

A “spokesperson for Index Exchange told Adweek that the SSP prohibits MFA inventory.”

SSP PubMatic told Adweek that it was eliminating MFA inventory from the auction packages it sells. A spokesperson for Google said Google does not allow “publishers to engage in disruptive, invasive or deceptive ad-serving practices simply for the purposes of generating ad revenue.”

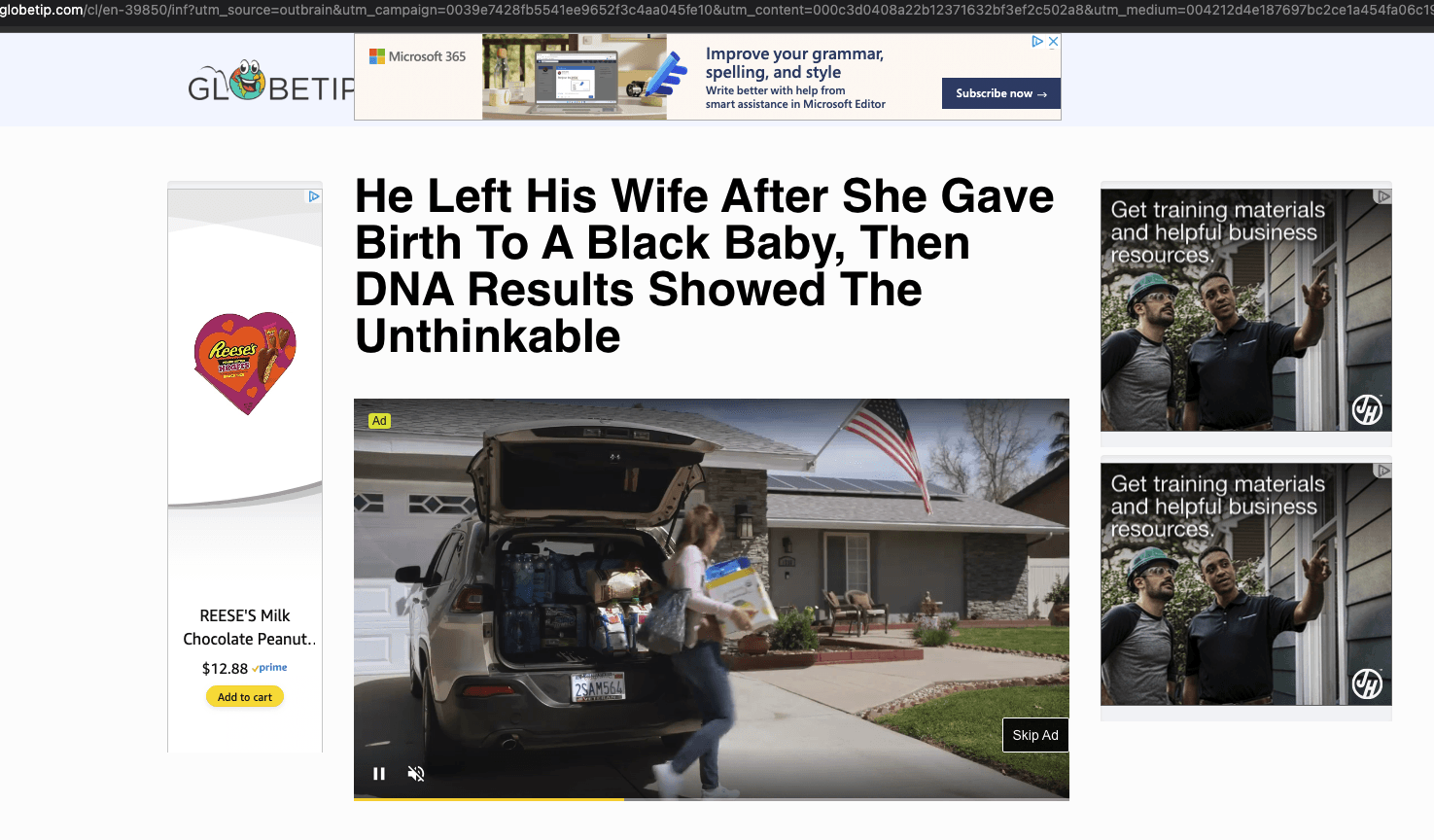

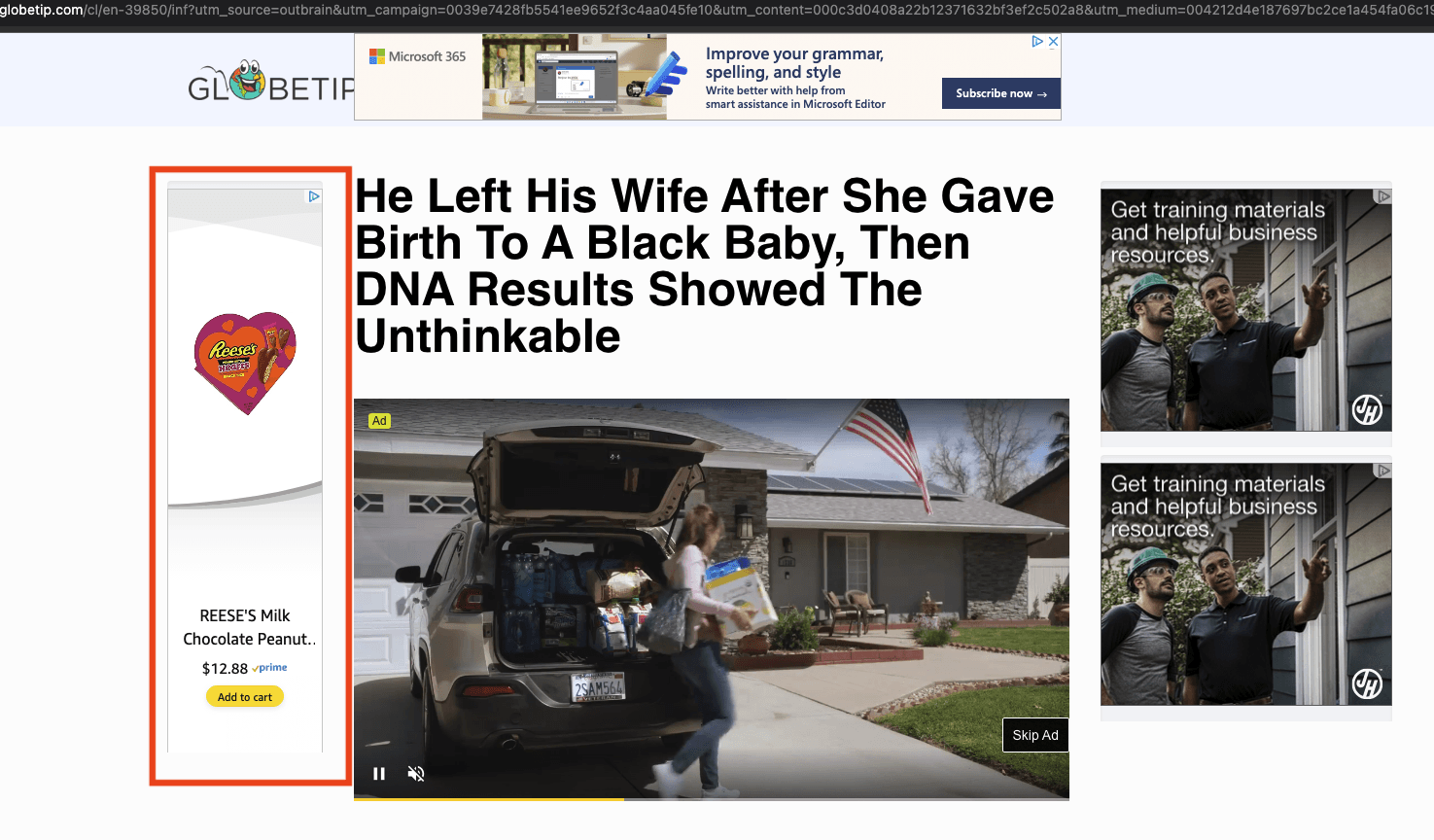

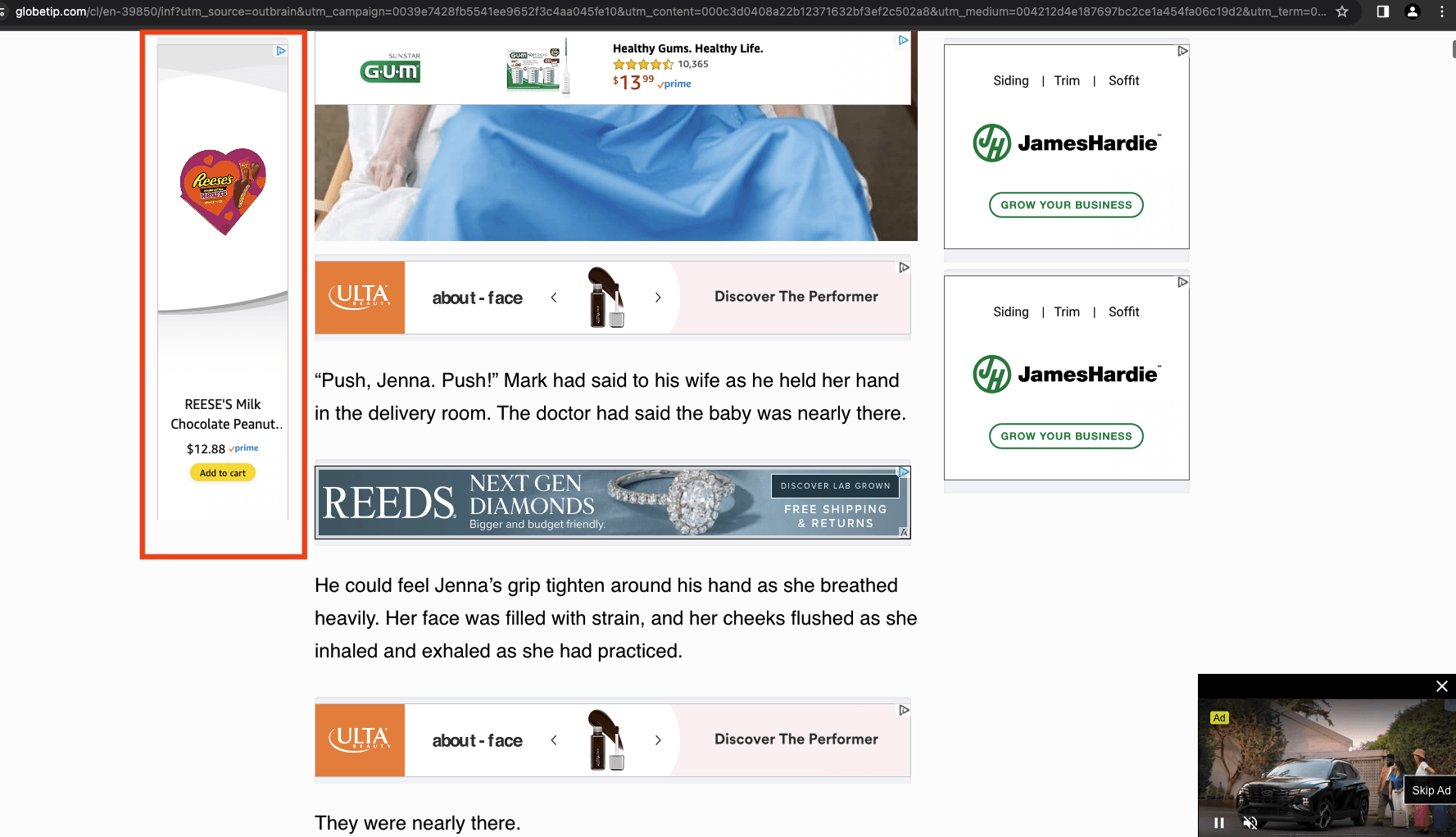

Screenshot of Hershey’s Reese’s, Microsoft, and James Hardie ads observed on a website which meets the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website. The Hershey’s ads were transacted via Amazon DSP. Other ads on this page were transacted via OpenX, Nexxen, Xandr, Magnite, Index Exchange, TripleLift, Media.net, ShareThrough, Pubmatic, and other ad exchanges.

GroupM announced “the introduction of new protections against Made For Advertising (MFA) websites and domains”, which “will see GroupM integrate Jounce’s industry-leading technology in tracking MFA domains with GroupM’s leading campaign planning processes.”

Screenshot of an ad for Ford, transacted by GroupM, observed on a website which meets the ANA’s, WFA’s, ISBA’s, 4A’s, and DeepSee.io’s definition of “Made for Advertising” website. The source code of the Ford ad reference’s GroupM’s programmatic trading desk Xaxis.

More recently, in February 2024, Digiday published an article titled: “Buyers say the MFA panic is over – but not forgotten”. The global head of brand assurance at Dentsu said, “In terms of priorities for 2024, MFAs are currently about a 4 out of 10 [...] we are confident that our current approach is successful”.

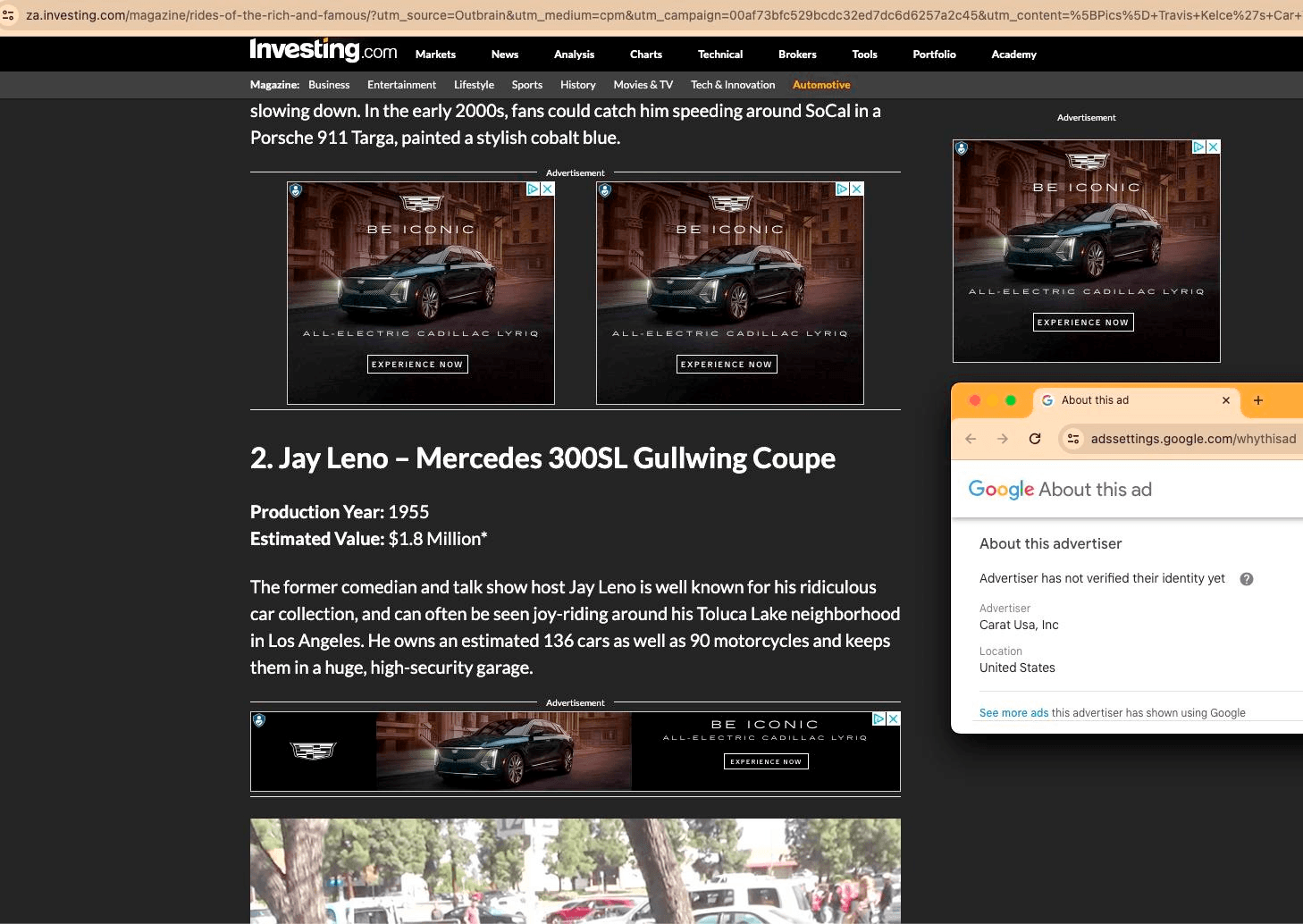

Screenshot showing four Cadillac General Motors ads served on a website which meet’s the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website. The “Why this ad?” info modal shows the ads were placed by Dentsu’s Carat subsidiary. These and other Cadillac ads were placed using Google’s DV360 DSP and Index Exchange, TripleLift ad exchange.

Another agency executive said: “[MFAs] are not any more of a concern going into 2024 than [they were] last year because we have so many different systems in place that would mitigate any concern”. Digiday reported that the SVP and Head of Precision Media at Digitas (Publicis), said that MFAs are still a “higher priority” in 2024, but between the targeting tools and MFA filters created by Publicis Groupe and DSPs like The Trade Desk, she said she feels her team is in a strong position to maintain the “pursuit of quality inventory” in the new year. Another agency executive told Digiday that “We have identified tools and protocols to solve for MFAs and feel good about our path forward there.”

Omnicom Media Group’s CEO told Digiday in a December 2023 article that Omnicom has “been investing a lot of time and resources, partnering with vendors, partnering with technology companies in really screening websites for MFA-suspicious activity. And once that’s been confirmed, they’re being weeded out.”

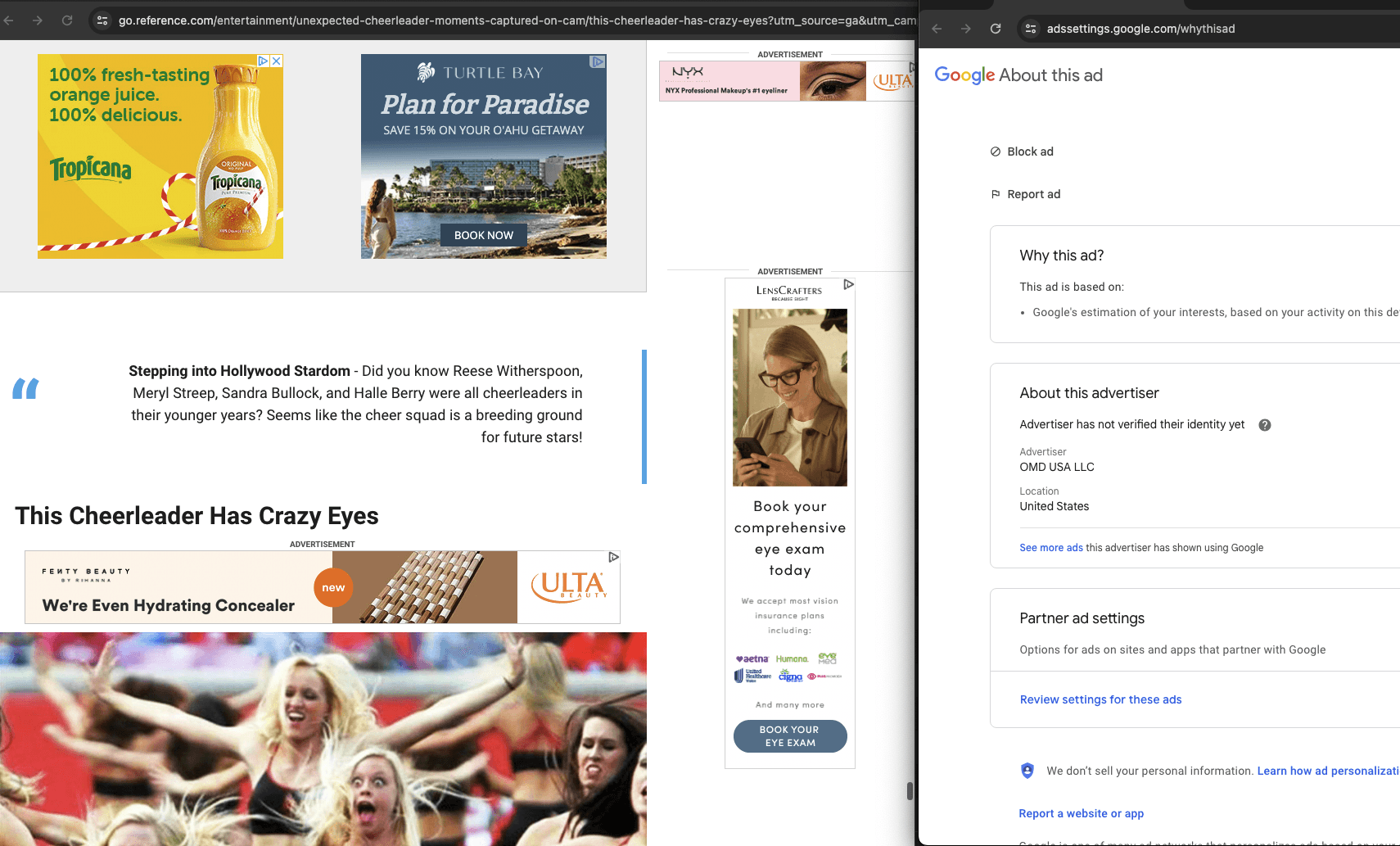

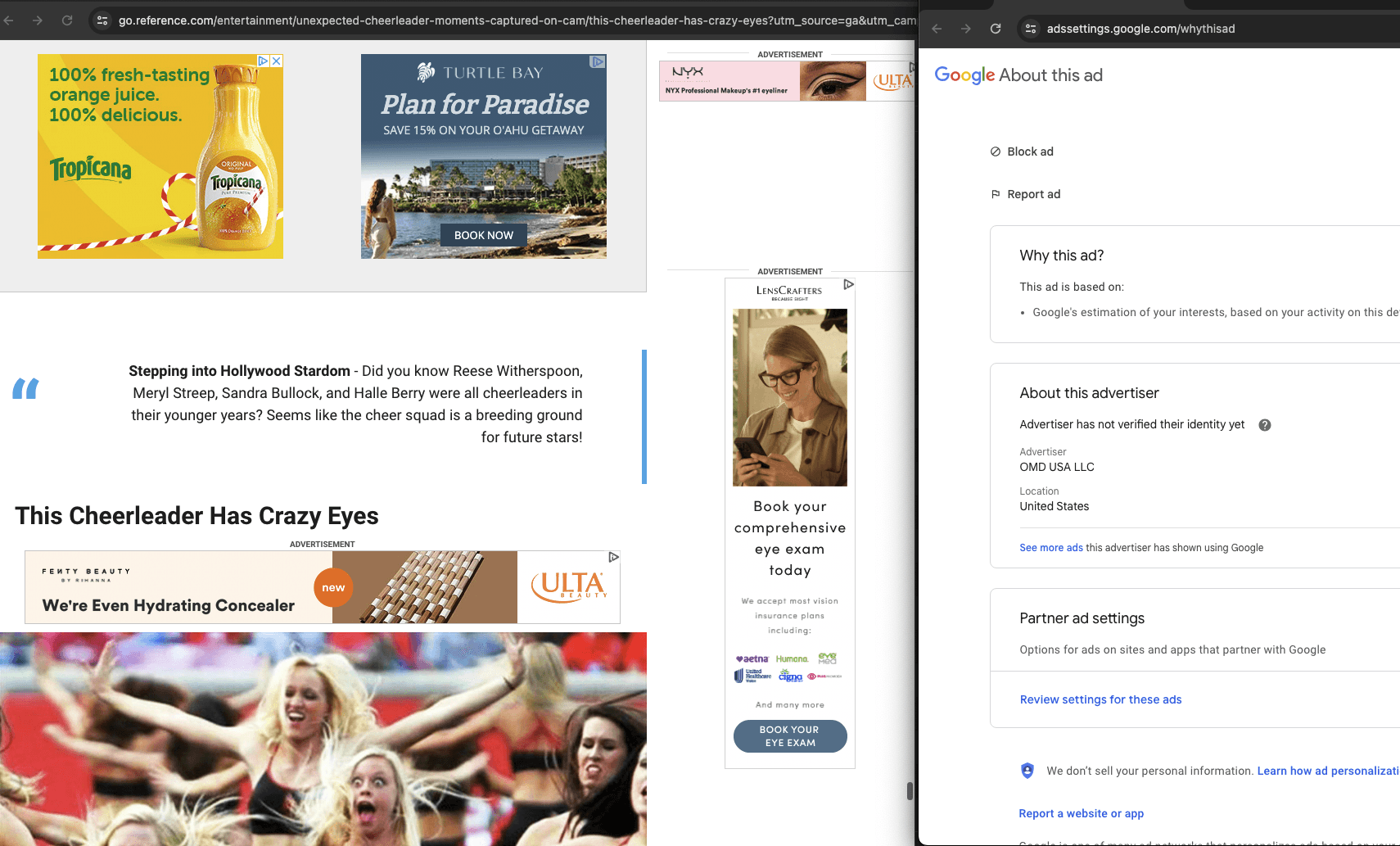

Screenshot showing Tropicana ads served on a website which meets the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media, and DeepSee.io’s definition of “Made for Advertising” website. The “Why this ad?” info modal shows the ads were placed by OMD, an Omnicom subsidiary.

However, despite various vendors’ public statements, the ANA’s report contains a warning of caution: “it should be noted that advertisers would be well-advised to verify that such MFA-blocking offerings function as sold to ensure policy compliance” (emphasis added).

Overview of Adalytics findings

Informed by the ANA’s playbook recommendations and using empirical collection of publicly accessible data, this Adalytics observational study found that:

Hundreds of ANA member and other brands continue to have their ads observed on “Made for Advertising” websites as of January 2024, including major ones such as Procter & Gamble, Bayer, Reckitt, AT&T, Johnson & Johnson, AbbVie, Novartis, Pfizer, State Farm, PwC, Hershey’s, Unilever, Mondelez, Mars, Haleon, Ford, NBC Universal, Disney, AARP, Pfizer, Dell, US Army, US Air Force, US Navy, the Wall Street Journal, General Motors, Google, Meta, Hyundai, Molson Coors, and many others.

Almost all of the brands that participated in the ANA’s 2023 Programmatic Transparency Study continue to have their ads placed on “Made for Advertising” websites as of January 2024 - more than 6 months after the ANA released its transparency report.

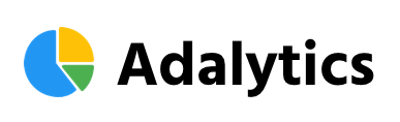

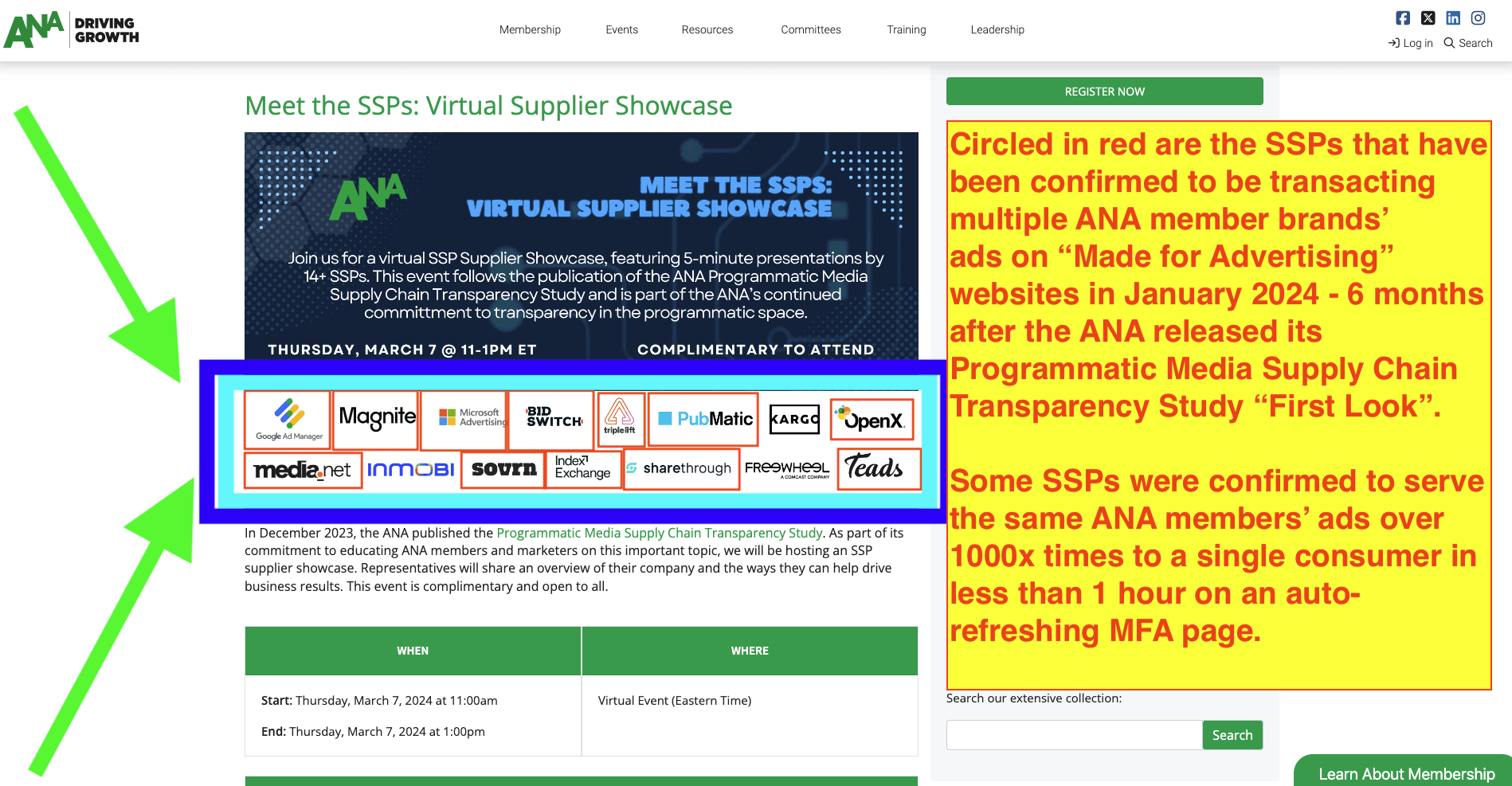

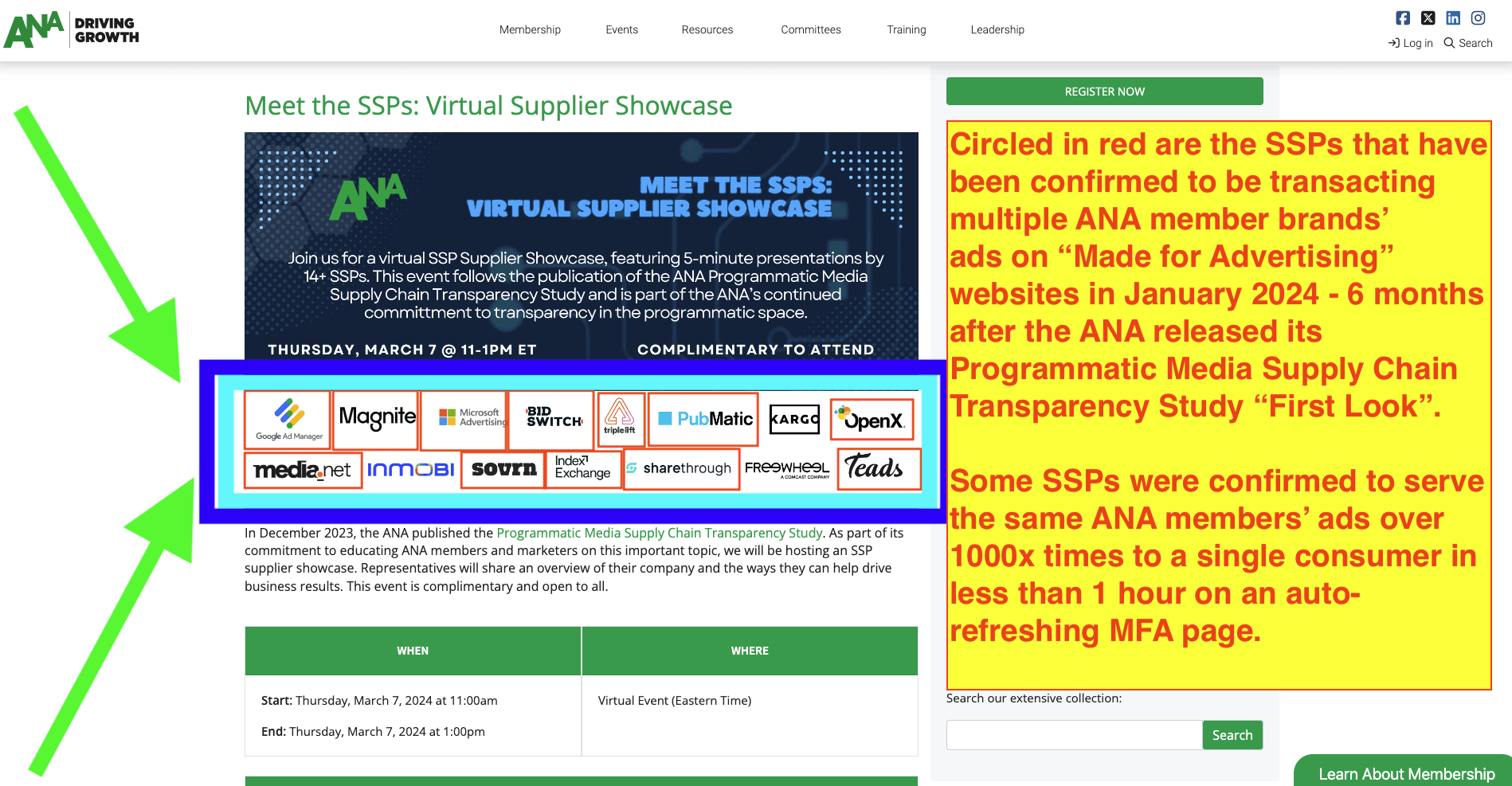

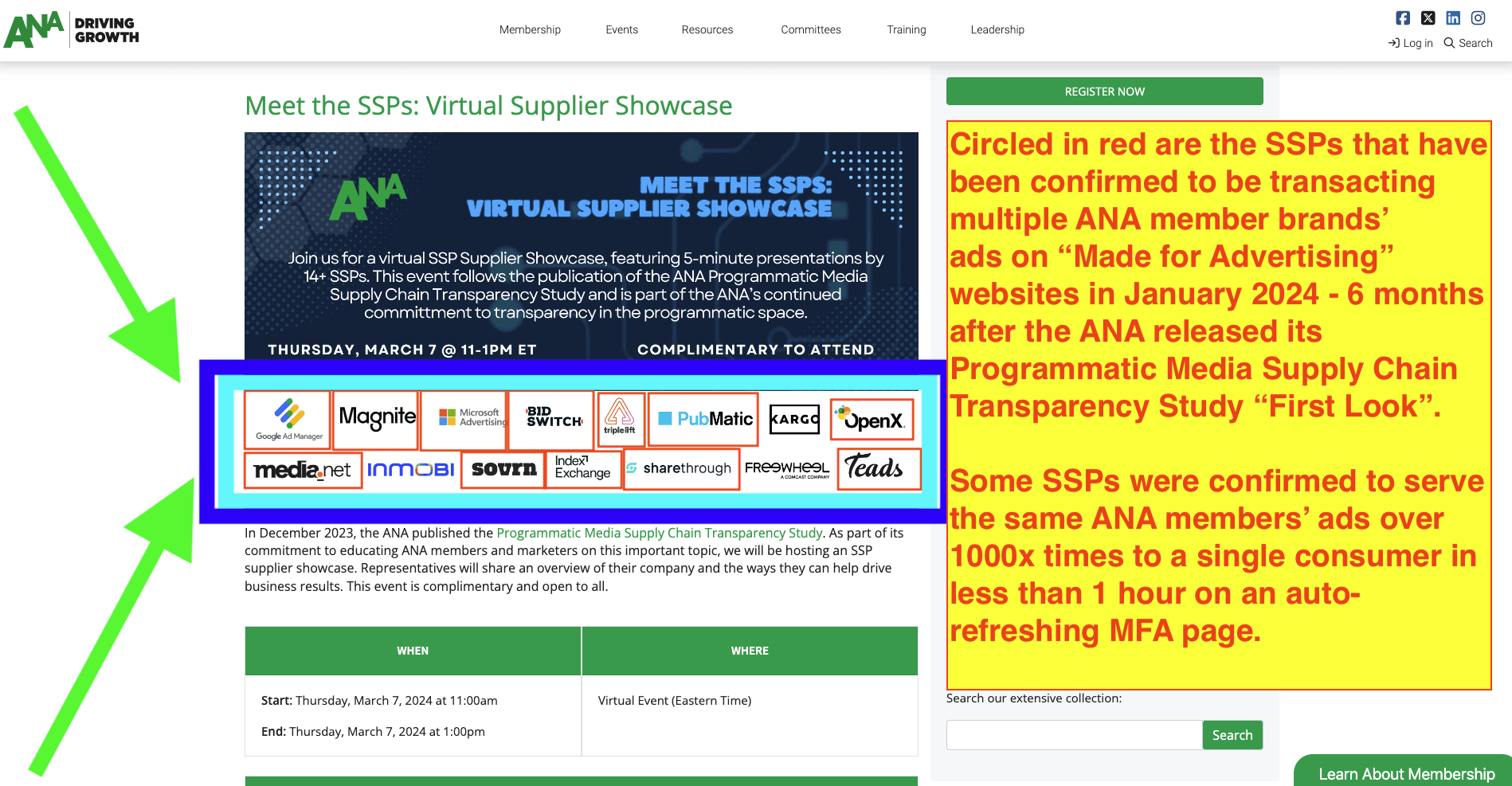

Eighty percent of the SSPs invited to present at the ANA’s upcoming March 2024 event continue to serve ANA members’ ads on websites that meet their definition of MFA sites. The ANA event follows the publication of its Supply Chain Transparency Study, which included a report dedicated to addressing brands’ exposure to MFA sites.

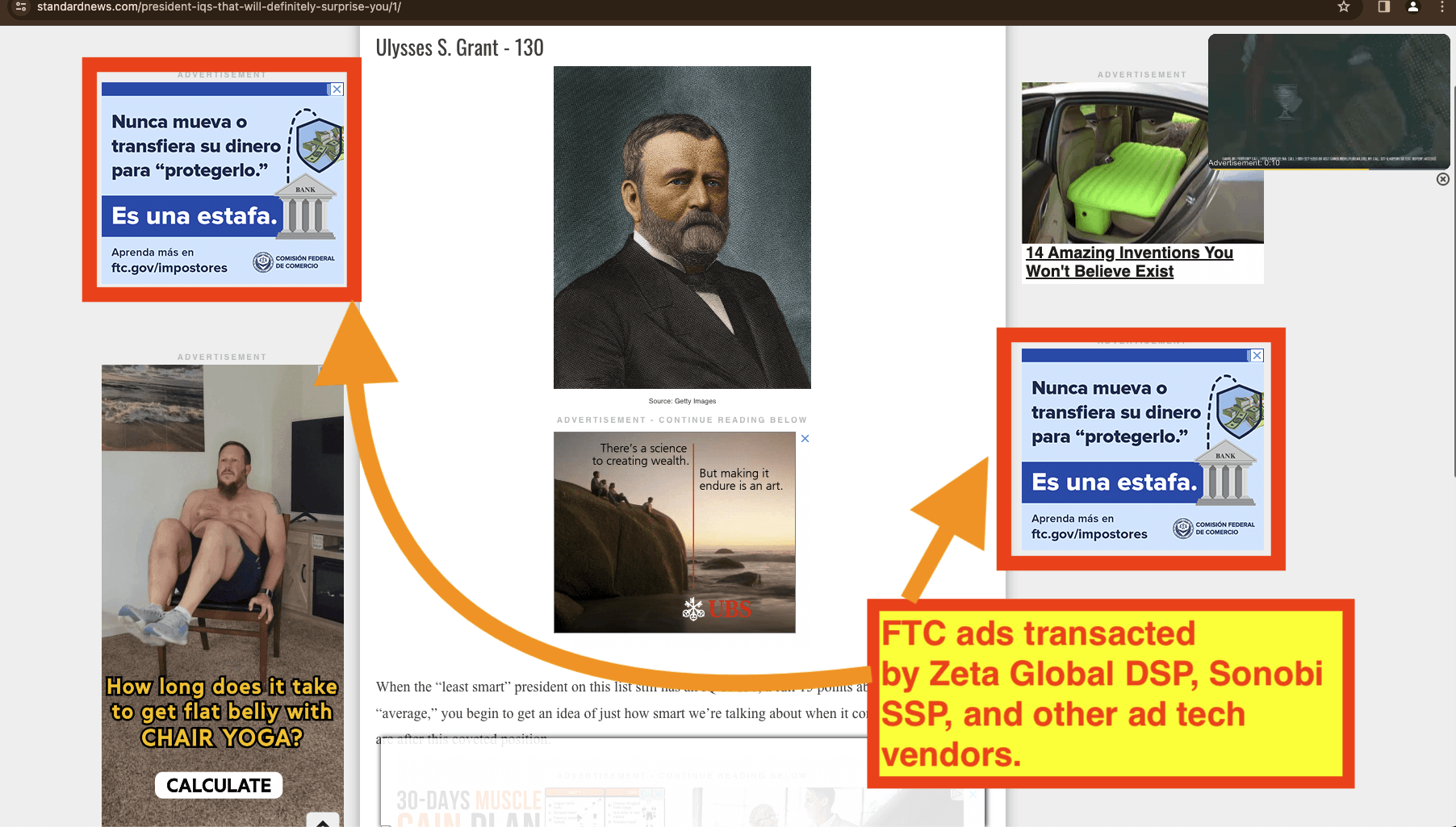

Several US government agencies and departments were exposed to MFA sites, including the US Army, Navy, Social Security Administration, and Federal Trade Commission (FTC).

Screenshot from 2024 of a Federal Trade Commission (FTC) ad observed on a website not affiliated with Maxim which meets the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website. The ad was transacted via Zeta Global DSP, Magnite SSP (seller ID 17960), and Sovrn SSP. Two Verizon ads (one stacked on the second one) are visible below.

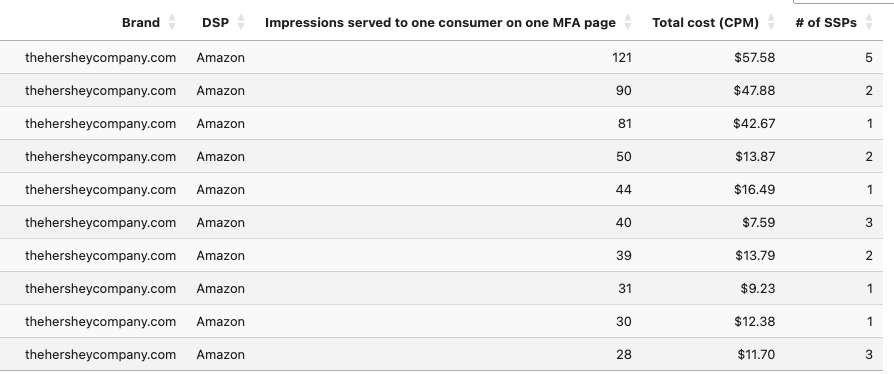

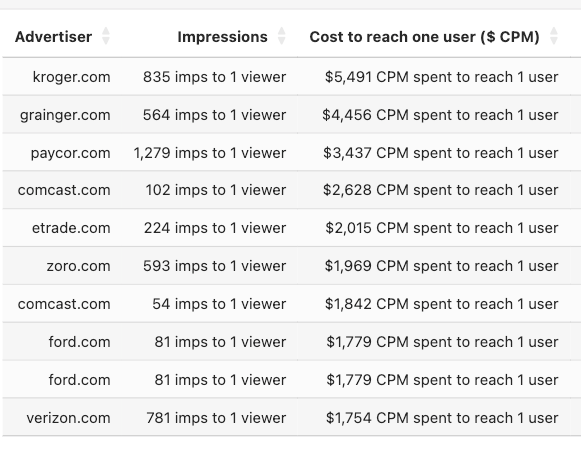

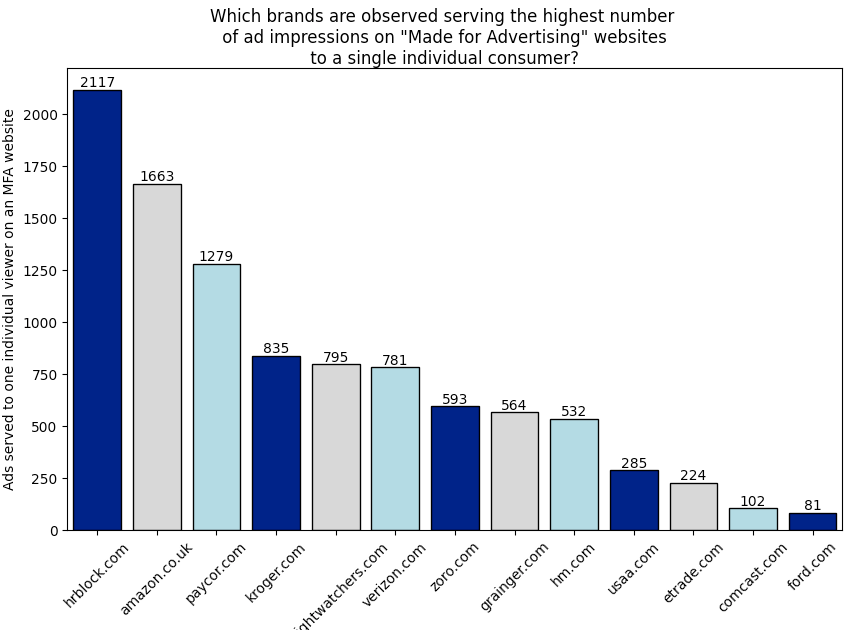

MFA sites employ aggressive ad refreshes, which can result in a user being shown the same ad up to thousands of times during a single page view session, raising concerns about the efficacy or utilization of frequency capping. For example, H&R Block had 2,117 impressions served to one consumer on a single MFA article in less than one hour. Verizon had 781 ad impressions served to one consumer on an MFA article in less than one hour.

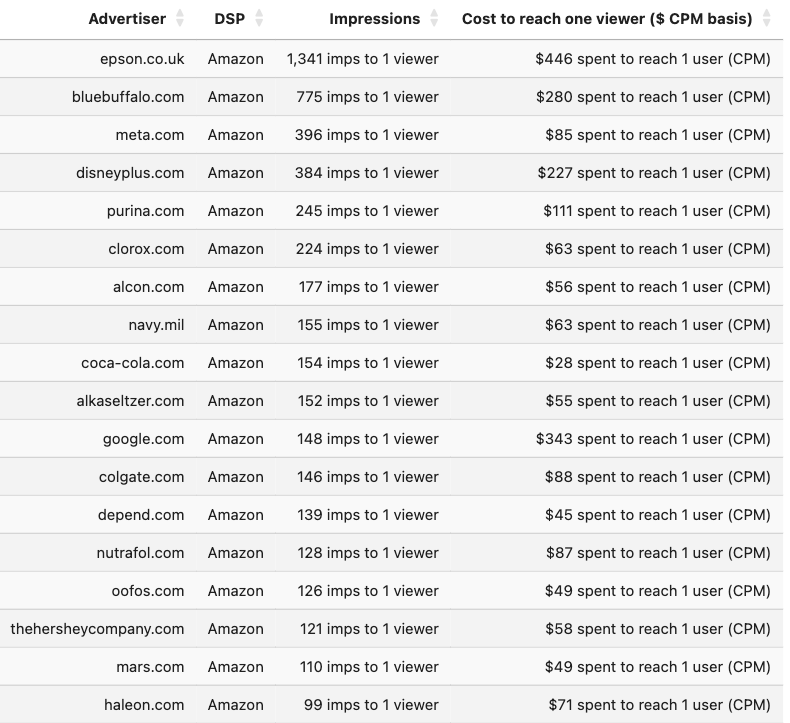

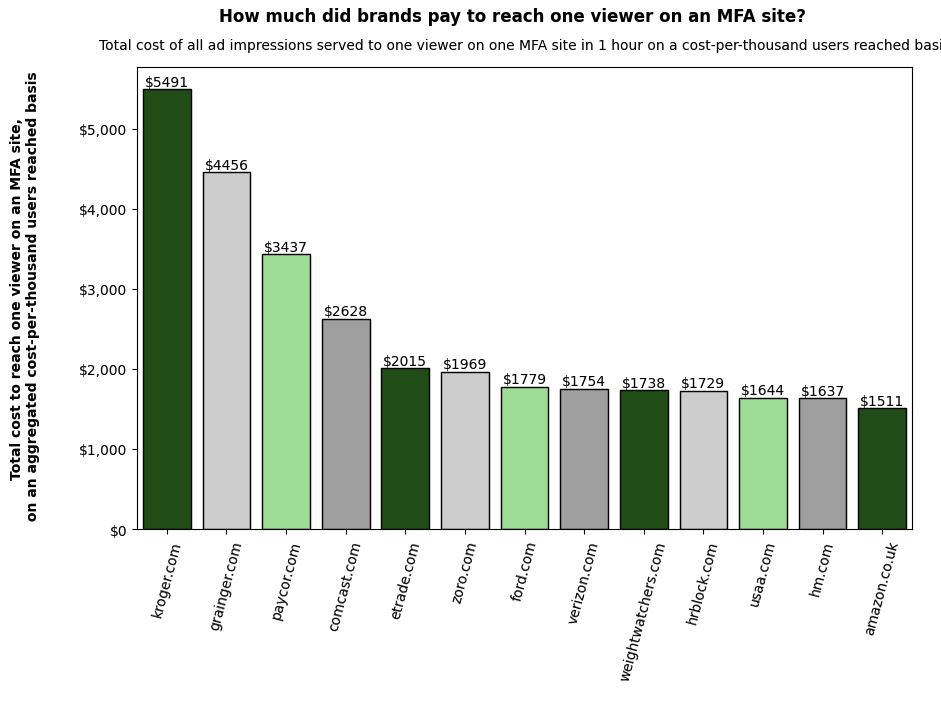

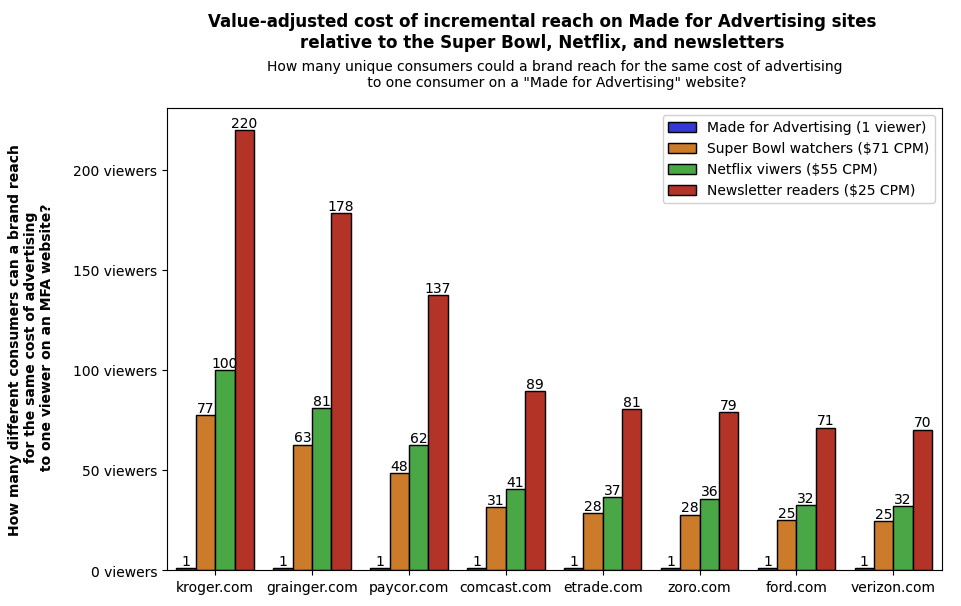

Due to an apparent lack of frequency capping when campaigns serve on MFA sites, some brands are paying astronomically high prices to reach a single consumer. For example, Kroger paid an effective cost per 1000 people reached of $5,491 to reach one consumer on an MFA site. Comcast paid an effective cost per 1000 people reached of $2,628 to reach one consumer on a MFA site in a single page view session. The cost to reach one unique viewer on an MFA site can be more expensive than the cost of incremental reach of advertising on the Super Bowl half-time show or of running ads on Netflix or Amazon Prime video.

Many ad exchanges and supply side platforms (SSPs) continue to serve ads on MFA sites, including ShareThrough, Epsilon Conversant, TripleLift,Teads, GumGum, Colossus, Sovrn, Sonobi, Ogury, Zeta Global, Nexxen, Google, Criteo, Smart AdServer, 33Across, Magnite, Pubmatic, Index Exchange, OpenX, OpenWeb, and Microsoft Xandr.

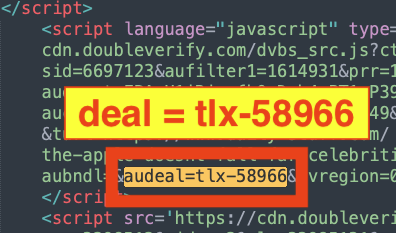

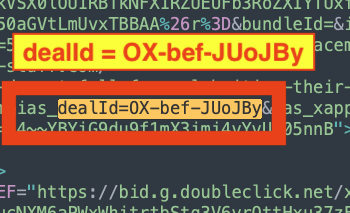

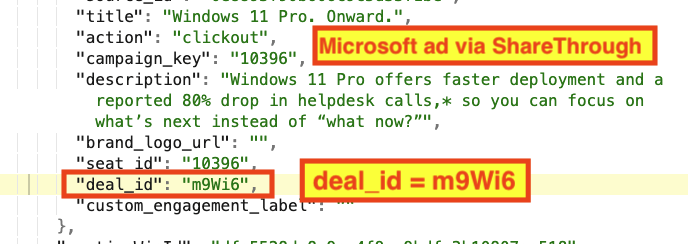

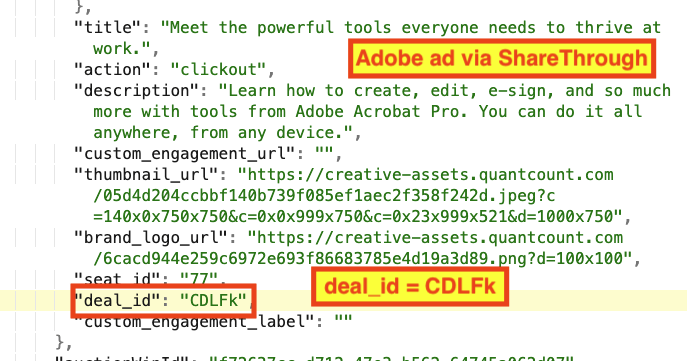

Some ad exchanges which claim to work with vendors such as Jounce Media to eliminate Made for Advertising inventory from Private Marketplace (PMP) deals appear to continue to serve brands’ ads on MFA sites specifically via PMP deals. For example, it appears that the Dell, Microsoft, Comcast, Vail Resorts, Adobe, and other brands had ads served on sites Jounce Media has classified as MFA specifically via PMP deals that were transacted via ShareThrough

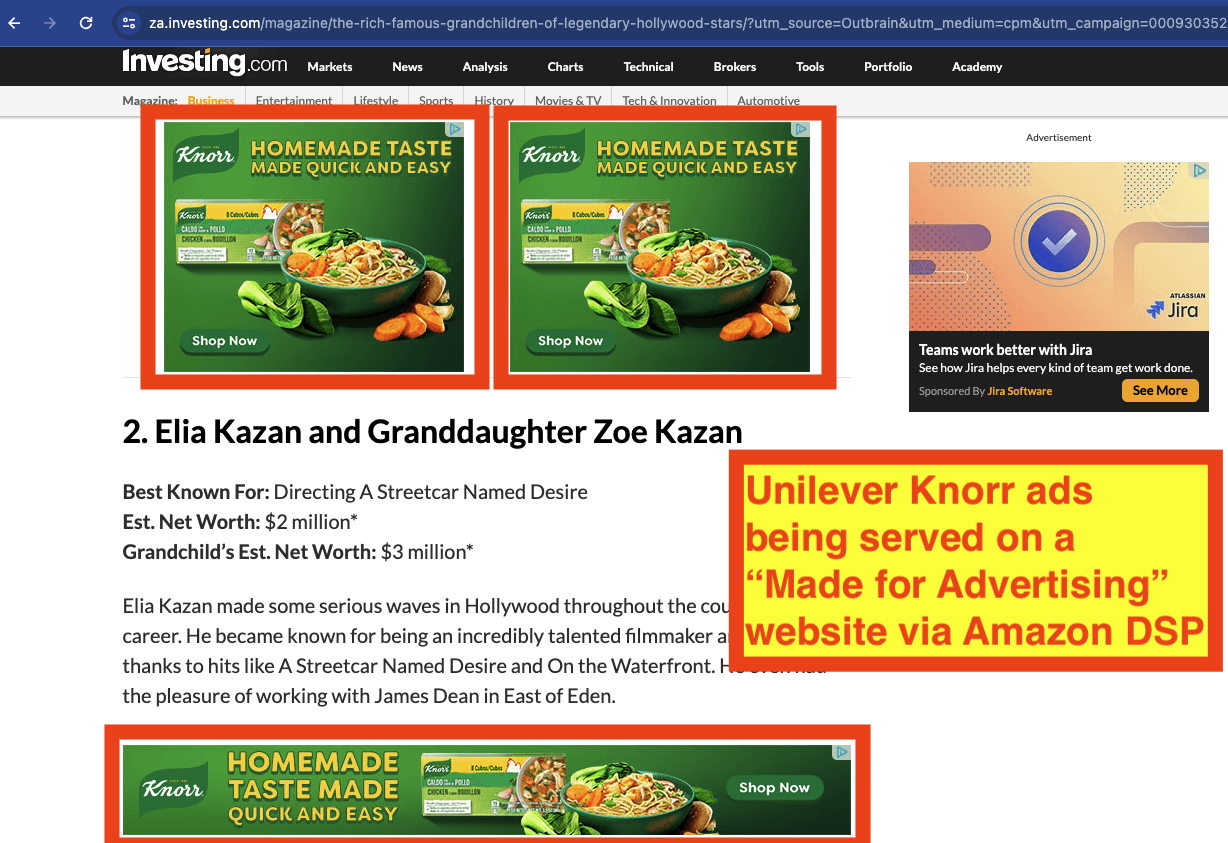

Annotated screenshot of the Association of National Advertisers (ANA’s) “Meet the SSPs” showcase event on March 7th, 2024. Eighty percent of the SSPs invited to present at the ANA event were confirmed to serve multiple ANA members’ ads on websites which meet the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website.

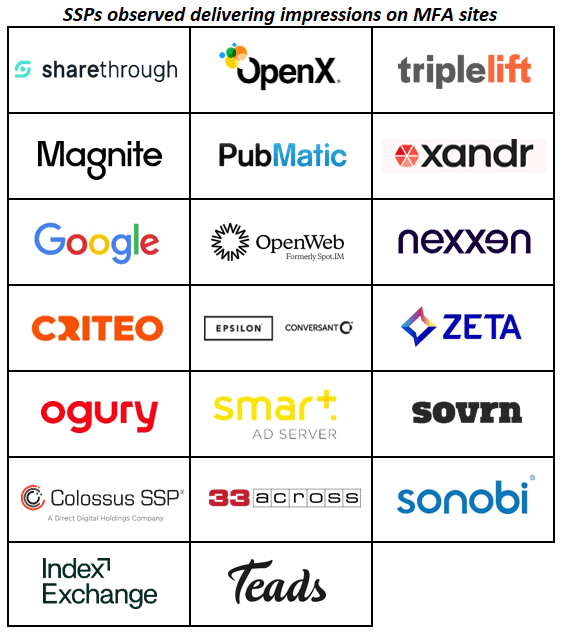

Many demand side platforms (DSPs), including Roku OneView, AdTheorent, Quantcast, StackAdapt, Comcast’s Beeswax, Criteo, Yahoo DSP, Xandr DSP, Epsilon Conversant, Google DV360, and Amazon DSP, have been observed transacting Made for Advertising inventory. Many pharmaceutical brands have their ads served on Made For Advertising sites via PulsePoint and DeepIntent - both are healthcare marketing focused platforms

Trade Desk and Walmart DSP (which runs on Trade Desk software) did not appear to have any ads served on Made for Advertising sites, possibly due to enforcement of its own inventory policies.

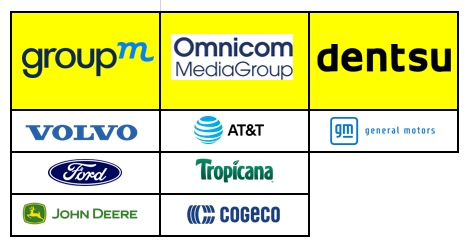

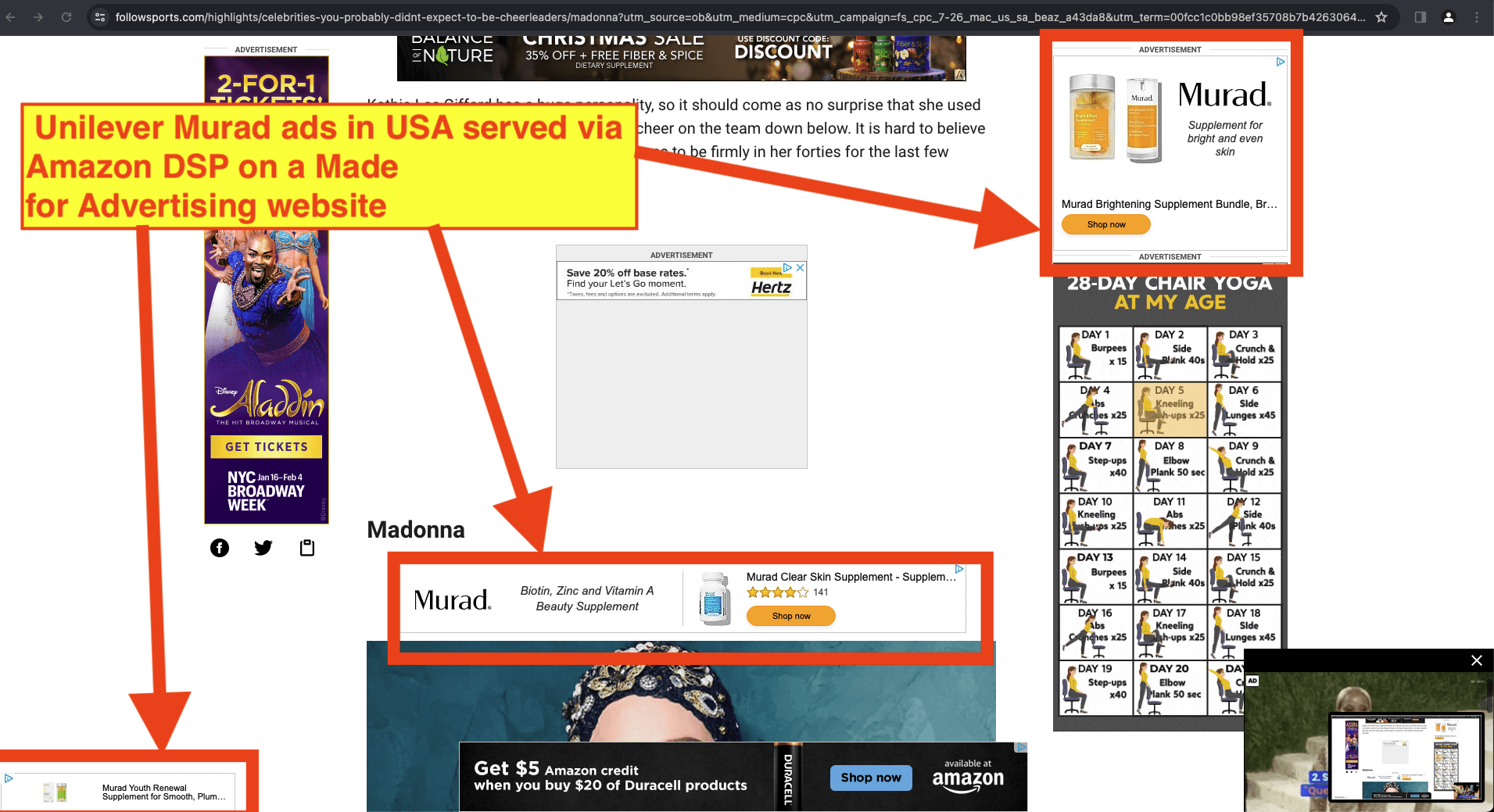

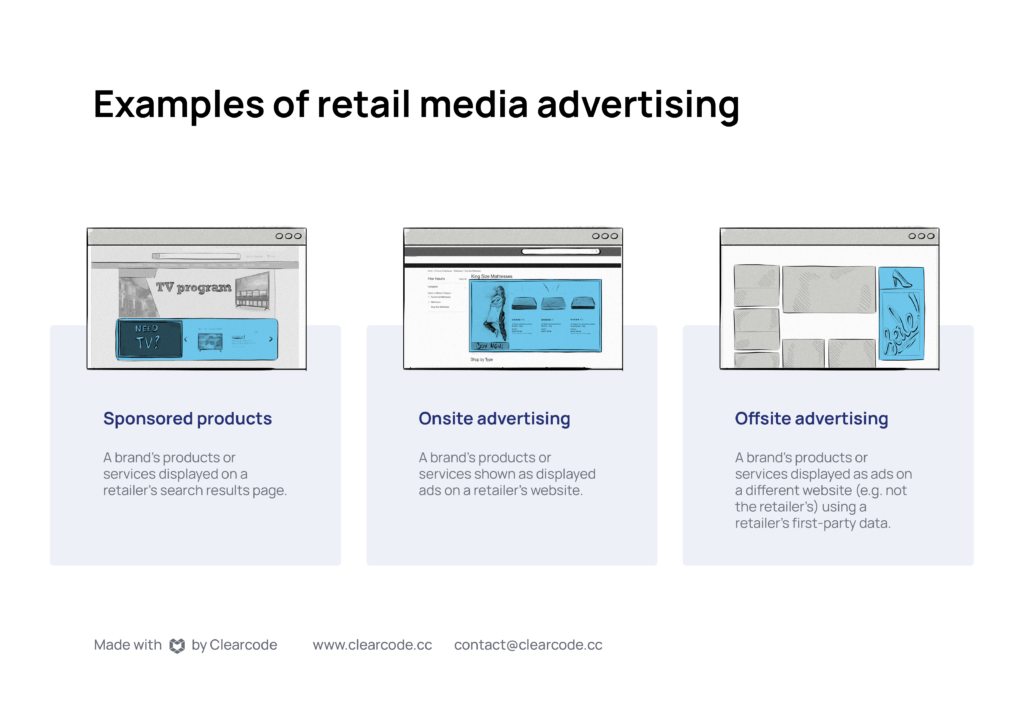

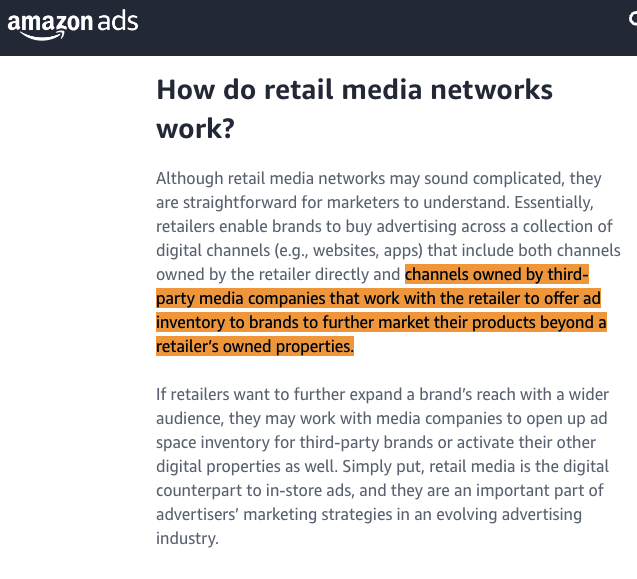

Many major brands appear to have their ads placed on MFA sites specifically via retail media networks (also known as RMNs), such as Amazon’s retail media network. Brands such as Hersheys, Bayer, Procter & Gamble, Haleon, S. C. Johnson & Son, Henkel, Unilever, Reckitt, Nestle, Clorox, Colgate, Google, Georgia-Pacific, Kenvue, PepsiCo, Coca-Cola, Mars, Smuckers, and General Mills had ads observed on MFA sites via retail media networks such as Amazon’s.

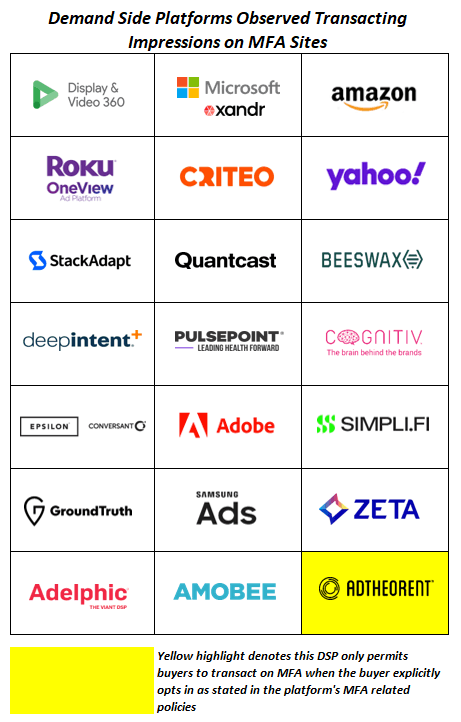

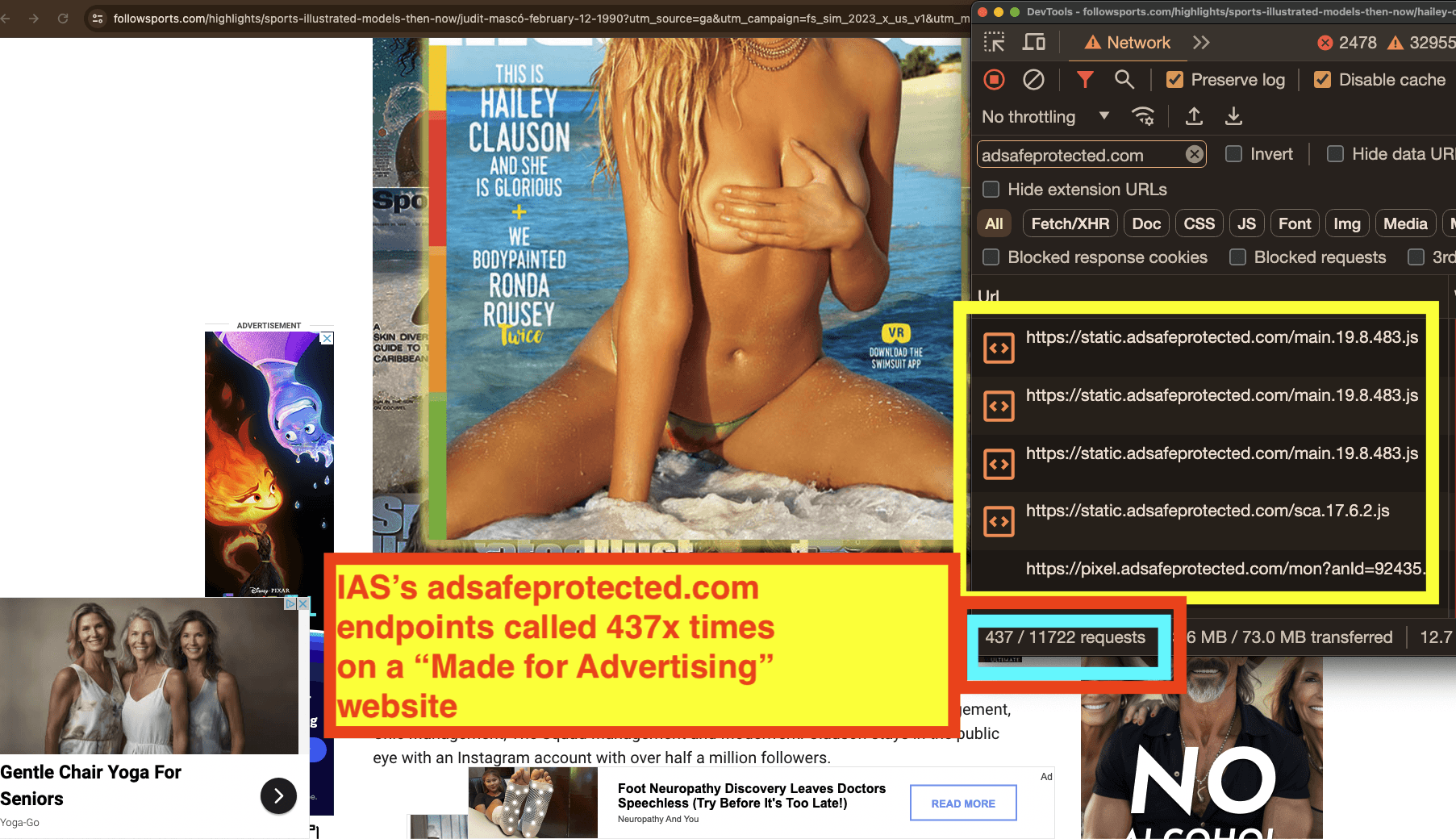

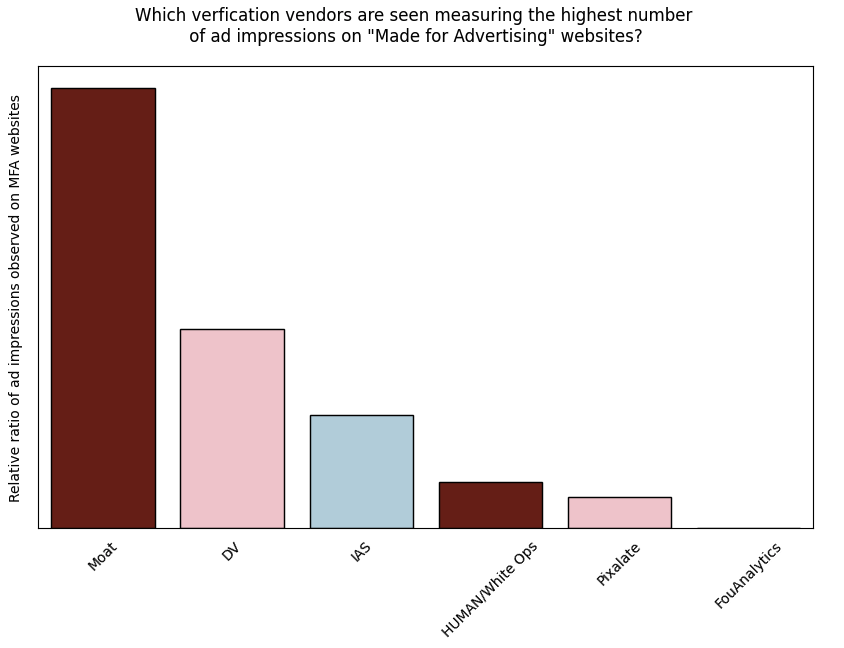

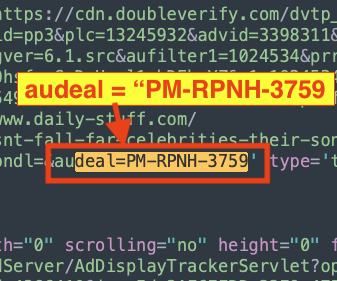

Many ads placed on Made for Advertising sites appear to include measurement or verification tags from vendors such as Integral Ad Science (IAS), DoubleVerify (DV), Oracle Moat, Pixalate, HUMAN (fka White Ops), and/or Fou Analytics.

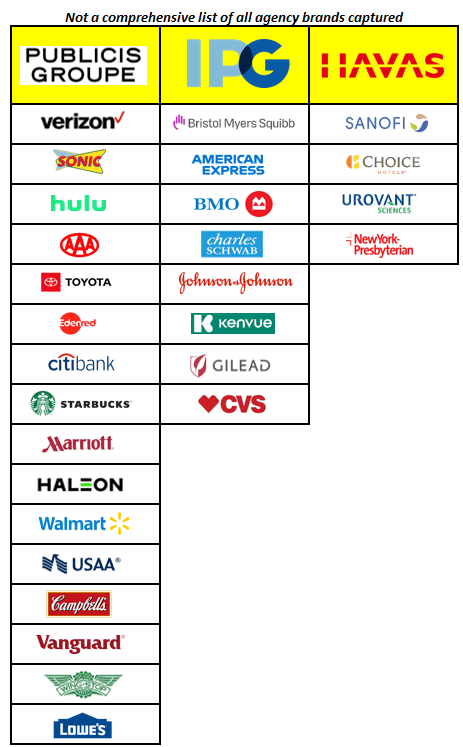

Many major agencies - including all seven agency holding companies (Havas, Dentsu, Omnicom, Publicis, IPG, WPP, Stagwell) and independent agencies such as Horizon Media and Digilant appear to be transacting major brands’ ads on Made for Advertising sites. For example, IPG was observed transacting ads for Bristol Myers Squibb, American Express, BMO Bank, Charles Schwab, Johnson & Johnson, Kenvue, Gilead, and CVS on MFA sites. GroupM’s MindShare or Xaxis was observed transacting ads for Volvo, Ford and John Deere on MFA, and Dentsu’s Carat was observed transacting ads for General Motors on MFA. Omnicom was observed transacting Tropicana, Cogeco, and AT&T ads on MFA. Publicis was observed transacting ads for Verizon, Sonic Drive-In (part of Inspire Brands), Hulu, AAA, Toyota, Edenred, Citi, Starbucks, Marriott, Haleon, Walmart, USAA, Campbell Soup Company, Vanguard, Wingstop, and Lowe’s on MFA. Havas was observed transacting ads for Sanofi, Choice Hotels, Urovant, and NewYork-Presbyterian Hospital on MFA. Stagwell’s GALE was observed transacting thousands of H&R Blocks ads to the same few individuals on auto-refreshing MFA sites. Horizon Media was observed transacting United Healthcare and SleepNumber ads on MFA sites via DV360 and using DoubleVerify.

Thousands of brands appear to have their ads placed on Made for Advertising sites via the Microsoft Audience Network.

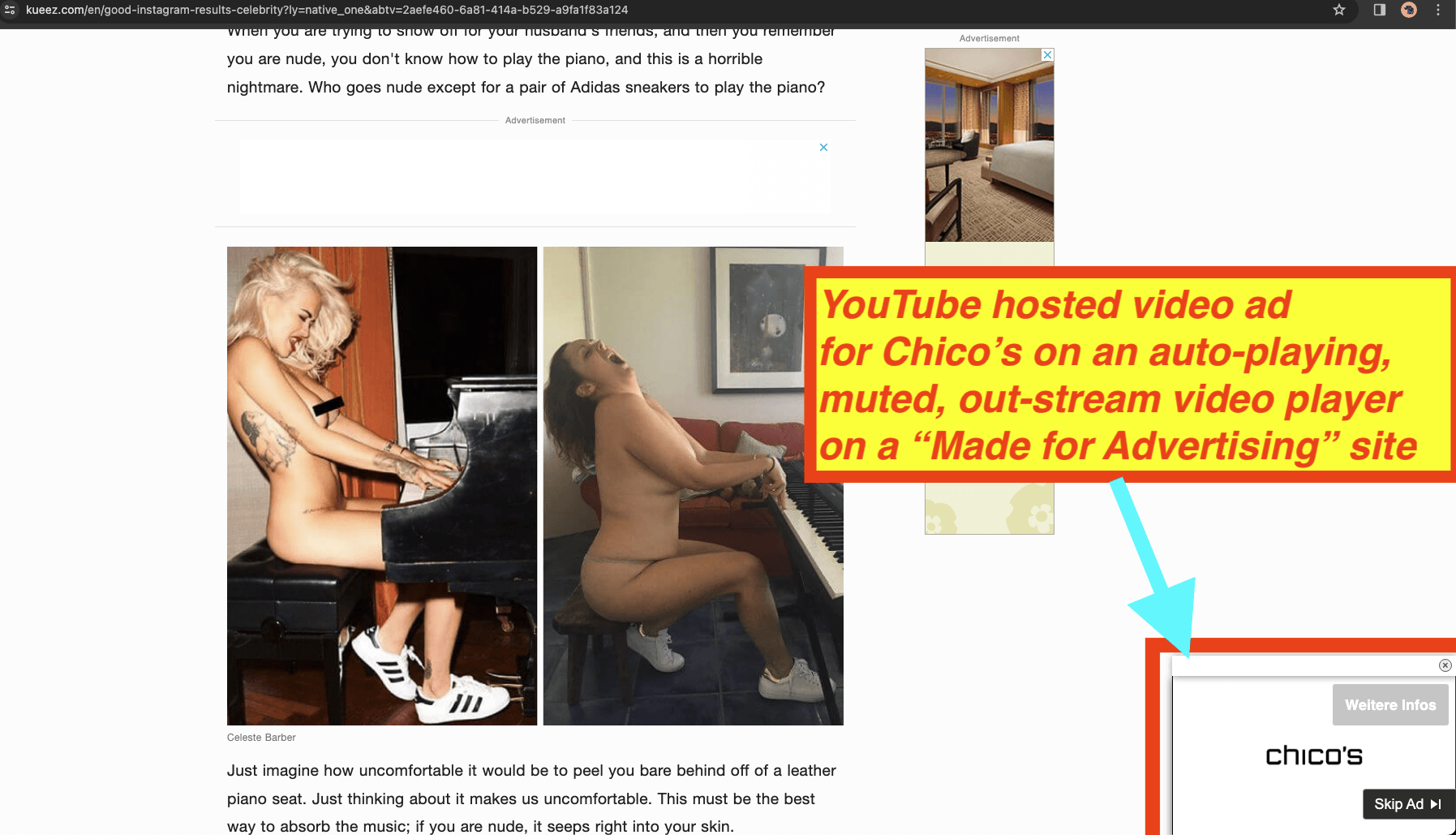

Some brands such as Grammarly and Vrbo continue to have their skippable YouTube TrueView video ads observed in muted, auto-playing out-stream video players on Made for Advertising websites via the Google Video Partners (GVP) network.

Many brands’ ads were placed on “Made for Advertising” sites via vendors which allege to use AI to serve or target ads, or wherein the vendors claim to have access to some kind of special dataset, such as NPI lists of US healthcare providers.

Table of Contents

What are “Made for Advertising” (MFA) websites? 20

Leading Trade Groups define “Made for Advertising” websites 23

Identifying a sample of “Made for Advertising” (MFA) websites 31

Considering the ownership and audience of the sample of putative “Made for Advertising” websites 43

Thousands of brands have their ads observed on “Made for Advertising” websites in 2024 50

Ad tech vendors observed transacting brands’ ads on “Made for Advertising” websites in 2024 69

Demand side platforms observed transacting brands’ ads on “Made for Advertising” websites in 2024 77

Brand Safety Vendors and Bot Detection Vendors Observed Collecting Data on MFA sites in 2024 89

Private marketplace (PMP) deals serving ads on “Made for Advertising” websites 95

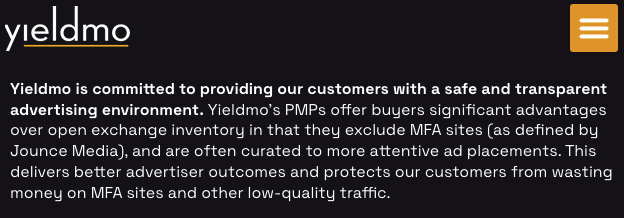

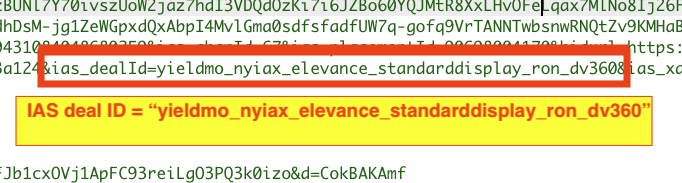

Yieldmo observed potentially transacting PMP deals on “Made for Advertising” websites 97

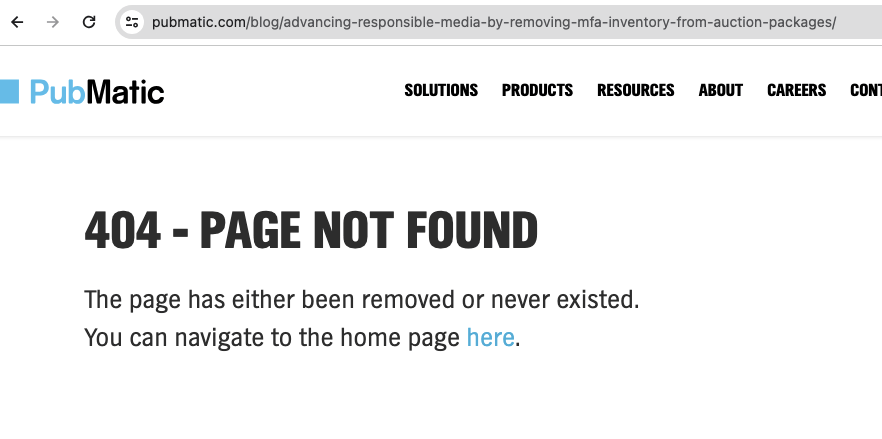

Pubmatic observed potentially transacting PMP deals “Made for Advertising” websites 99

OpenX observed potentially transacting PMP deals serving ads on “Made for Advertising” websites 102

ShareThrough observed potentially transacting PMP deals on “Made for Advertising” websites 104

Retail Media Networks appear to transact ads on “Made for Advertising” websites 108

Media agencies observed transacting ads on “Made for Advertising” websites in 2024 139

Microsoft Audience Network 153

Potential solutions for advertisers 165

Background

What are “Made for Advertising” (MFA) websites?

Screenshot of a X (fka Twitter) post referencing “Made for Advertising” websites in August 2021.

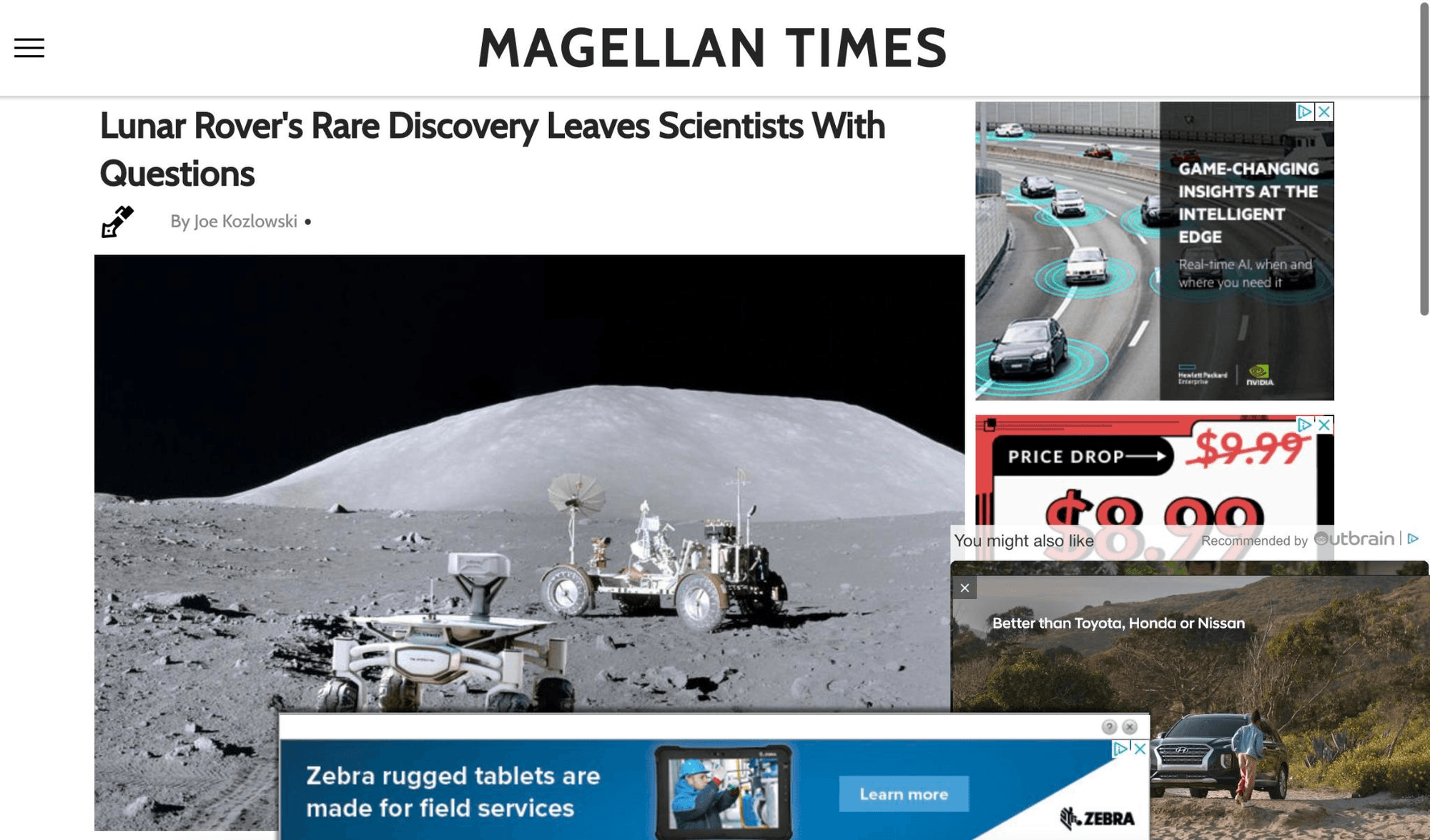

According to the Association of National Advertisers, “MFA sites typically use sensational headlines, clickbait, and provocative content to attract visitors and generate page views, which in turn generate ad revenue for the site owner. MFA sites also usually feature low-quality content, and may use tactics such as pop-up ads, auto-play videos, or intrusive ads to maximize ad revenue.”

Illustration of what a Made for Advertising (MFA) website can look like. Source: Interactive Advertising Bureau (IAB) UK

The ANA states: “Some of the lower quality websites, especially Made for Advertising sites, create more carbon emissions than the average site. That is because they have many ads per page and indiscriminately make ad calls to as many demand sources (like SSPs, DSPs, and ad networks) as they possibly can. According to Scope3 (a new industry organization with the mission to decarbonize advertising), MFA sites are 26 percent higher in carbon emissions than non-MFA inventory”.

Furthermore, the ANA states: “MFA sites generally are designed to fool digital advertising buyers. MFA websites exhibit high measurability rates, good viewability rates, and low

levels of invalid traffic, and usually have brand-safe environments. They also

perform higher on video completion rates, often with autoplay ads that have the

sound off. Notably, media CPMs paid on MFA websites are 25 percent lower than

those paid on non-MFA websites. All this makes MFA websites attractive to DSP

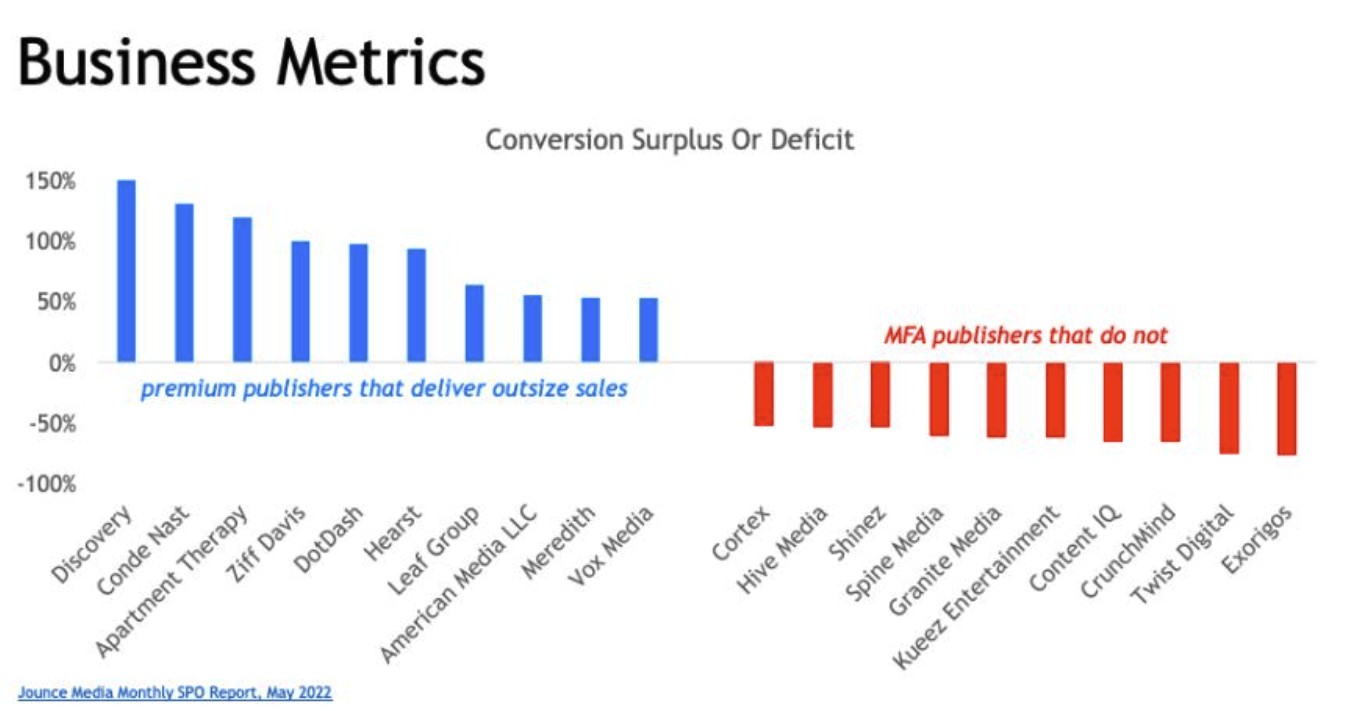

bidding algorithms. But typically, MFA websites don’t perform well on key metrics like brand lift. According to Jounce Media, ads on MFA websites are at least 50 percent less

likely to be attributed with driving a sale than the internet average.”

Histogram showing that “Made for Advertising” publishers tend to drive less conversions for advertisers than premium publishers. Source: Jounce Media Monthly SPO Report, May 2022, via Campaign

One of the contributors to the ANA report, Jounce Media states that: “MFA is defined as a category of “inventory that achieves superficial KPIs like viewability by creating a user-hostile advertising experience.””

Furthemore, the ANA states: “The experience of visiting MFA websites can also fool digital advertising buyers. Going directly to an MFA site (i.e., simply typing in the URL of the site) results in a very different ad experience than clicking on a referral link (often at the bottom of the page on the site of a well-known publisher). In the former case, the user experience is generally cleaner. In the latter case it is not, typically exhibiting characteristics in the aforementioned definition such as high ad-to-content ratio and rapidly auto-refreshing ad placements. While investigating MFA supply, DeepSee.io found that many remove ads when people visit a site directly, but flood the page when people come via social media, search engines, or content recommendation widgets.”

The same site visited directly vs visited by paid link. Source: DeepSee.io

Two screenshots of the same website. The top screenshot shows when the site is visited directly. The bottom screenshot shows there are significantly more ad density on the page when the visit is visited by a paid ad click on another website (Taboola, Outbrain, Facebook, etc).

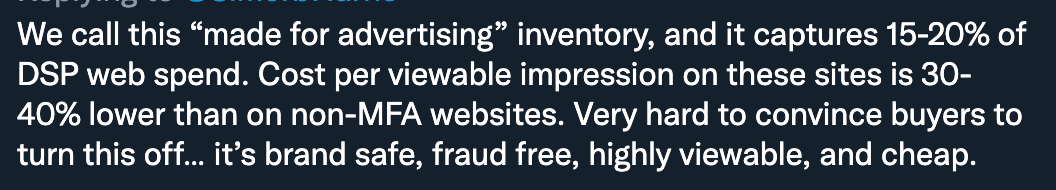

According to Chris Kane, CEO of Jounce Media, “Made for Advertising” “ad inventory is viewable, brand safe and cheap, designed to meet standards buyers and content verification ad-tech firms have implemented in the past half-decade. Yet these sites rarely drive real-world business outcomes.” Kane further said: “There is more and more consensus among industry insiders that [MFA] meets all the industry’s minimums but fails basic inventory quality standards,” Kane said. “It’s not fraud, but it’s tiptoeing close to fraud.”

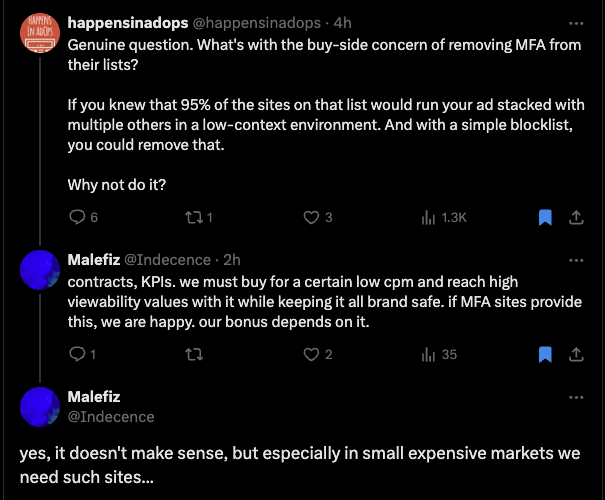

The Vice President of programmatic & display media at performance marketing agency Tinuiti, Geoff Litwer, told Adweek that: media “buyers currently have all the tools they need to mostly avoid MFA inventory, but that low-quality websites continue to exist because they help marketers fulfill vanity metrics without actually making for good advertising.“If you have a marketer whose CFO assigns a budget based on a particular KPI, [MFA] makes [their] life so much easier,” Litwer said. “[MFA] is the ‘feel-good, I can save time’ trick.””

Campaign reported that: “MFAs cannot manipulate outcomes, fake incremental brand, behavioural, or business outcomes. The only caveat is that MFA can game attribution measurement but not incrementality measurement [...] So, despite having killer reach and viewability metrics, the MFA inventory would be exposed as worthless if the campaign's goal was to drive sales."

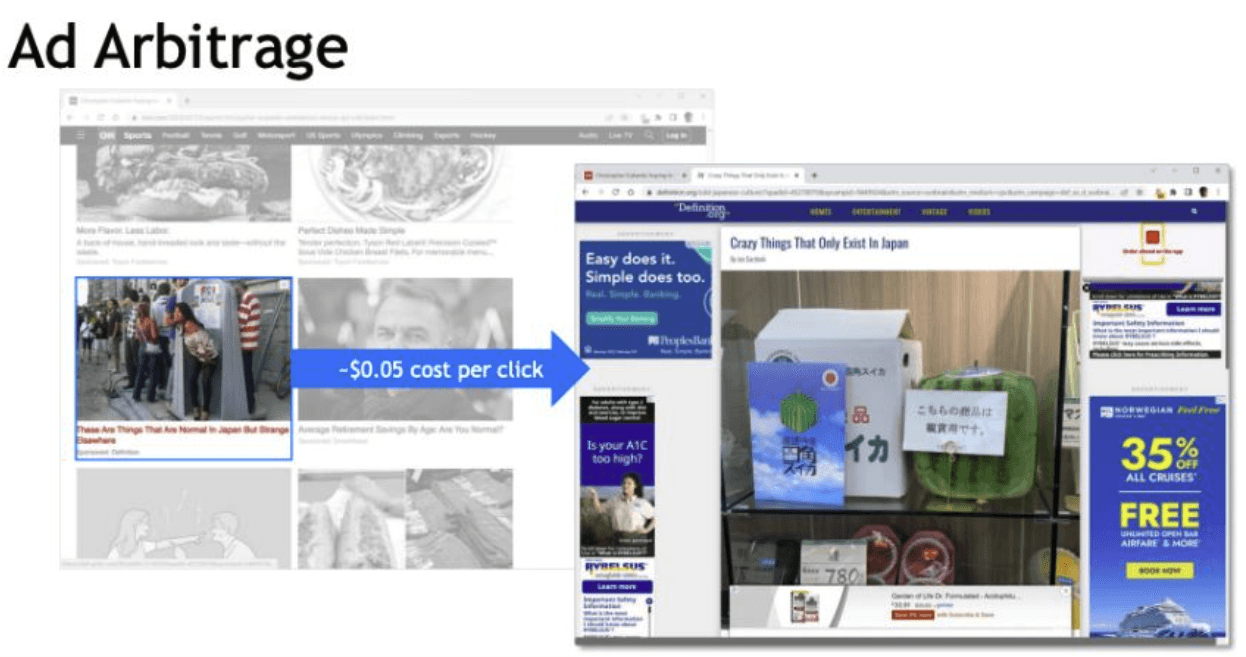

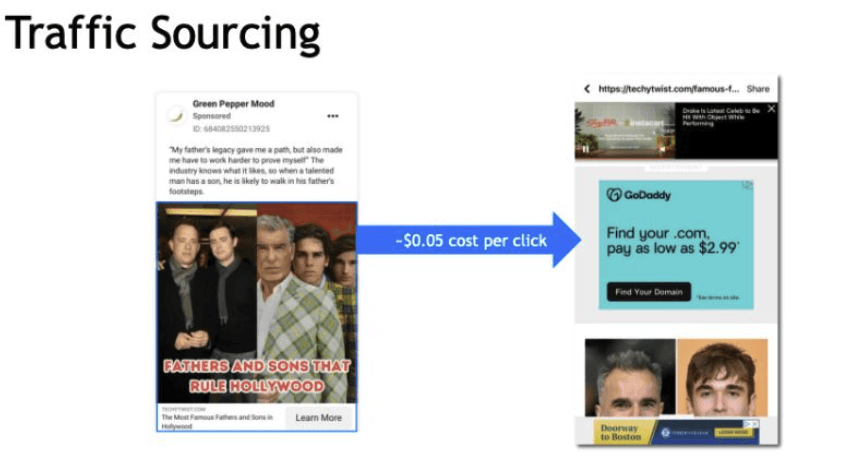

The ANA states that Made for Advertising websites have “High percentage of paid traffic sourcing” and “often have little-to-no organic audience and are instead highly dependent on visits sourced from clickbait ads that run on social networks, content recommendations platforms, and even on the websites of reputable publishers. Buying paid traffic is the primary cost driver of operating an MFA business. Overcoming paid traffic acquisition costs requires MFA publishers to engage in aggressive monetization practices and arbitrage.”

Some MFA sites go even a step further, and specifically configure their websites to not appear in organic Google or Bing search results. This further reduces the probability that a viewer would arrive at one of the websites through organic, un-paid traffic sources.

Leading Trade Groups define “Made for Advertising” websites

On September 26th, 2023, a “consortium of marketing and advertising trade organizations [...] released a detailed definition of so-called “Made for Advertising” websites.” The “group included the ANA, the 4A’s, the World Federation of Advertisers (WFA) and the Incorporated Society of British Advertisers (ISBA). The MFA definitions were also developed in consultation with Chris Kane, Founder of Jounce Media, and Rocky Moss, Co-Founder and CEO of DeepSee.io.”

“MFA sites, also referred to by the 4A’s as “Made for Arbitrage” sites, are created for that singular purpose—to simultaneously buy and sell advertising inventory.” The ANA said “MFA sites generally are designed to fool digital advertising buyers. MFA websites exhibit high measurability rates, good viewability rates, low levels of invalid traffic, and usually have brand-safe environments.”

Source: Jounce Media, via Campaign

Source: Jounce Media, via Campaign

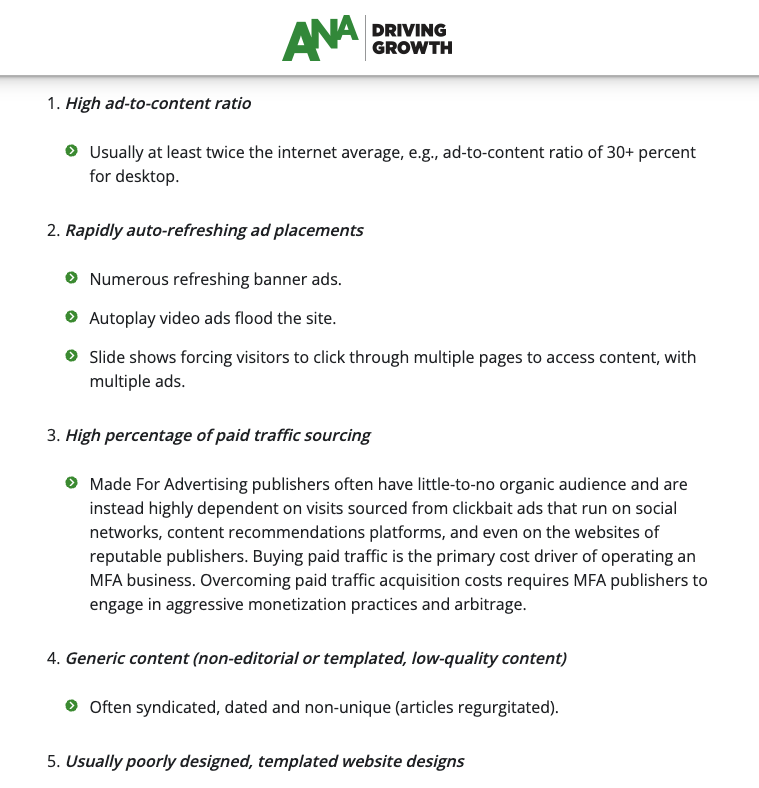

The trade organizations said MFA sites usually exhibit some combination of the following characteristics:

High ad-to-content ratio

Usually at least twice the internet average, e.g., ad-to-content ratio of 30+ percent for desktop.

Rapidly auto-refreshing ad placements

Numerous refreshing banner ads.

Autoplay video ads flood the site.

Slide shows forcing visitors to click through multiple pages to access content, with multiple ads.

High percentage of paid traffic sourcing

Made For Advertising publishers often have little-to-no organic audience and are instead highly dependent on visits sourced from clickbait ads that run on social networks, content recommendations platforms, and even on the websites of reputable publishers. Buying paid traffic is the primary cost driver of operating an MFA business. Overcoming paid traffic acquisition costs requires MFA publishers to engage in aggressive monetization practices and arbitrage.

Generic content (non-editorial or templated, low-quality content)

Often syndicated, dated and non-unique (articles regurgitated).

Usually poorly designed, templated website designs

A consortium of leading advertising trade groups established a joint definition for “Made for Advertising” sites. Source: Association of National Advertisers

Lastly, the IAB UK published a “Guide to identify made for advertising websites” in July 2023.

Which ad tech vendors and media agencies have issued statements about reducing ad delivery on “Made for Advertising” websites?

Since the ANA issued its June 2023 “First Look” report documenting the issue of “Made for Advertising” websites, a number of ad tech vendors and media agencies have issued statements or told journalists about various initiatives they were undertaking to reduce advertisers exposure to “Made for Advertising” websites.

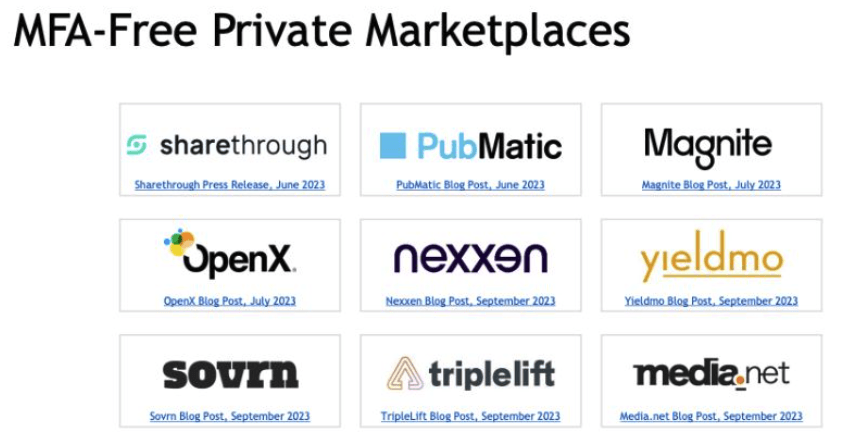

ShareThrough, PubMatic, Magnite, OpenX, Nexxen, Yieldmo, Sovrn, TripleLift, and Media.net issued various blog posts or press releases disavowing “Made for Advertising” in certain cases. TripleLift said that “we are committed to: Blocking Made for Advertising (MFA) inventory from all private marketplace and publisher first-party data deals; Refusing to onboard any MFA inventory, a part of our supply standards.” Magnite said: “we ensure that all inventory made available meet our core standards [...] Magnite leads the way in protecting buyers from MFA sites.” Magnite’s inventory quality policies state that: “using automatic ad refreshes (unless instigated by an end-user refreshing the seller’s media)” is a form of “invalid impressions”.

OpenX states that it “has partnered with Jounce Media” and has “started to block known MFA traffic on Auction Packages running through OpenX.” It further states: “OpenX leverages the Jounce Media MFA domain list as the standard baseline, and in its continued commitment to inventory quality and transparency, the SSP has committed to eliminating MFA domains in all direct-sold deals by default.”

ShareThrough announced on June 14th, 2023 that “Sharethrough becomes the first ad exchange to remove MFA sites, which are sites created for the purpose of ad arbitrage, from all its off-the-shelf deals and custom PMPs created after July 1, 2023. The company is leveraging Jounce Media data to identify MFA sites and has built filters within its curation platform to remove them.”

SSP press releases announcing removal of MFA supply from PMPs, compiled by Jounce Media

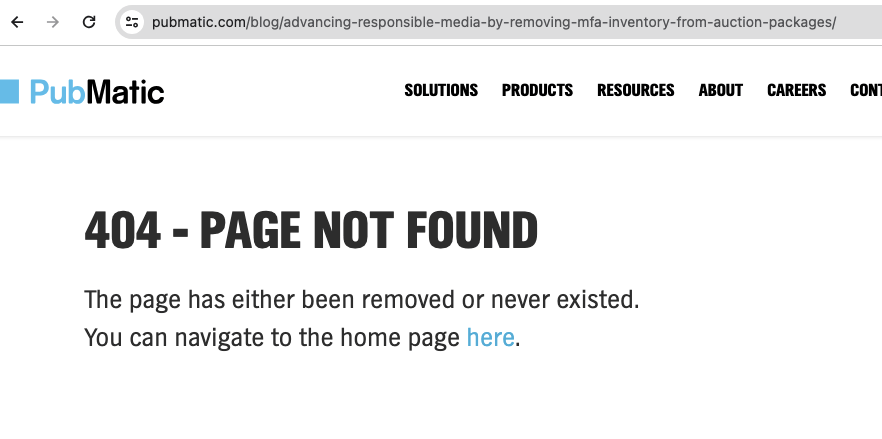

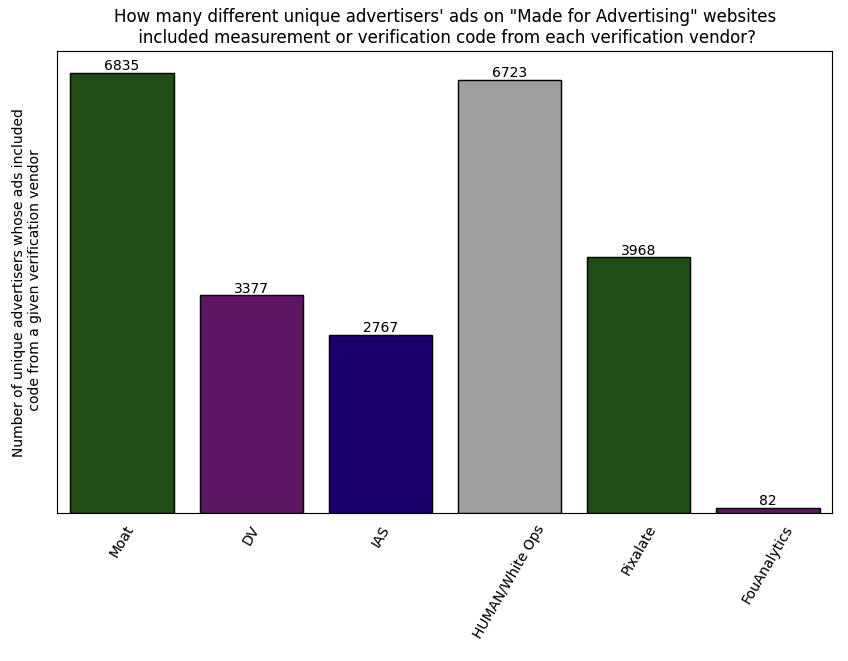

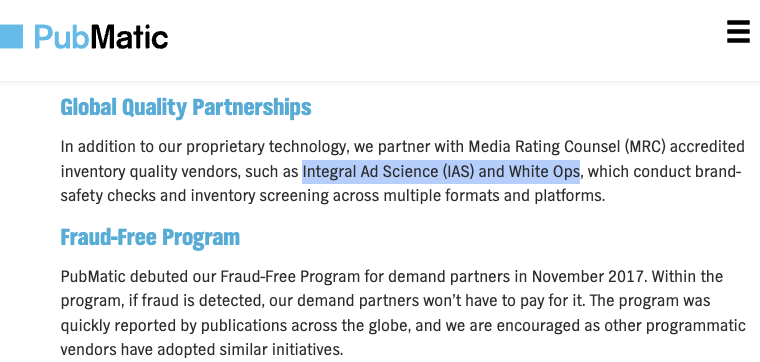

PubMatic senior director of marketplace quality Eric Bozinny told Adweek in June 2023 that it “will announce it’s eliminating MFA inventory from the auction packages it sells.” Pubmatic issued a blog post in June 2023 regarding “Made for Advertising”, but it is now no longer accessible. The inaccessible blog post said: “PubMatic is [...] turning responsible media insights into action by eliminating made for advertising (MFA) websites from PubMatic-sold Auction Packages.” The inaccessible post further said: “our work to provide powerful, quality advertising experiences for buyers has been recognized by Jounce Media, which ranks PubMatic as the omnichannel supply-side technology company with the lowest exposure to MFA inventory among our peer group. According to Jounce Media’s Chris Kane, “Bidding into the PubMatic open auction creates less exposure to MFA inventory than bidding into the open auction from any other major exchange.”

Screenshot of Pubmatic’s blog post titled: “Advancing Responsible Media By Removing MFA Inventory From Auction Packages.” (URL: https://pubmatic.com/blog/advancing-responsible-media-by-removing-mfa-inventory-from-auction-packages/) showing that the page is “not found”. An archived copy of the page can be found on the Internet Archive from June 2023.

Index Exchange told Digiday that: “We have always made an effort to block inventory that is low effort or low quality, has a high ad density to content ratio, and has high levels of social or display ad traffic, which are all common criteria of MFA content [...] Quality has been a cornerstone of Index since the launch of the exchange, and our policies are continually revised to support this, in lockstep with feedback from our buyers and partners.”

Several ad buying or demand side platforms (DSPs) have also issued statements regarding filtering out “Made for Advertising” in certain situations. For example, the DSP AdTheorent announced it was partnering with Jounce Media to “verify removal of Made for Advertising (MFA) Properties from Its Campaigns) [...] to ensure that AdTheorent’s campaigns remain MFA-free, unless affirmatively elected by an advertiser. “

DSP Centro Basis “partnered with Jounce Media to automatically prevent ads from being served on [Made for Advertising] sites.”

Digiday wrote that DSP Trade Desk “have put up a good fight, implementing robust measures to curb MFA inventory purchases through their ad tech platform” and “refuse to buy this [MFA] inventory outright.”

Several ad verification vendors also issued statements about helping brands monitor or eliminate delivery on “Made for Advertising” websites.

In September 2023, DoubleVerify announced a “solution to enable advertisers to monitor and avoid MFA”.

In October 2023, IAS “announced a new Made for Advertising (MFA) AI-driven site detection and avoidance product.” “IAS’s new product leverages AI to uncover MFA sites at scale” and “provide [advertisers] with the ability to both detect and avoid MFA sites”.

In November, 2023, Pixalate “announced the launch of “Made for Advertising” (MFA) technology to detect and block MFA websites, CTV and mobile apps.”

Several media agencies also issued public statements about various approaches or initiatives related to “made for advertising” websites.

GroupM announced “the introduction of new protections against Made For Advertising (MFA) websites and domains”, which “will see GroupM integrate Jounce’s industry-leading technology in tracking MFA domains with GroupM’s leading campaign planning processes.”

The global head of brand assurance at Dentsu told Digiday: “In terms of priorities for 2024, MFAs are currently about a 4 out of 10 [...] we are confident that our current approach is successful”.

Digiday reported that the SVP and head of precision media at Digitas (Publicis), said that MFAs are still a “higher priority” in 2024, but between the targeting tools and MFA filters created by Publicis Groupe and DSPs like The Trade Desk, she said she feels her team is in a strong position to maintain the “pursuit of quality inventory” in the new year.

Digiday reported that for Omnicom: “By using its own standards, as well as those of the ANA, OMG delivered results for its clients that it said outperformed the averages the ANA study revealed [...] OMG was able to keep MFA delivery to less than 1%.”

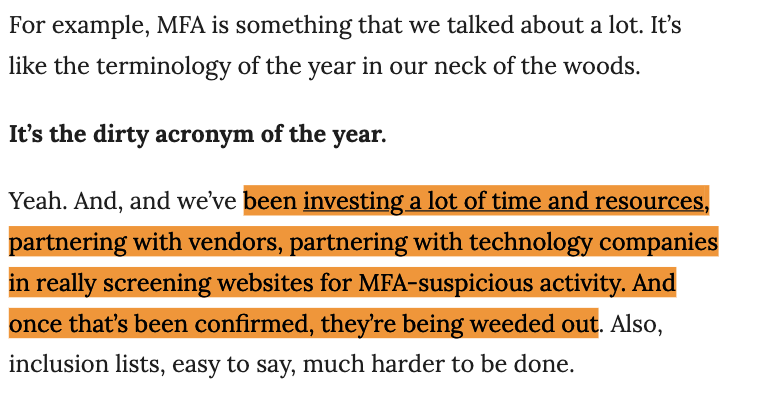

Omnicom Media Group’s CEO told Digiday in a December 2023 article that Omnicom has “been investing a lot of time and resources, partnering with vendors, partnering with technology companies in really screening websites for MFA-suspicious activity. And once that’s been confirmed, they’re being weeded out.”

Screenshot from a December 2023 Digiday article interview with the CEO of Omnicom Media Group

The Director of Supply Intelligence at IPG’s KINESSO subsidiary wrote that: “At KINESSO, we have generated an arsenal of tactics to help us review inventory and weed out MFAs.”

Research methodology

In order to be able to observe which brands have ads served on “Made for Advertising” websites in January 2024, as well as which vendors were transacting said ads, it was first necessary to identify a sample of websites which can be reasonably described to meet the criteria for “Made for Advertising” sites. While there are hundreds to thousands of different unique domains which can meet the various criteria of being ‘Made for Advertising’, this study chose to focus on a list of twenty two websites for which there was relatively strong justification for sites being classified as “Made for Advertising”.

Identifying a sample of “Made for Advertising” (MFA) websites

In order to identify a list of twenty two websites which can be considered “Made for Advertising”, this study sourced information on tens of thousands of different websites, including the following metrics or data points:

ad delivery

ad refresh rates

number of simultaneously displayed video and banner ad slots per page

total number of unique or distinct ad slots per page

total number of ad impressions served to individual consumers per page

audience traffic sources (paid, organic, direct, search, etc)

ads.txt and sellers.json seller IDs

relative prevalence of ads served within mobile in-app browser webviews

number of templated or “cloned” websites, using network analyses to identify related websites

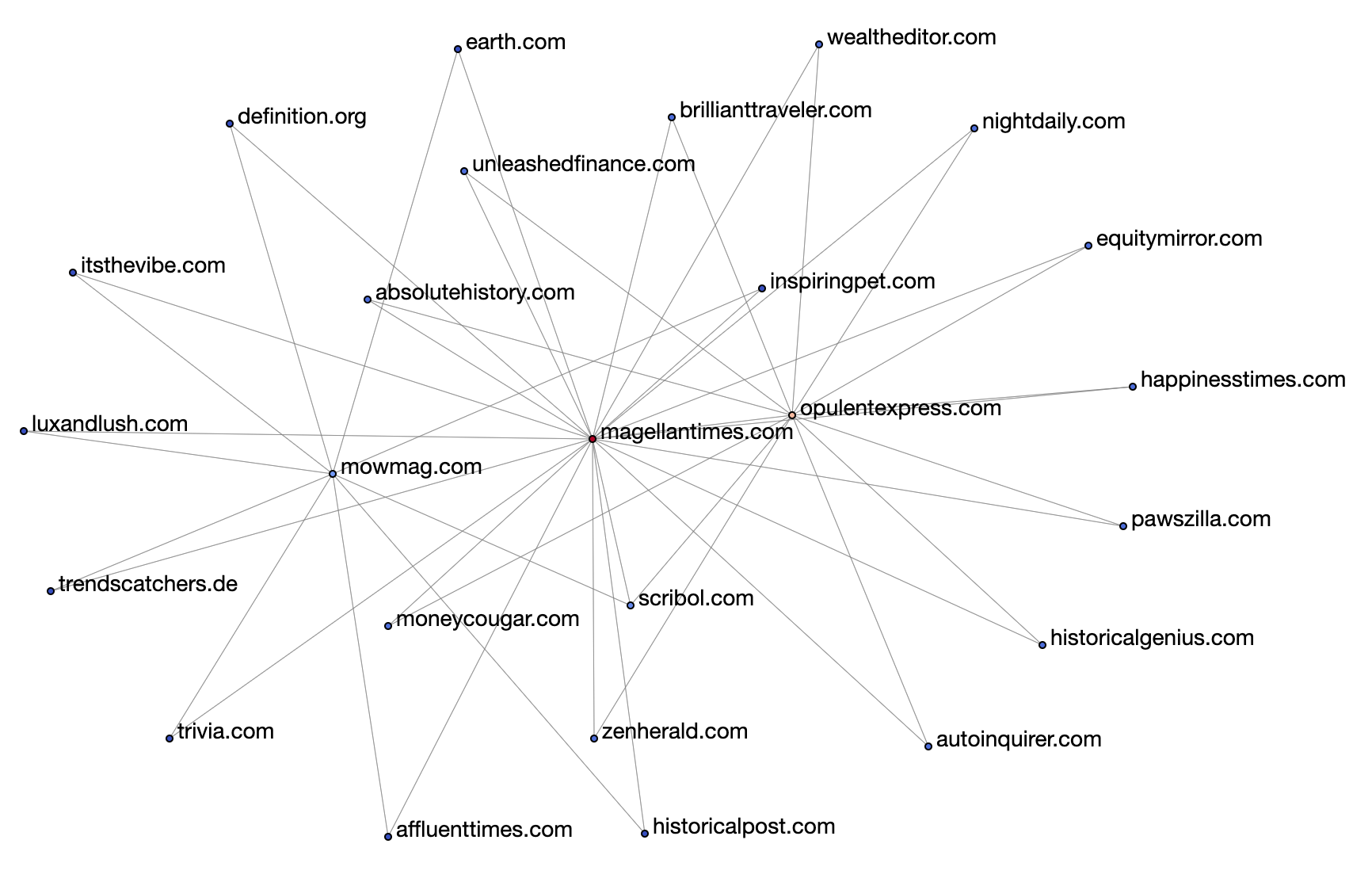

To better explain the last point regarding templated websites - in the network graph analysis below, one can observe a cluster of websites which appear to be linked by analytics and seller IDs, as well as content displayed.

Network graph analysis of websites that are observed clustered together due to similarity in web assets and high entropy identifiers.

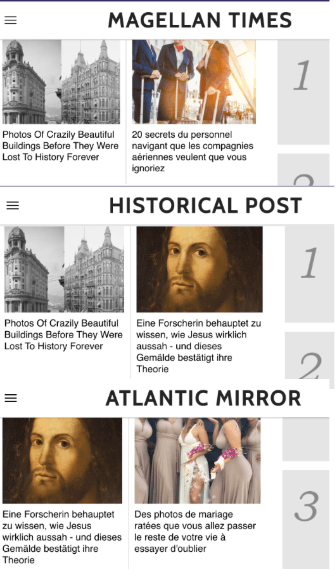

A manual inspection of these websites confirms that many of them appear to be visually similar in layout.

Screenshot of 3 different websites showing similar layouts, images, and content.

Furthermore, Adalytics reviewed a list of websites with both Jounce Media and DeepSee.io, who were both involved in the ANA’s programmatic transparency study in 2023 and helped various trade groups define the standard for “made for advertising”.

The list of websites was filtered to a sub-set which met all of the following criteria:

The website exhibited audience traffic sourcing, content, and ad delivery behaviors that are consistent with the Association of National Advertisers’ (ANA), American Association of Advertising Agencies’ (4A), Incorporated Society of British Advertisers’ (ISBA), and World Federation of Advertisers’ (WFA’s) detailed definition of “Made for Advertising” websites.

The websites were observed sourcing traffic via Taboola or Outbrain ads, and the websites were confirmed to have a large percentage of their audience traffic originating from paid media sources (as opposed to organic, search, direct, etc).

The websites were observed serving over one thousand ad impressions to a single consumer in a short duration page view session - due to either refreshing ad slots aggressively or loading new ads slots aggressively. This means that an advertiser could end up spending $5.00 to reach just one person/consumer, if the brand was paying $5.00 CPMs and had 1000 ads served on the putative MFA domain to a single consumer.

Were confirmed by DeepSee.io and/or Jounce Media to be classified by them as “Made for Advertising”.

With regards to ad placement density, the IAB UK’s “Guide to identify made for advertising websites” notes that its “Rules of Attention” research found that one or two ads per screen commanded more than double the attention of three plus ads.

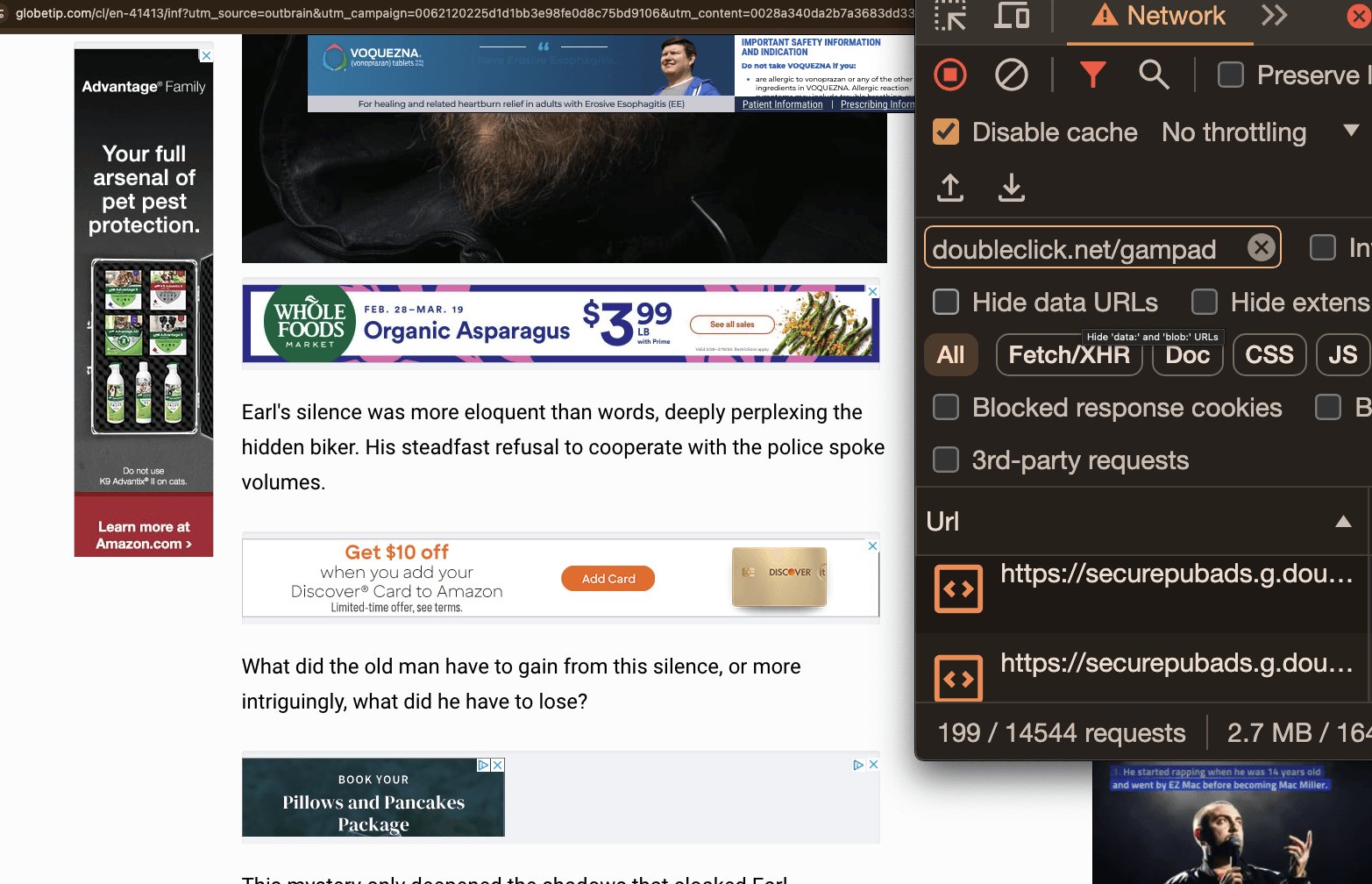

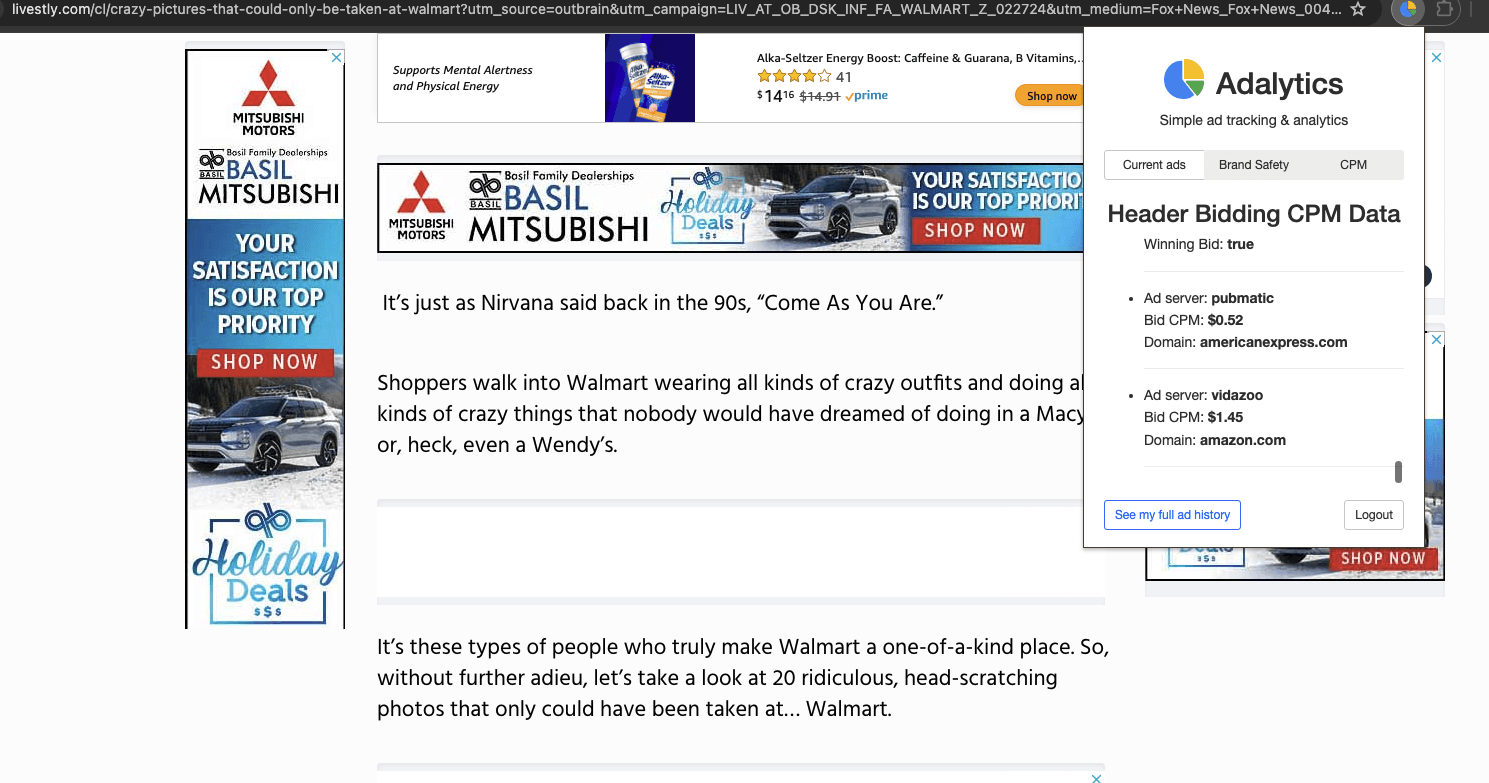

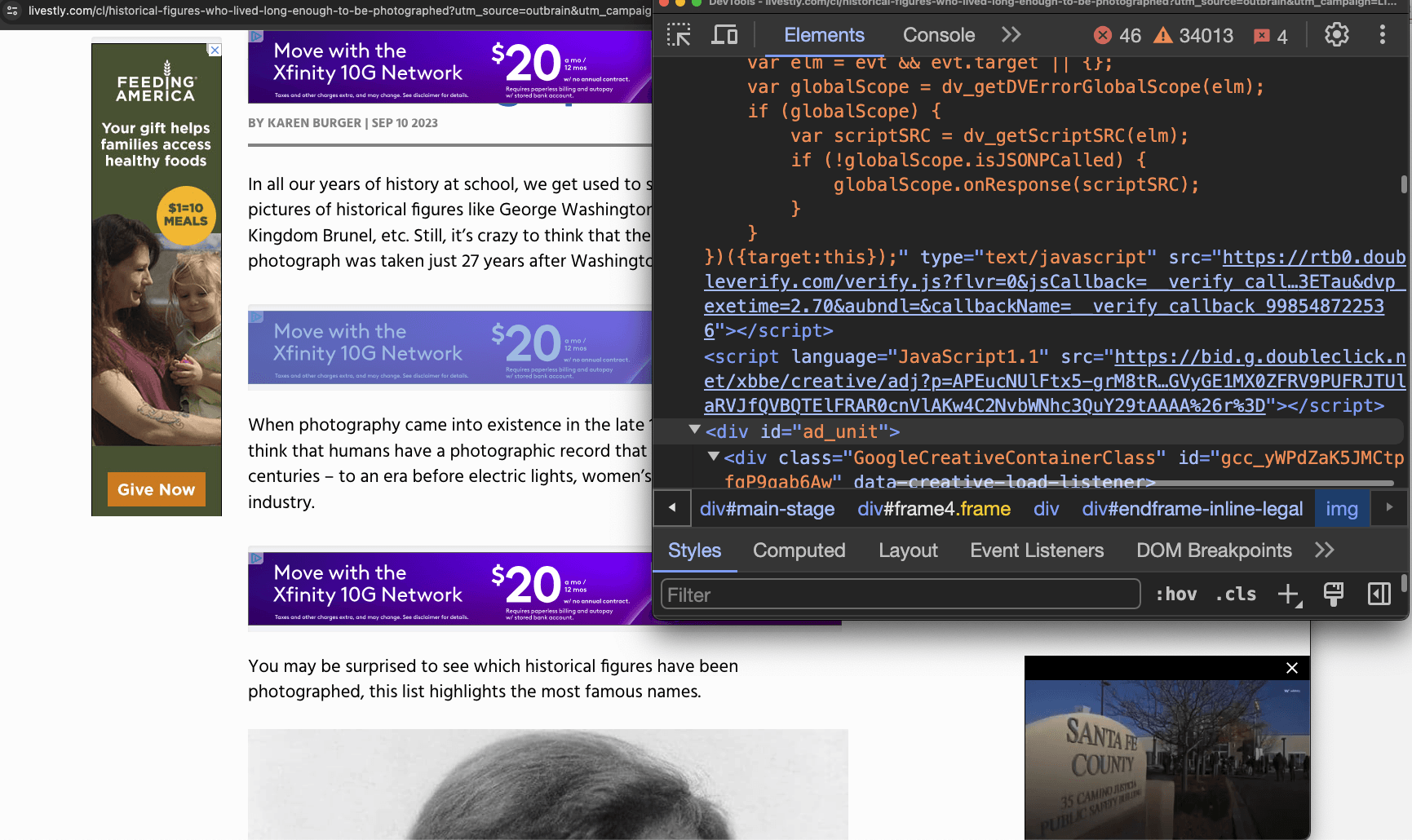

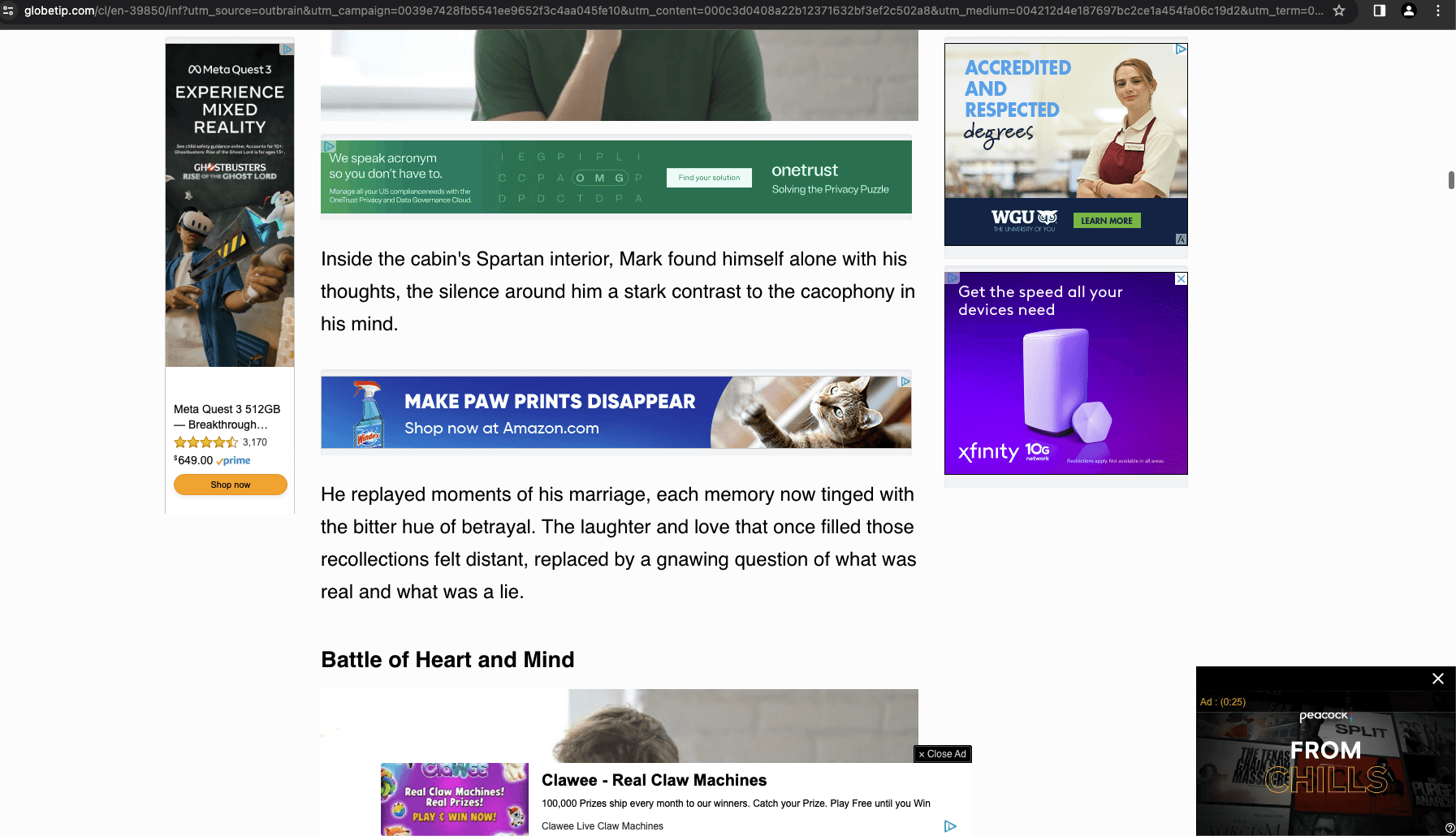

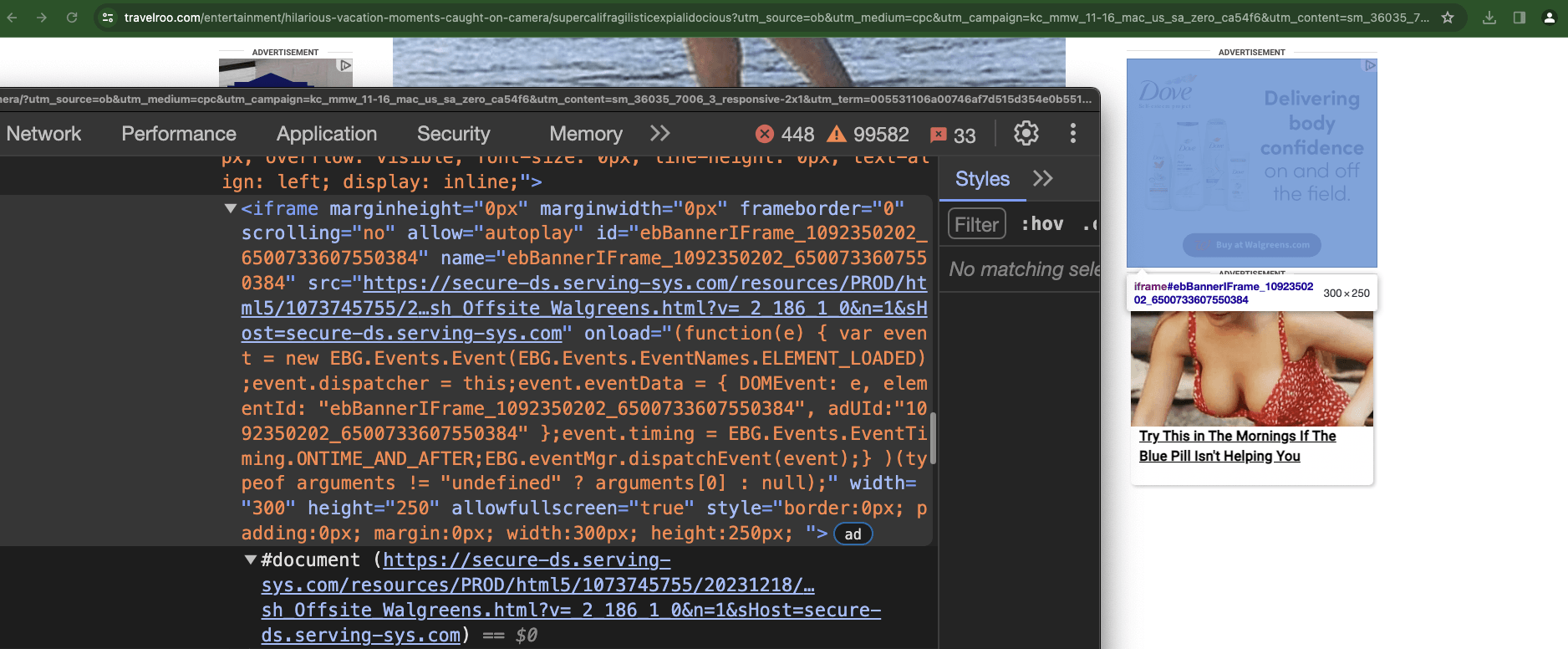

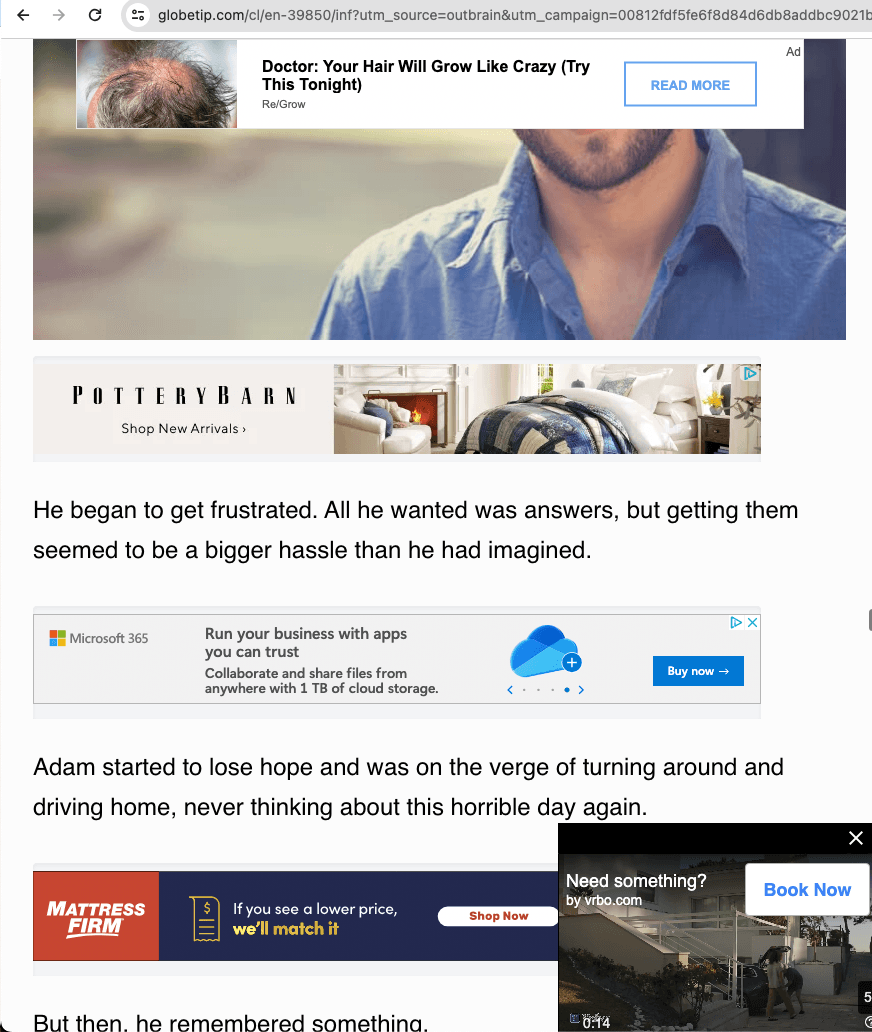

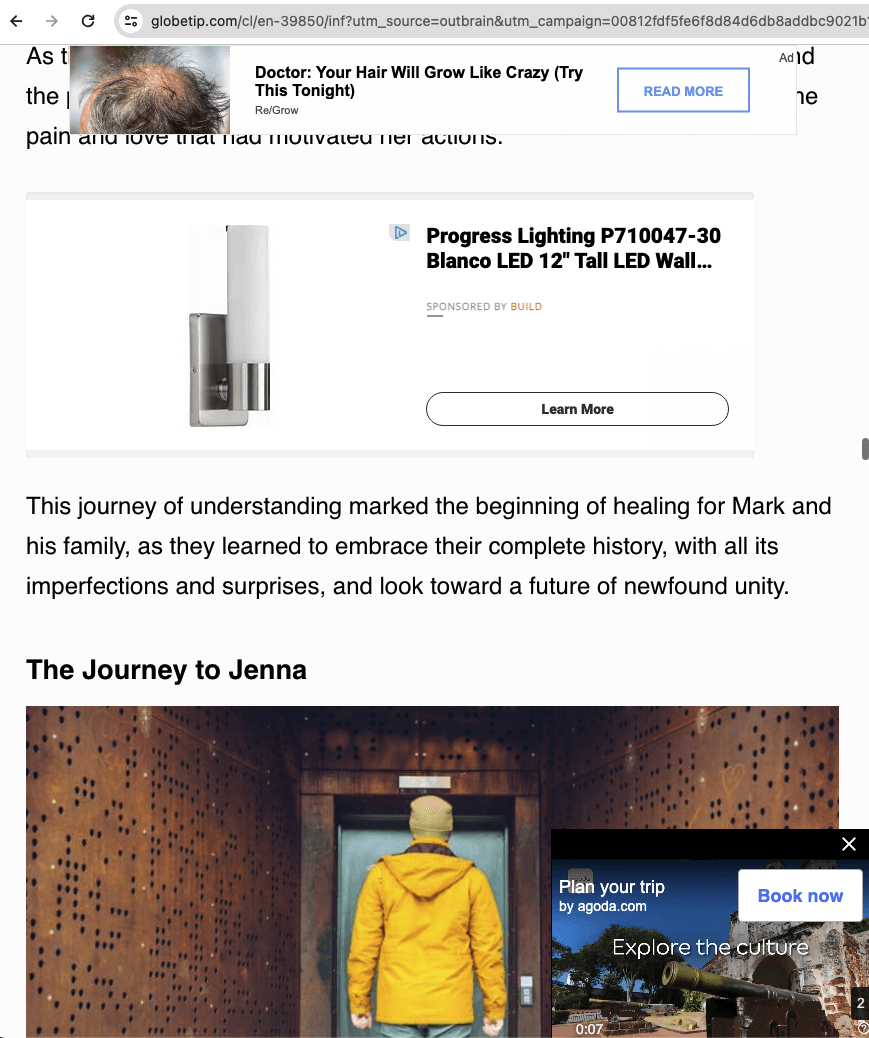

Additionally, some of the filtered domains were observed to modulate how many ads are served to the viewer depending on how the viewer arrived on a given website. When a viewer navigates to a page on the website directly, far fewer or no ads are served to the viewer. However, when the viewer clicks on a Taboola or Outbrain ad that re-directs the viewer to the given page, specific code is triggered that loads a far higher density of ad units.

For example, in the two screenshots below, one can observe the exact same article page on the exact same domain. In the first screenshot, the consumer navigates directly to the given page by simply pasting in the exact page URL. In the second screenshot, the consumer navigates to the given page by first clicking on an Outbrain ad hosted on another website. One can observe that the density and number of ad slots is significantly higher when the viewer arrives on the page via paid media acquisition.

Screenshot of a website after a viewer arrives on the page through direct navigation - by directly typing in the URL of the page into their browser navigation bar. Only two ad slots are visible in the viewport.

Screenshot of the same website as shown above, after a viewer arrives on the page by clicking on an ad. At least six ad slots are visible in the viewport, and the ad slots refresh or rotate automatically leading to higher ad serving density.

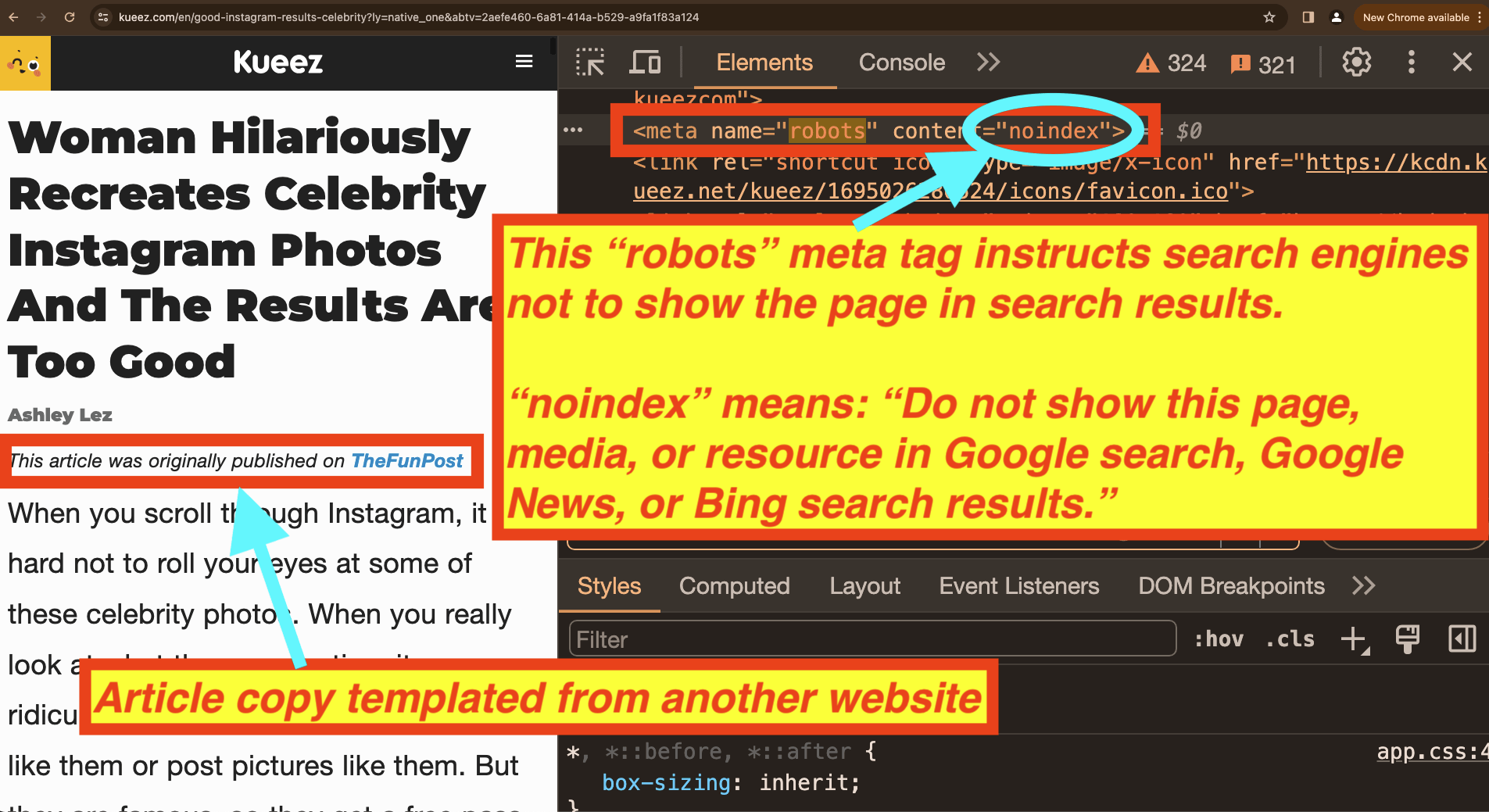

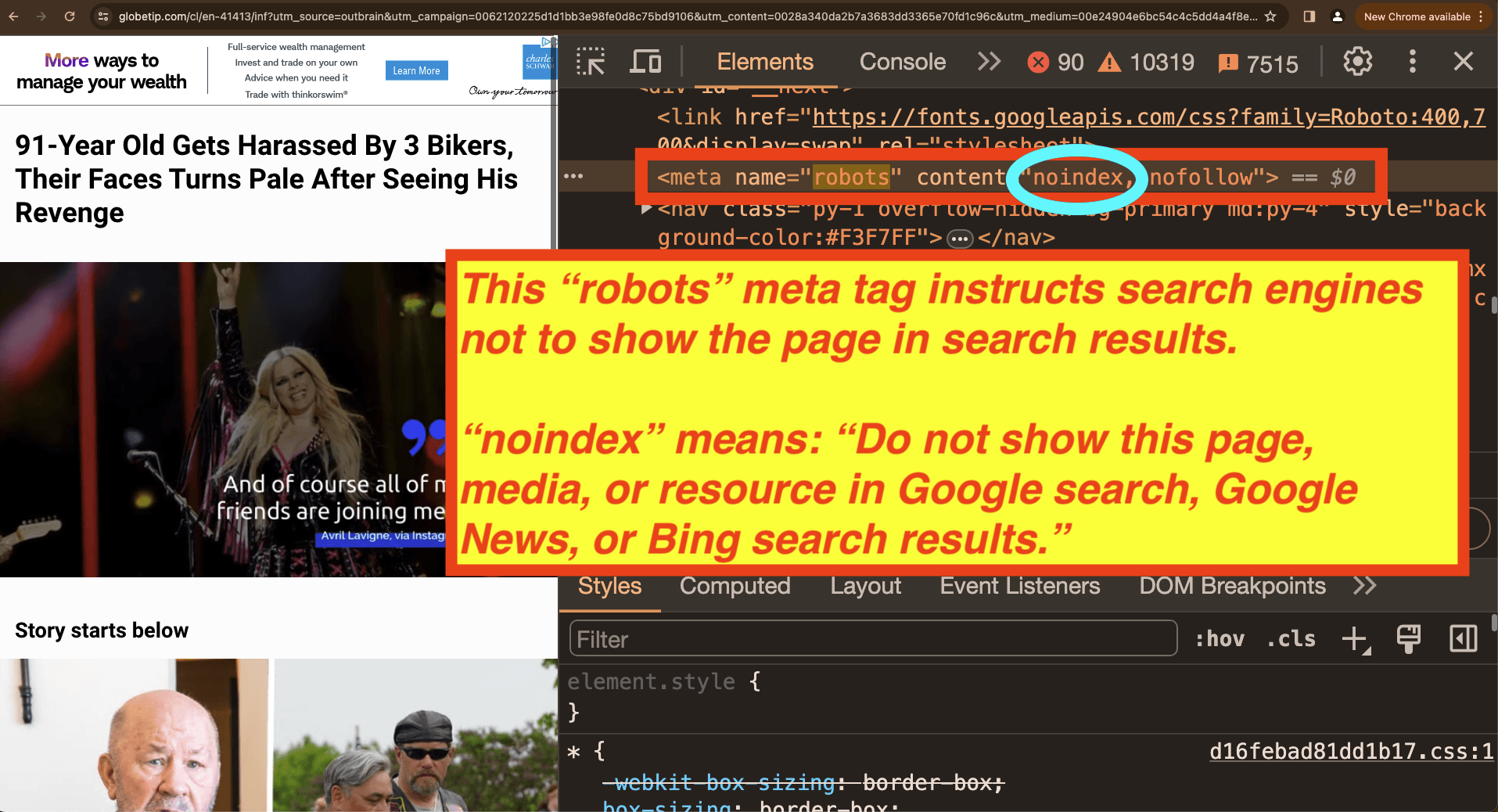

Some of the filtered domains also disallow Googlebot and BingBot crawlers from indexing specific pages or sub-domains where they are hosting ads. This prevents the specific articles from appearing in Google or Bing search results. All user agents are also disallowed from indexing any images on the website. Many premium publishers specifically want Google or Bing to index and surface their content in search to attract readers. However, these putative “Made for Advertising” websites appear to specifically only want readers to find these individual ad dense pages after clicking on a paid ad on another website. Consumers are specifically discouraged from finding these ad dense article pages through search.

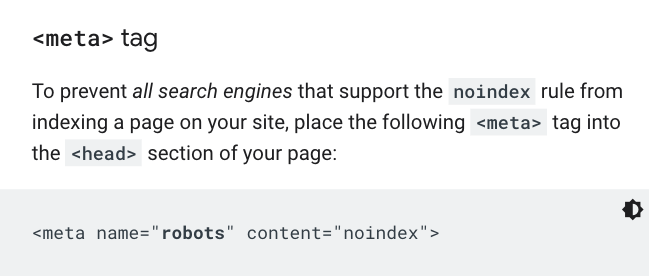

Wikipedia and Google’s documentation titled: “Block Search indexing with noindex” explain that the “noindex” attribute for the “robots” meta tag prevents all searching engines from indexing a specific page on your site.

Source: Google’s documentation titled: “Block Search indexing with noindex”

For example, a specific article on the website Kueez.com, titled: “Woman Hilariously Recreates Celebrity Instagram Photos And The Results Are Too Good” was observed trying to attract readers through paid ads on other websites and serving many ad impressions. The specific page contains a “meta” tag in its source code that is set to “noindex”. This instructs crawlers such as Google search, Google news, and Bing search crawlers to avoid indexing a given page URL.

Screenshot of the source code on a particular Kueez.com article, showing that the “robots” meta tag is configured to “noindex”. This instructs Google and Bing to not index or show search results for the given page.

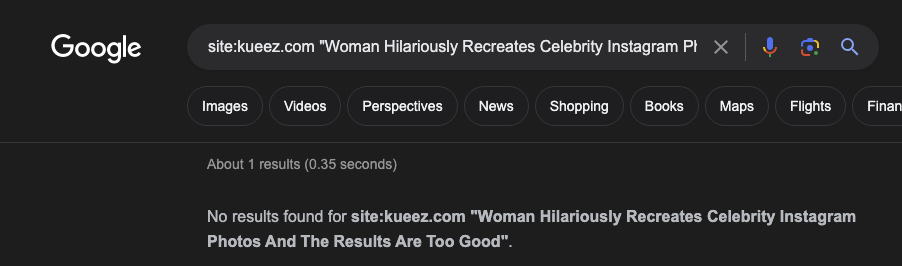

A quick manual Google and Bing search confirms that this specific kueez.com article cannot be located in Google or Bing search.

Google search query for ‘site:kueez.com "Woman Hilariously Recreates Celebrity Instagram Photos And The Results Are Too Good"’. No results are returned as the page is hidden from search crawlers by the “noindex” attribute.

Bing search query for ‘site:kueez.com "Woman Hilariously Recreates Celebrity Instagram Photos And The Results Are Too Good"’. No results are returned as the page is hidden from search crawlers by the “noindex” attribute.

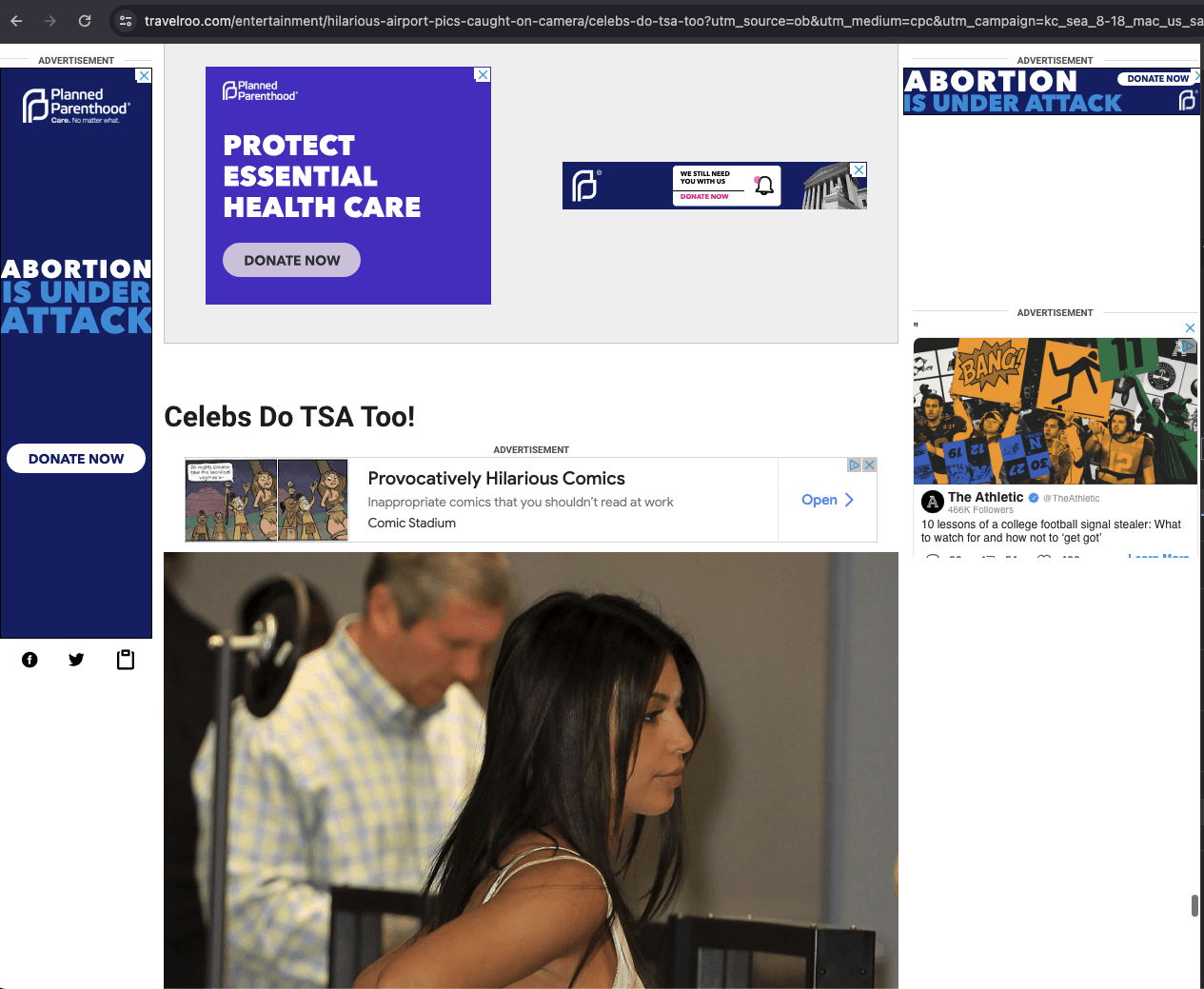

The sample of websites that were considered to meet the ANA and other trade groups’ definition of “made for advertising”, serve over 1,000 ad impressions to a single consumer in a single short duration page view session, have paid traffic acquisitions through Taboola, Outbrain, Facebook, and other sources, and were confirmed by DeepSee.io and Jounce Media to be “Made for Advertising” includes:

wealthydriver.com

daily-stuff.com

globetip.com

heraldweekly.com

heroinvesting.com

kueez.com

lifestyle1st.com

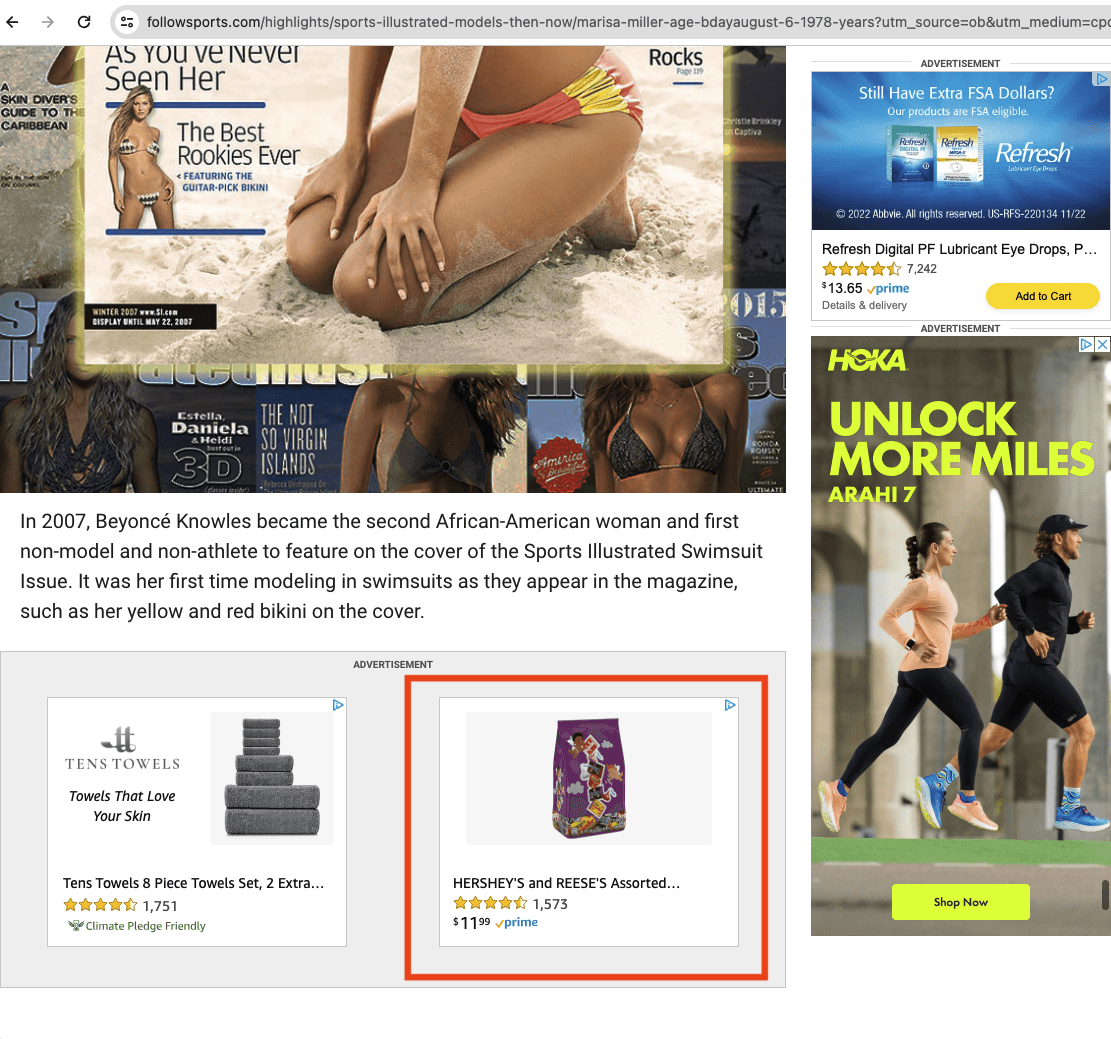

followsports.com

petsreporter.com

kaleandcardio.com

livestly.com

sciencepicker.com

smartworldmag.com

travelroo.com

worthly.com

moneytreestudio.com

natureworldtoday.com

travelerdoor.com

excellenttown.com

za.investing.com (note the "za." sub-domain of investing.com, and not the "normal" "www.investing.com" domain)

Additionally, there were two other sites identified for observation in this study:

sizzify.com

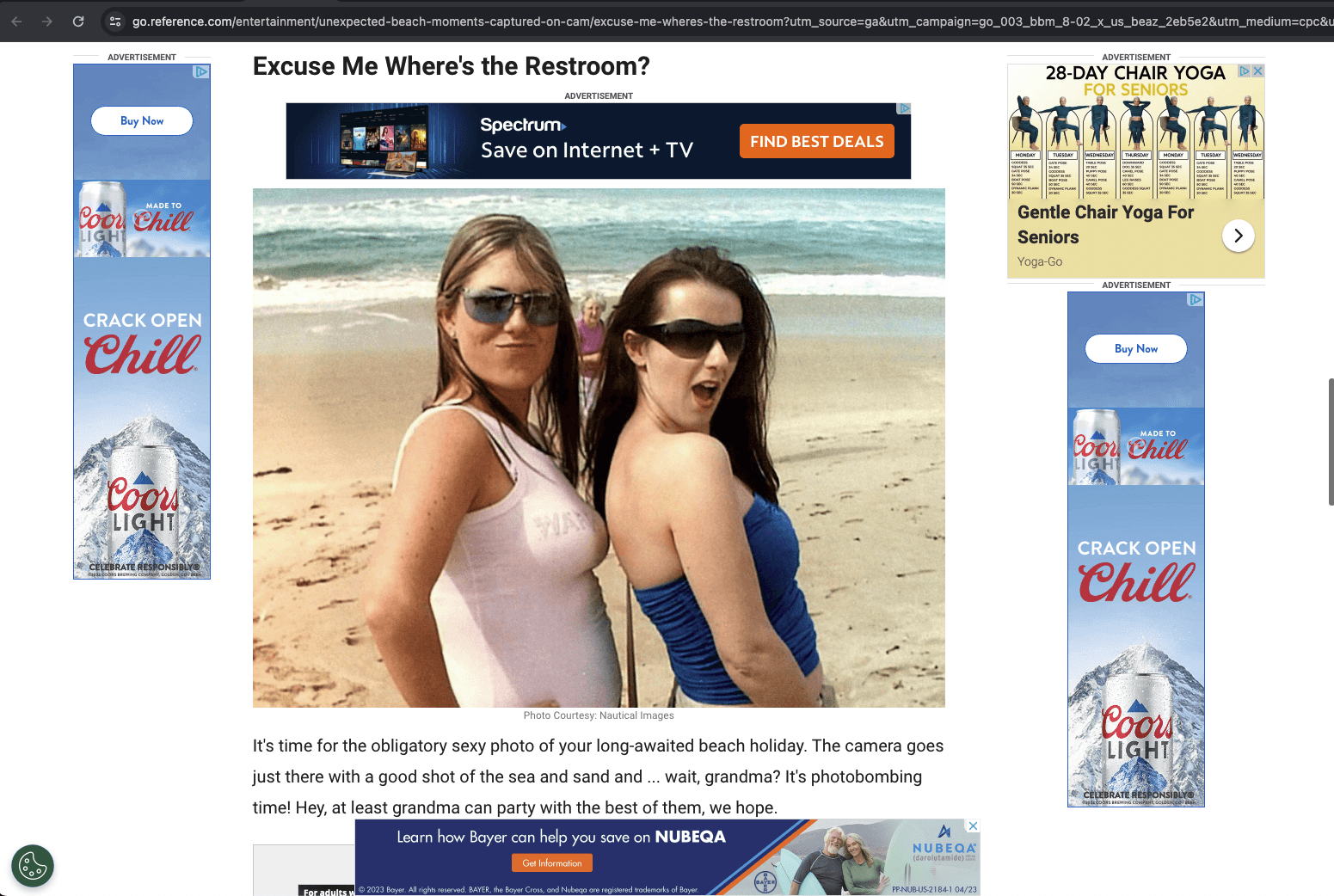

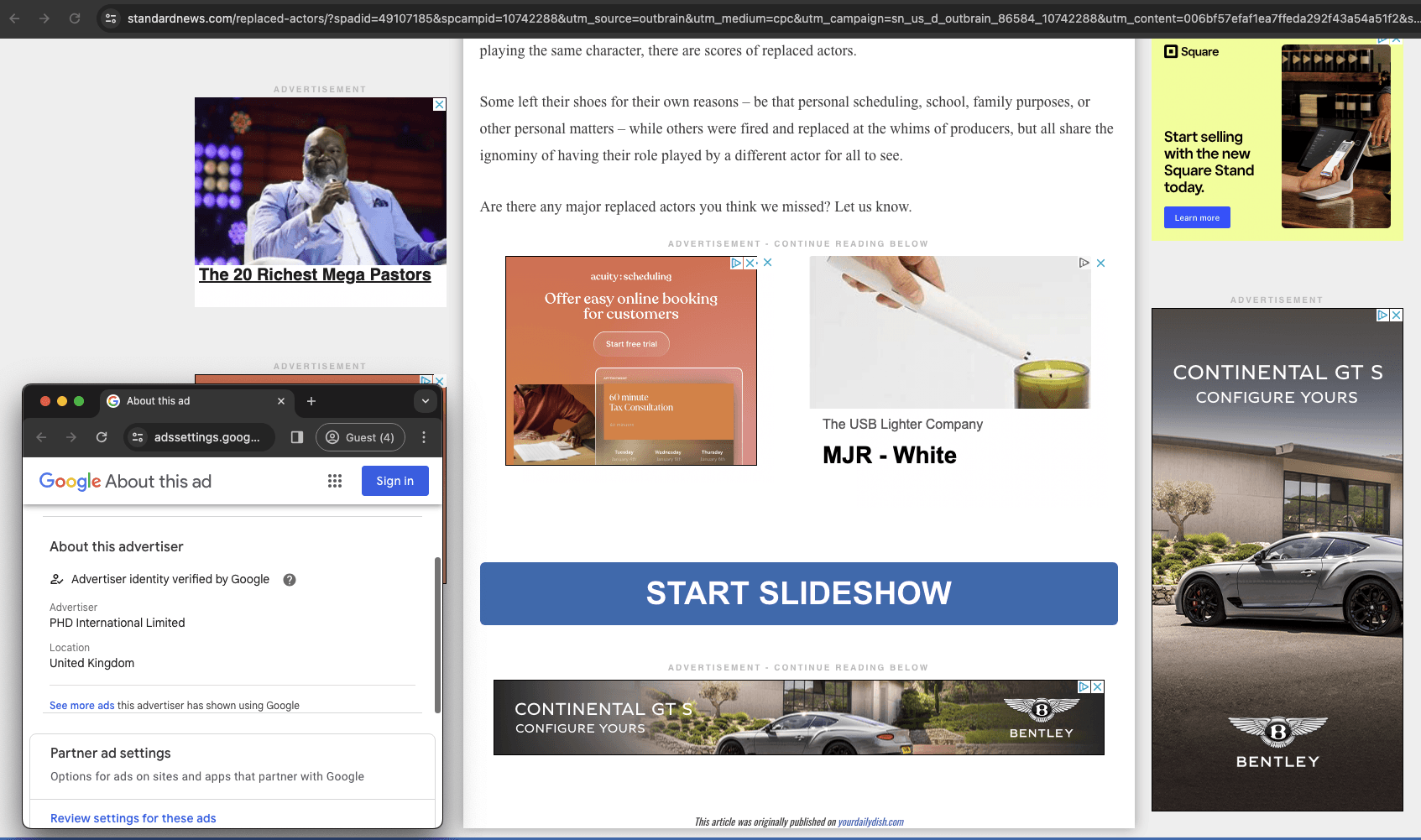

go.reference.com (subdomain only, and not inclusive of the "www.reference.com" sub-domain)

Jounce Media removed reference.com from its MFA domain list in October based on changes in the publisher's monetization strategy. Jounce Media added sizzlfy.com to its MFA domain list in March based on feedback from Adalytics.

The sizzify.com and go.reference.com sites exhibit properties consistent with the ANA's, 4A's, ISBA's, and WFA's definition of "Made For Advertising", and were confirmed to be classified as "Made for Advertising" by DeepSee.io. Furthermore, for the "go.reference.com" and the "za.investing.com" sub-domains, Adalytics observed that the publishers apparently applied the "robots" "noindex" meta tags specifically on articles on these sub-domains but not on the regular content on "www.reference.com" and "www.investing.com". This would have the effect of effectively "hiding" certain ad-dense pages on "go.reference.com" and "za.investing.com" from Google and Bing search engine results.

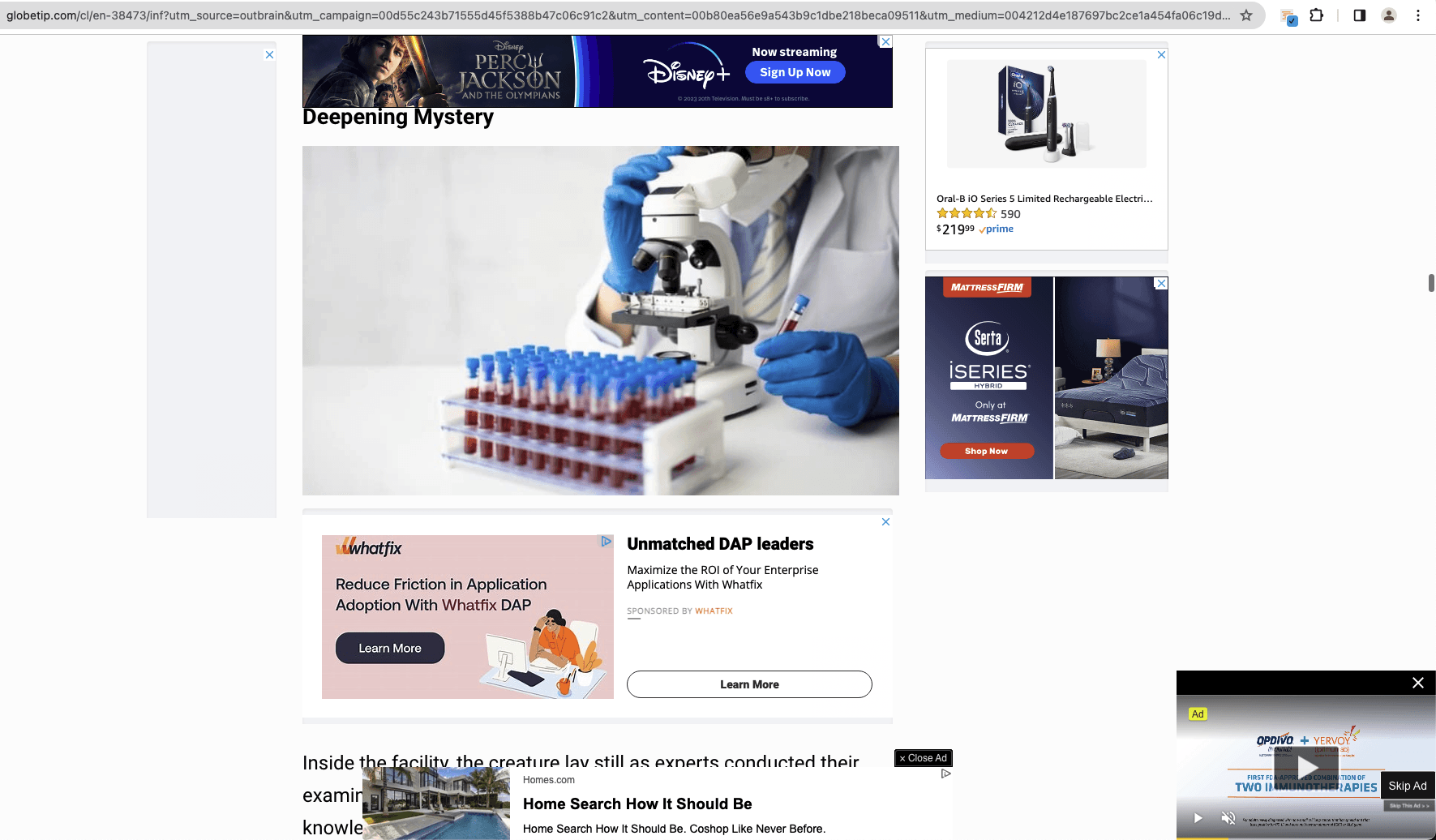

As an example, “globetip.com” was observed as running Outbrain ads on a foxnews.com article to drive readers to globetip.com. Various audience traffic sources suggest that more than 80% of globetip.com’s audience is acquired through paid media traffic sources.

Screenshot of an Outbrain ad promoting “globetip.com” on Fox News.

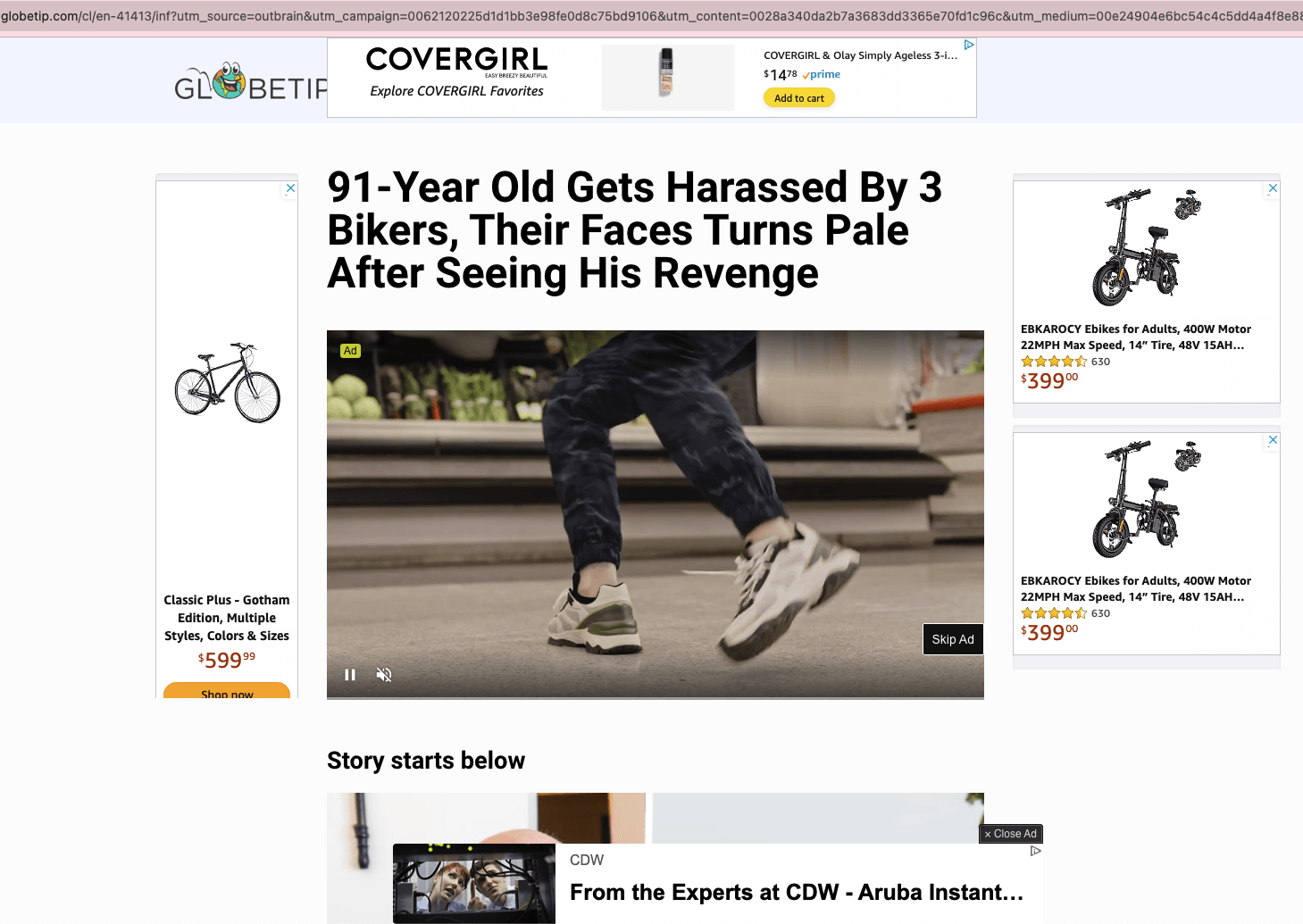

When a user arrives on the specific globetip.com article by first clicking on an Outbrain ad, five ad slots are seen.

Screenshot of globetip.com after clicking an Outbrain ad. The website serves five ads.

Visiting the same exact page URL directly without any UTM string decorators shows far fewer ads on the page.

Screenshot of globetip.com after clicking directly typing in a page URL into the browser bar without any UTM string or query string parameters. No ads are visible.

The specific article on the website globetip.com, titled: “91-Year Old Gets Harassed By 3 Bikers, Their Faces Turns Pale After Seeing His Revenge” contains a “meta” tag in its source code that is set to “noindex”. This instructs crawlers such as Google search, Google news, and Bing search crawlers to avoid indexing a given page URL.

Screenshot of the source code on a particular globetip.com article, showing that the “robots” meta tag is configured to “noindex”. This instructs Google and Bing to not index or show search results for the given page.

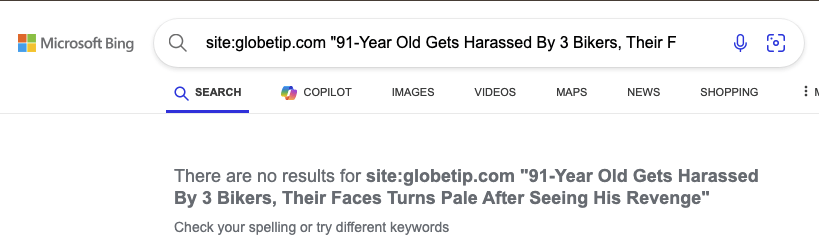

A quick manual Google and Bing search confirms that this specific globetip.com article cannot be located in Google or Bing search.

Bing search query for ‘site:globetip.com "91-Year Old Gets Harassed By 3 Bikers, Their Faces Turns Pale After Seeing His Revenge"’. No results are returned as the page is hidden from search crawlers by the “noindex” attribute.

The website is observed serving hundreds of ad impressions in a few minutes after the consumer arrives on the page via an Outbrain ad.

A viewer being served hundreds of auto-refreshing ads on globetip.com

Considering the ownership and audience of the sample of putative “Made for Advertising” websites

One concern raised by many industry thought leaders is that blocking “Made for Advertising” websites may inadvertently result in also blocking of minority-owned publishers or diverse audience directed publishers.

Source: X (fka Twitter)

According to AdMonsters, Jounce Media (one of the participants in the ANA Programmatic Transparency Study), “ According to Jounce Media’s data, Black-owned publishers are disproportionately *not* labeled as MFA.”

However, to account for these potential externalities and considerations, this study asked three programmatic media and ad tech experts to review the list of twenty two putative websites which appear to meet the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website. The experts were asked to evaluate both the ownership and the audience focus of each website.

The three experts that were consulted with were:

a consultant on diverse and multicultural media who has worked at brands and agencies, and has been quoted in numerous trade press articles. The consultant asked not to be named.

Arielle Garcia, advisor & former chief privacy and responsibility officer at UM Worldwide media agency and columnist at AdExchanger

Nandini Jammi, the co-founder of Check My Ads Institute

The independent experts asserted that for each of the twenty two putative “Made for Advertising” websites, there was no evidence to suggest diverse ownership. The experts also asserted there was no declaration of diverse ownership on site, nor any self attestation of identity. The experts adjudicated that the sites had no stated diverse or multicultural audience focus.

The experts also noted that for some of the websites, it was not possible to identify the ownership of a site with the information provided on their respective webpages.

Some of the websites were described as being operated out of foreign countries.

Collecting data on “Made for Advertising” websites

After identifying a small sample of websites which meet industry tradegroup’s definition of “Made for Advertising” and are confirmed to be classified as MFA by DeepSee.io and/or Jounce Media, ad impression data was collected in January 2024 on this list of websites.

Data was gathered through an audience panel of volunteers using the Adalytics browser plugin, manual inspection, crawlers, some data extraction from internet archives such as URLScan.io or HTTP Archive, and other sources.

Screenshot of the Adalytics browser extension open

For each ad impression served on the sample list of MFA websites, several pieces of information were collected.

Firstly, the OpenRTB “adomain” (advertiser domain) or ad clickthrough URL for each ad was collected, in order to identify for which brand the ad was placed. For example, if the “adomain” or ad click through for a given ad observed on MFA site was “hrblock.com”, this was categorized as an apparent “H&R Block” ad. Note that this methodology has some caveats and requires some nuance in interpretation. For example, ads for which the “adomain” is “doubleclick.net” are actually redirected to another website domain, as this is an ad serving or tracking domain operated by Google’s ad systems.

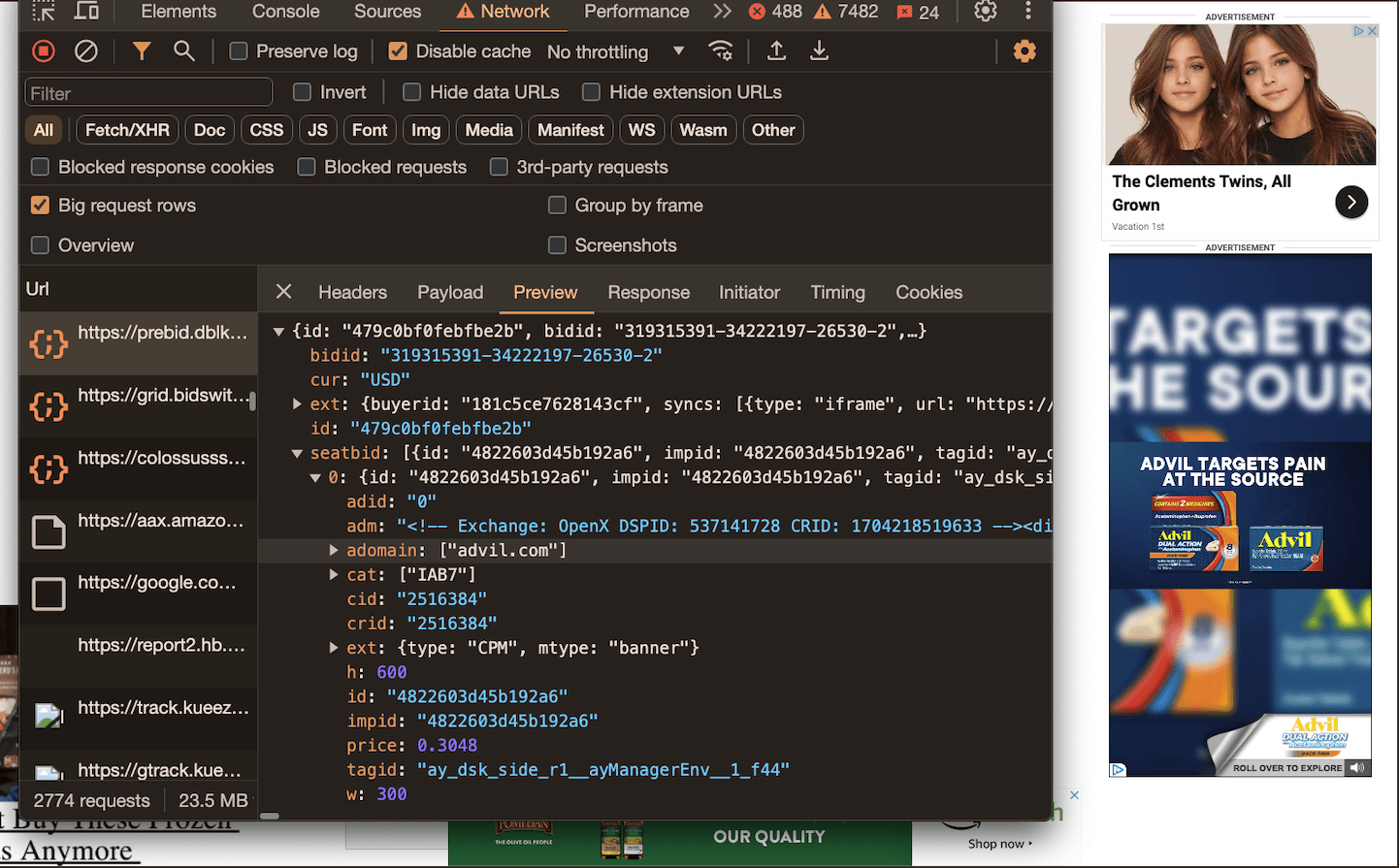

Secondly, where possible, for each relevant ad, meta-data and source code was stored, parsed, and tagged in order to identify which Supply Side Platforms (SSPs) or ad exchanges were involved in transacting a given ad. For example, if an ad was served via the TripleLift header bidding adapter or contained an image pixel whose “src” (source) attribute was the endpoint “tlx.3lift.com/s2s/notify” or “tlx.3lift.com/header/notify”, the given ad on the MFA site was labeled as having been transacted by TripleLift ad exchange.

Screenshot of an ad, wherein the source code of the ad shows the adomain is “advil.com”. The source code of the ad shows the ad was transacted via OpenX SSP.

Similarly, the meta-data and source code of each ad observed on the list of MFA sites was tagged to determine which Demand Side Platform (DSP) was used to place an ad. For example, if the ad’s source code included references to “bid.adsrvr.org” or “googleads.g.doubleclick.net/dbm/ad” the ad was tagged as having been transacted via The Trade Desk or Google DV360 DSP, respectively.

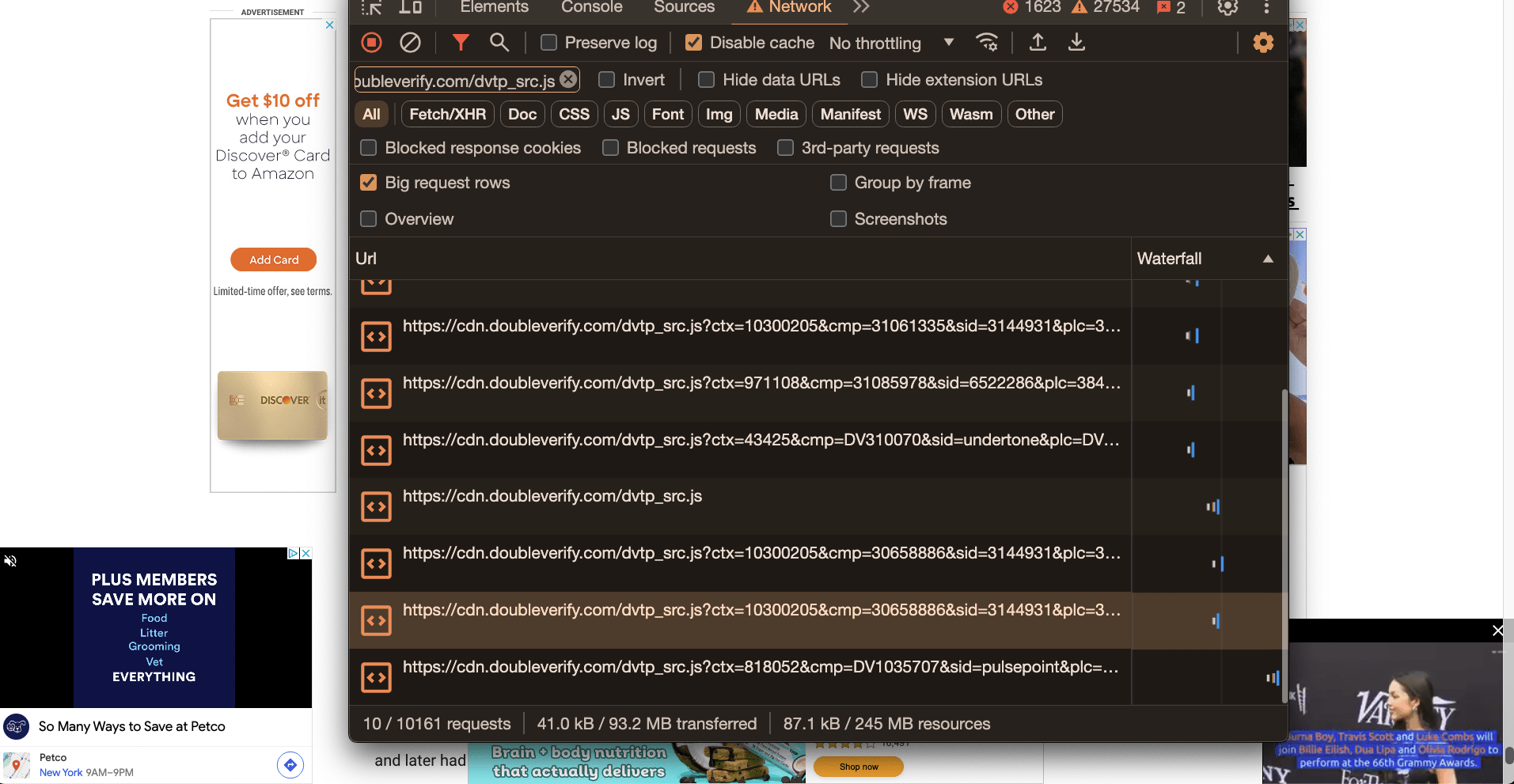

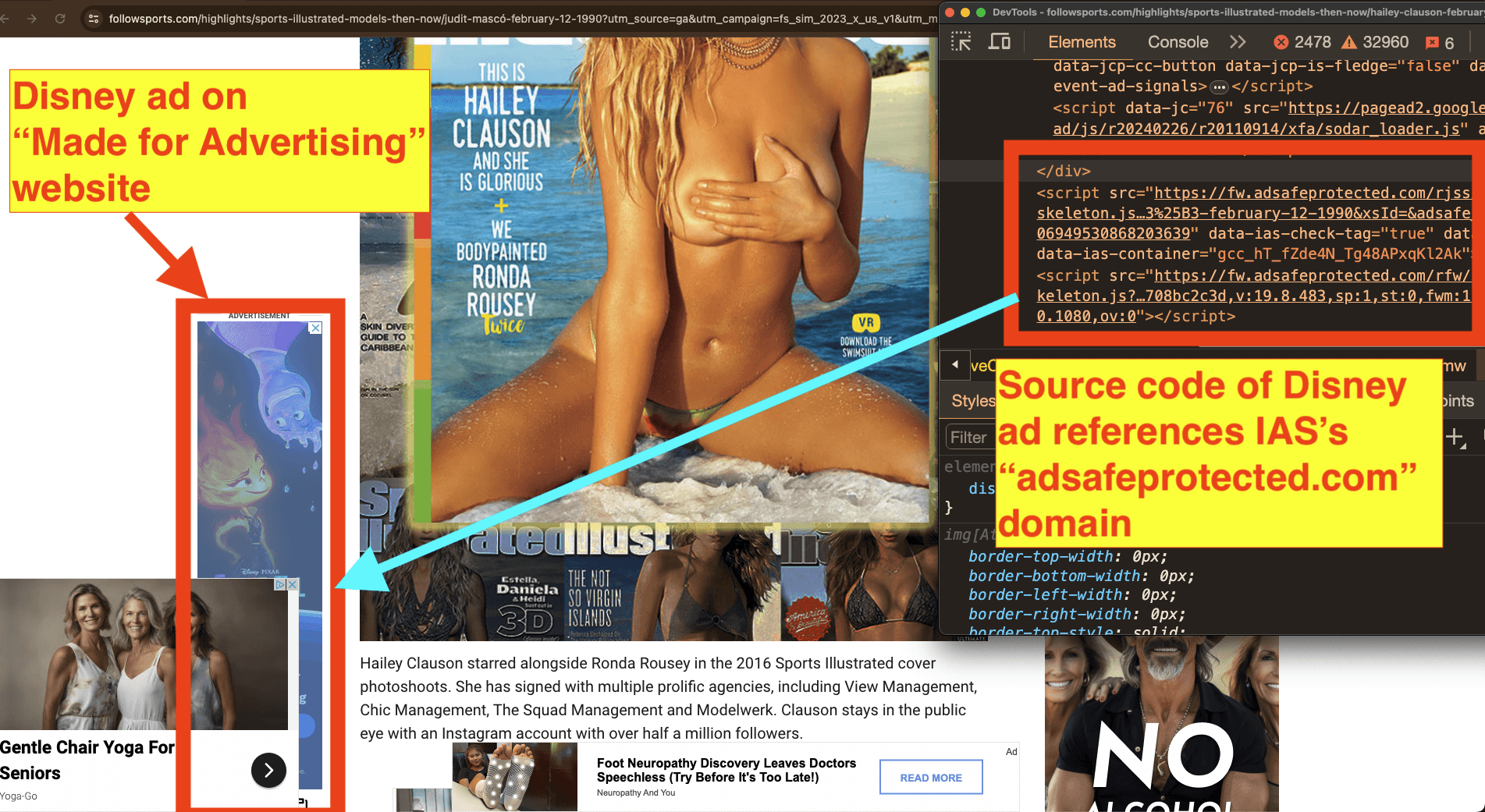

The source code of each ad was analyzed to see which verification or measurement vendors received telemetry about a given ad impression. For example, ad impressions whose source code included references to “cdn.doubleverify.com/dvtp_src.js” or “pixel.adsafeprotected.com/jload” were labeled as having been measured by DoubleVerify or Integral Ad Science (IAS), respectively.

Screenshot showing DoubleVerify Javascript code being invoked multiple times from different ad creatives loading on a website.

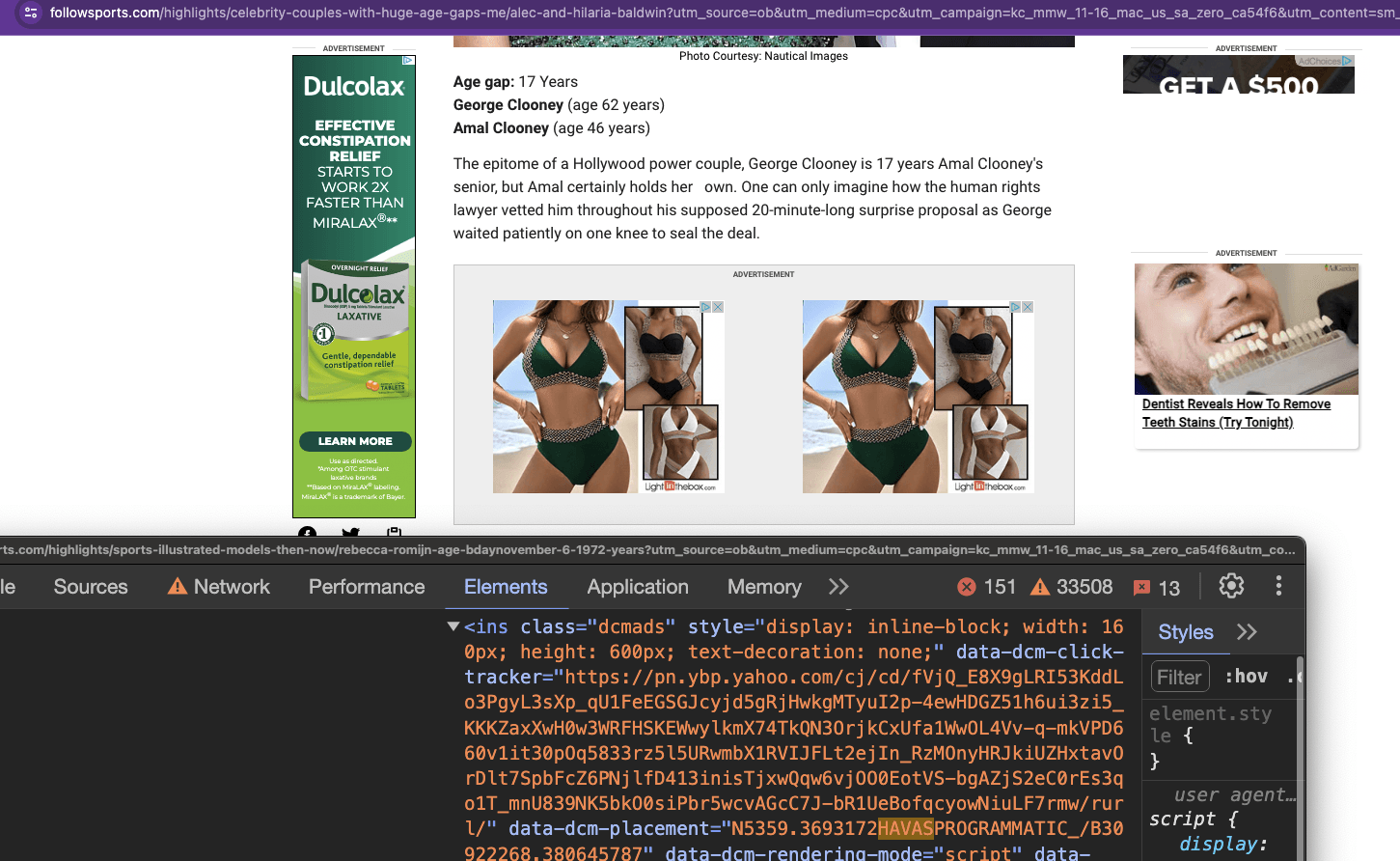

The source code of some ads included Campaign Manager 360 (CM360) ad server pixels, which contain various high entropy or uniquely identifying strings. These CM360 ad server pixels occasionally indicate which agency was transacting a given ad. For example, in the screenshot below, one can observe ads for Ford on a MFA website, wherein the source code of the ad include CM360 pixels that contain the string “XAXISUSAHEADLIGHT” (Xaxis USA Headlight). Xaxis is the programmatic trading arm of WPP / GroupM.

Screenshot of Ford ad, wherein the source code of the Ford ad contains a CM360 ad server tracking pixel which contains the string “XAXISUSAHEADLIGHT”.

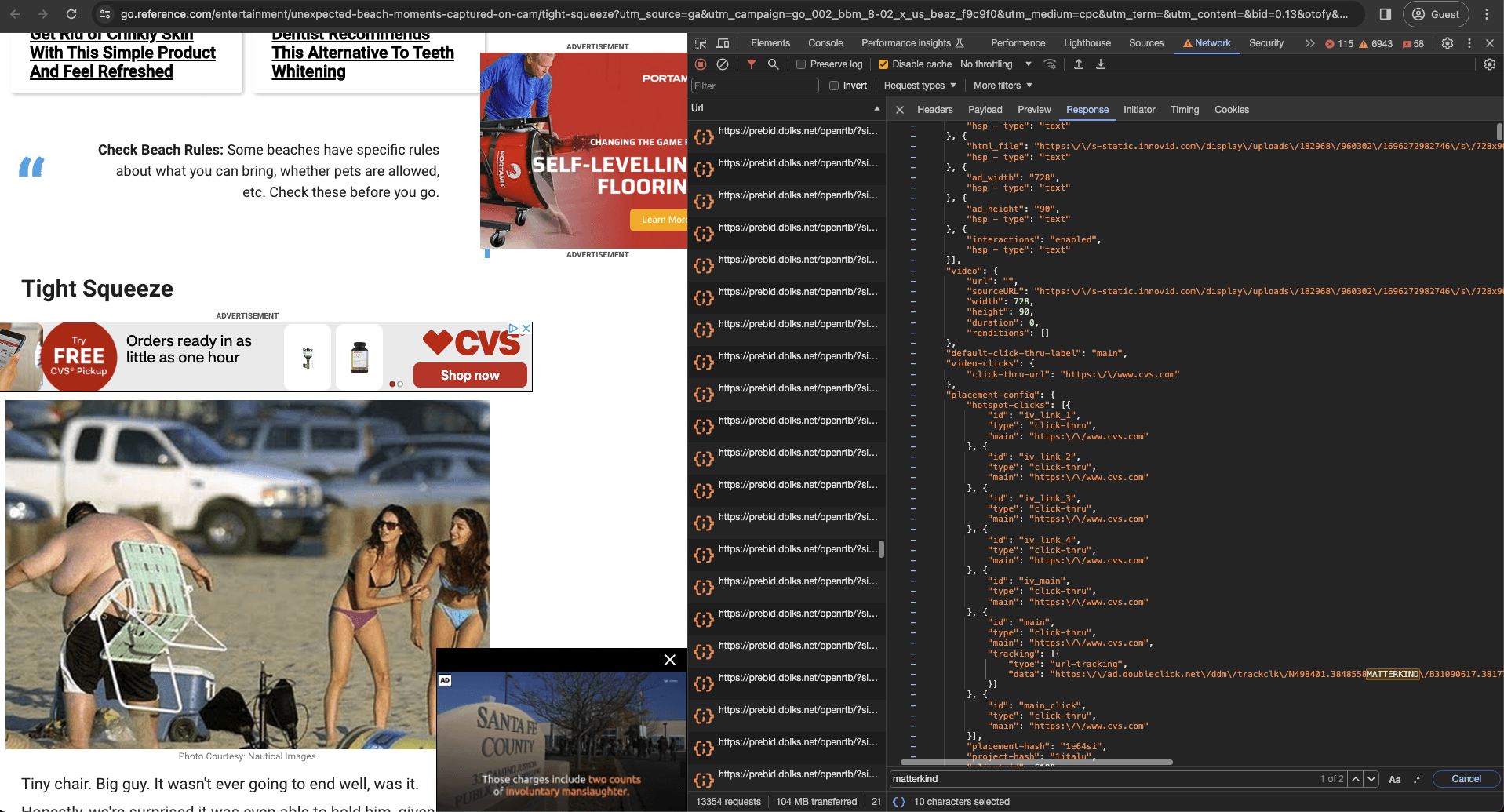

As another example, in the screenshot below, one can observe ads for CVS. The source code of the ad references a CM360 pixel with the string “MATTERKIND”. Matterkind is the former name of IPG’s programmatic trading desk. IPG lists CVS as one of its brand clients on its website.

Screenshot of a CVS ad, wherein the source code of the CVS ad contains a CM360 ad server tracking pixel which contains the string “MATTERKIND”.

Some ads also contain a “Why this ad?” information modal, which includes details about which media agency is directing ad placement on behalf of a given brand. For example, in the screenshot below, one can see an ad for AT&T. The “Why this ad?” modal for the ad shows the ad was transacted by Omnicom’s Hearts & Science subsidiary.

Screenshot of a AT&T ad, wherein the “Why this ad?” section references “Hearts & Sciences”, a subsidiary of Omnicom media agency.

Lastly, for each ad impression, the total number of times a given consumer was shown ads from a given brand on a single MFA website in a single session was tracked. This information helps assess when a consumer was over-exposed to ads from a given brand due to ad refreshes on a MFA website. Furthemore, wherein available, the Adalytics browser plugin collected header bidding pricing data showing how much brands were paying certain media supply chain vendors for a given ad impression that was rendered. This information helped assess how much brands were paying to reach individual consumers on MFA pages.

Given this methodology, one must note that this report is not meant to be construed as a comprehensive or quantitative audit. It cannot assert whether one vendor transacts more or less “Made for Advertising” impressions relative to another. It cannot assert whether one particular brand or agency spent more or less than another on “Made for Advertising” websites in general. It cannot ascertain which participant in a media supply chain implicitly or explicitly made a decision to transact MFA. The scholastic, observational nature of this study simply allows a binary, qualitative assessment of whether or not a given vendor was observed transacting ads on websites which are consistent with consensus definitions of “Made for Advertising” in January 2024.

Results

Thousands of brands have their ads observed on “Made for Advertising” websites in 2024

Thousands of different brands and advertisers (as defined by distinct “adomains”) were observed to have their ads served in 2024 on the sample of websites which meet the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and/or DeepSee.io’s definition of “Made for Advertising” website. Many of these brands were ANA members or even participants in the ANA’s 2023 Programmatic Transparency Study.

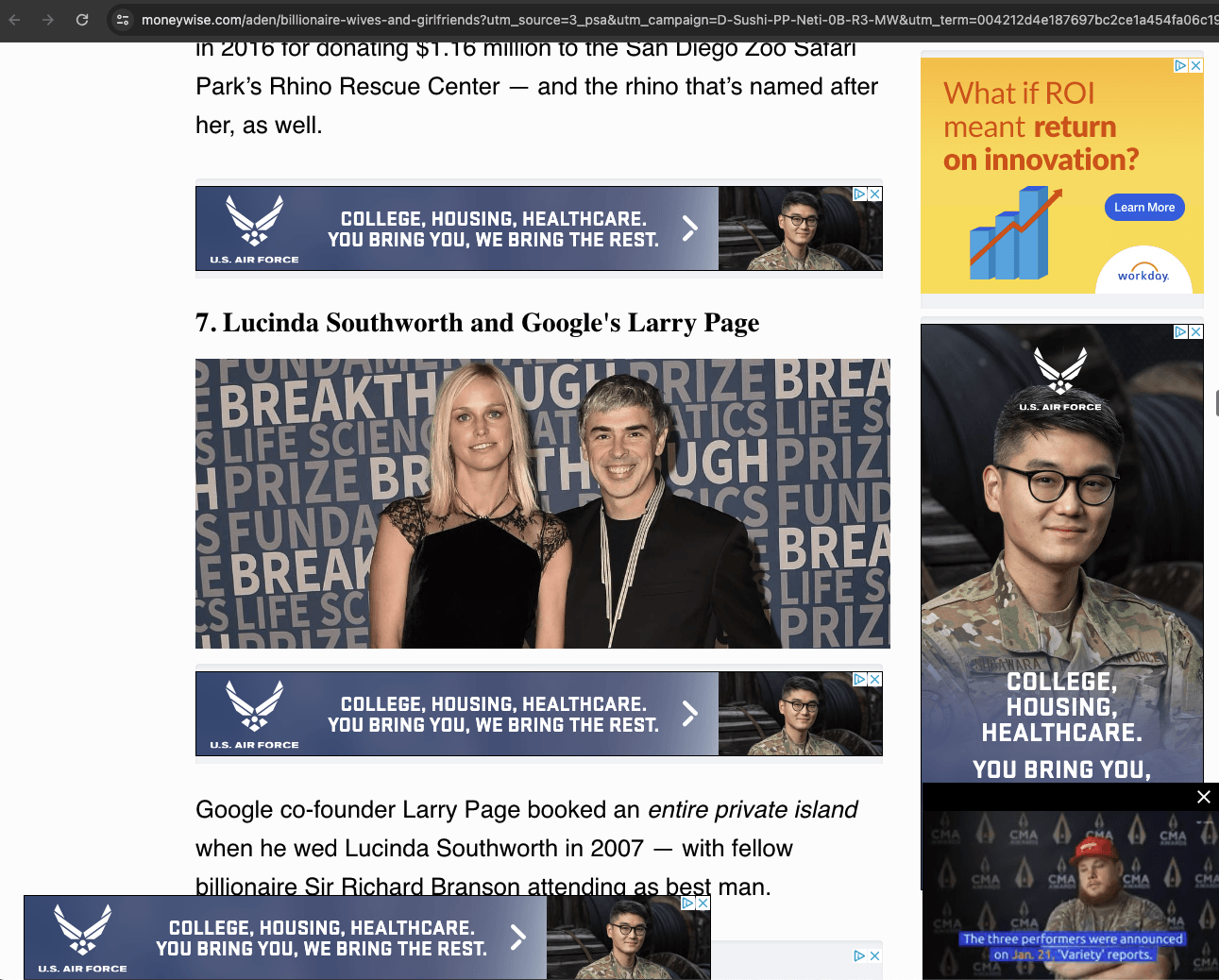

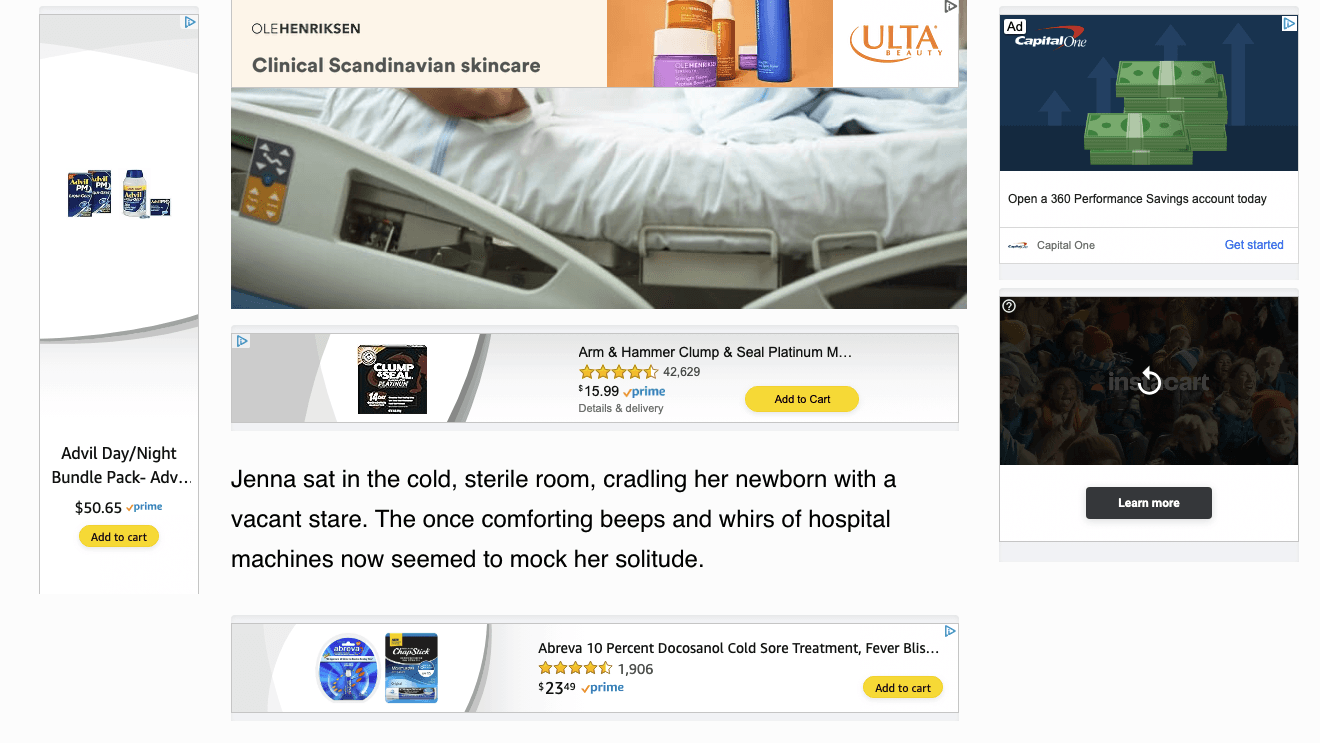

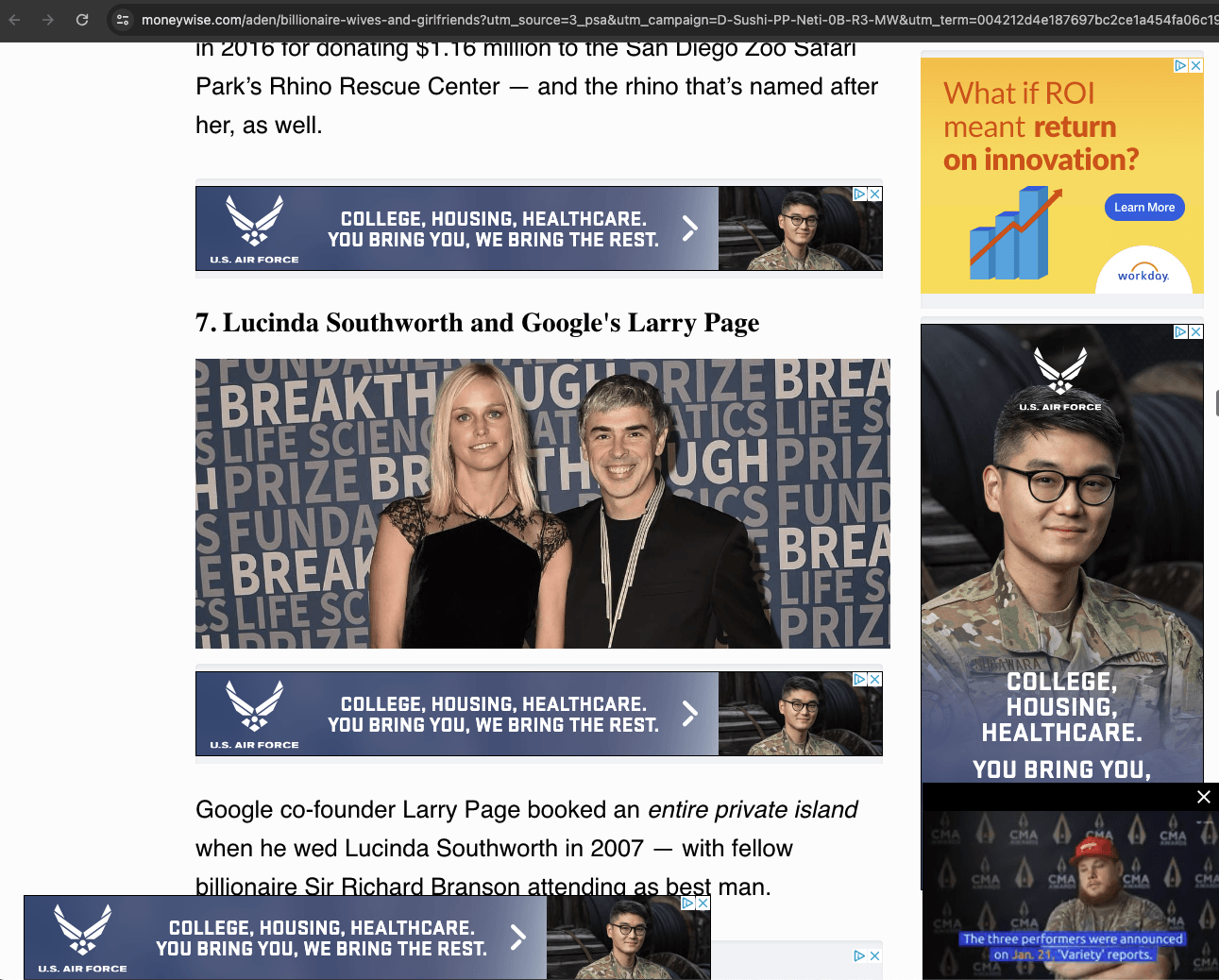

This included Fortune 500 brands such as Procter & Gamble, Hershey’s, Microsoft, Verizon, Google, AT&T, Disney, Meta, Mondelez, Mars, Clorox, Nike, General Motors, Johnson & Johnson, Charles Schwab, Apple, General Mills, Nestle, Wells Fargo, Pfizer, PepsiCo, Bayer, Reckitt Benckiser, Toyota, Amazon, Novartis, AstraZeneca, BMW, American Express, PwC, Opdivo (Bristol Myers Squibb), State Farm, Geico, and many others.

Screenshot from 2024 of Disney+, Wells Fargo and other ads observed on a website not affiliated with Maxim which meet’s the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website.

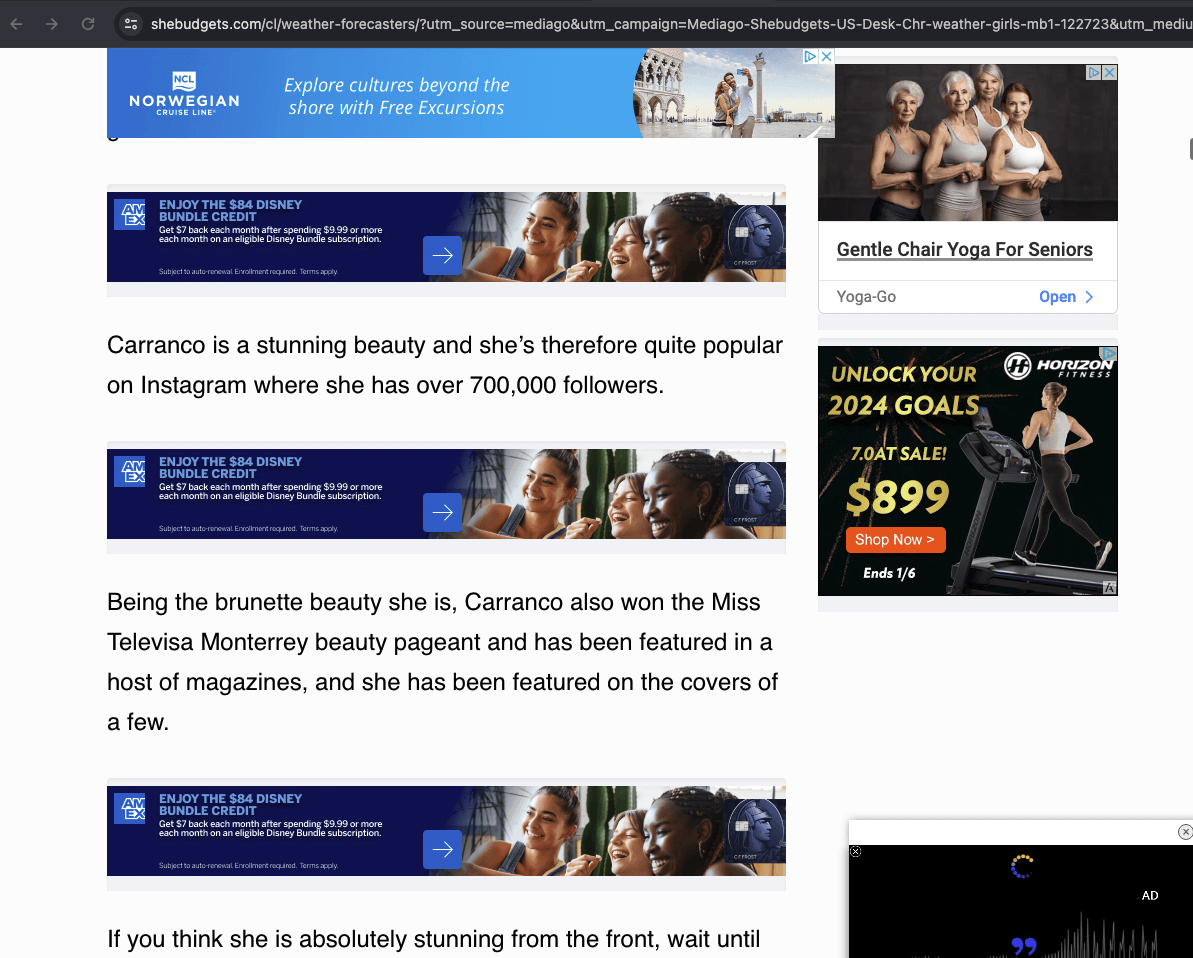

Screenshot from 2024 of three American Express ads and a Norwegian cruise line ad observed on a website which meet’s the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website.

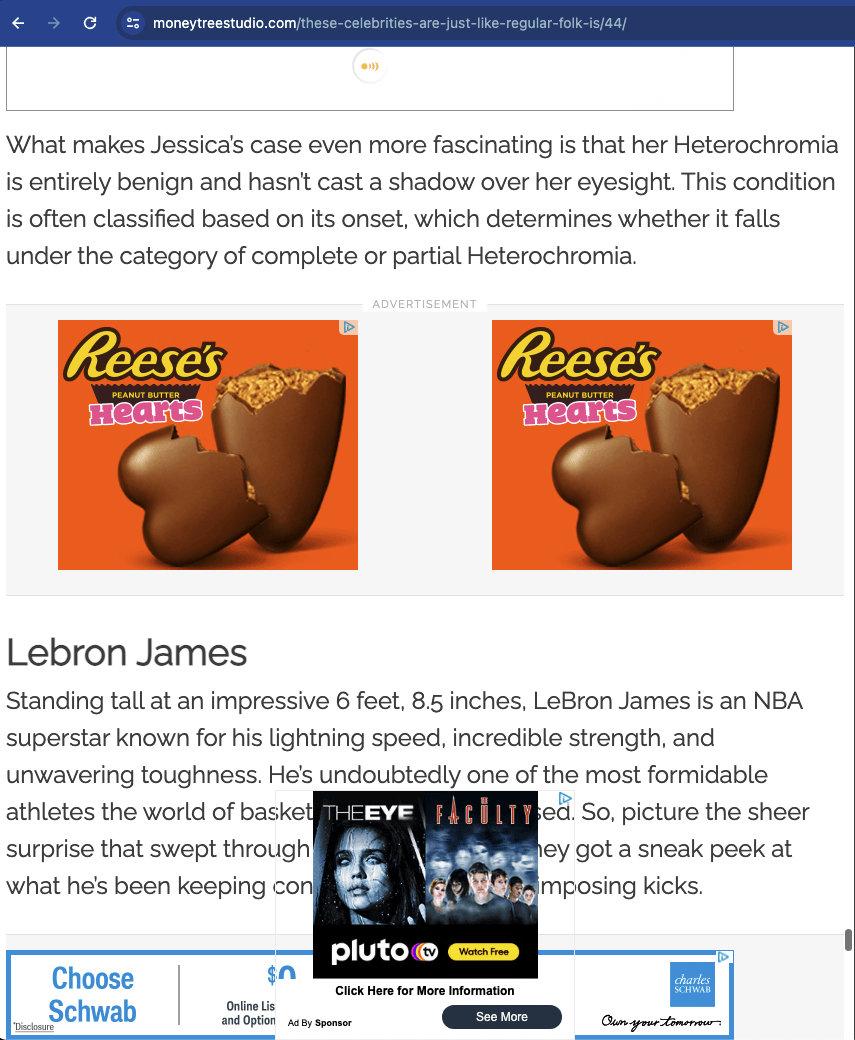

Example screenshot from 2024 of a Charles Schwab, PlutoTV, and two Hershey's Reese’s ads observed on a website which meet’s the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website.

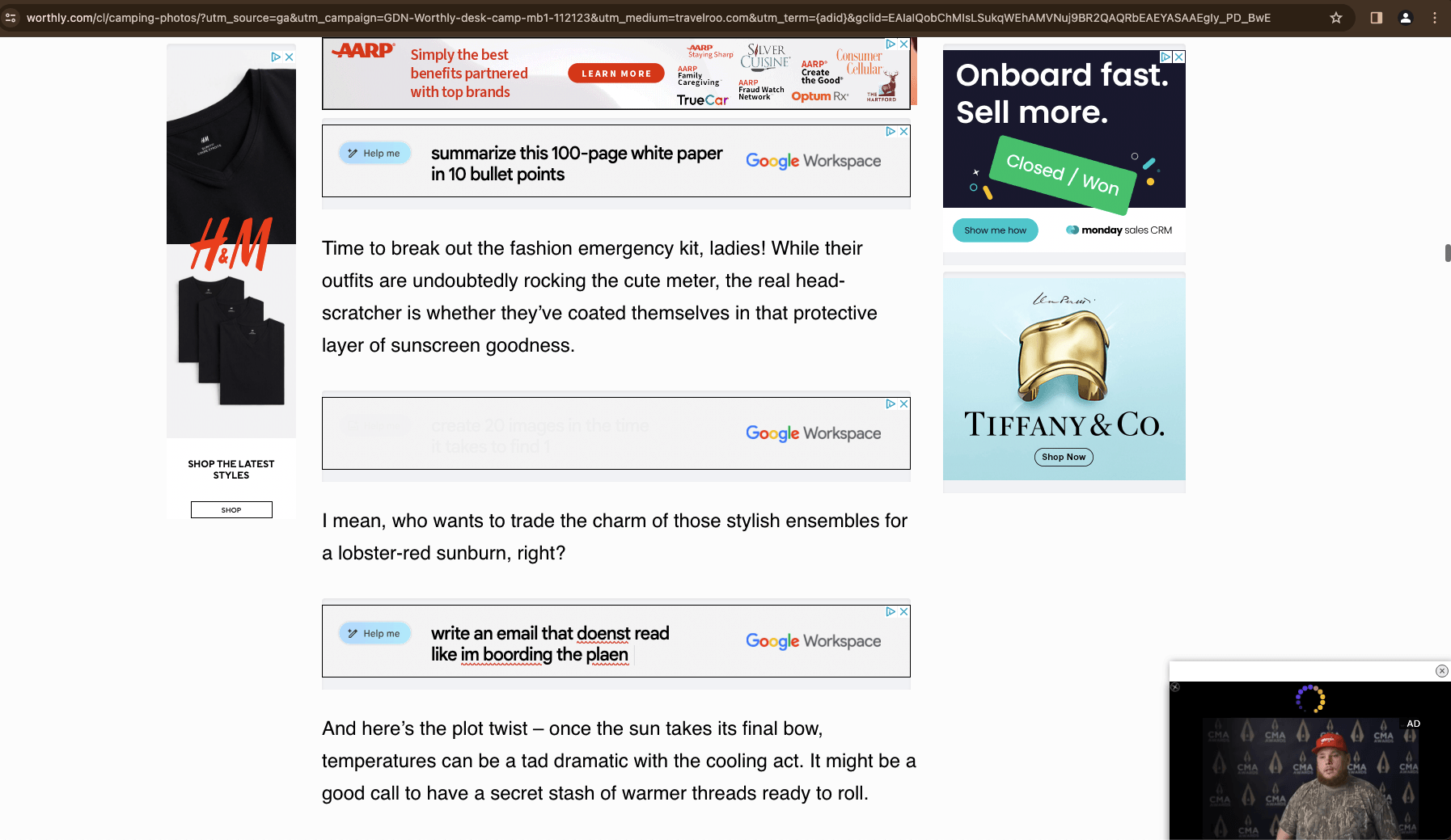

Screenshot of three Google Workspace ads observed on a website which meet’s the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website.

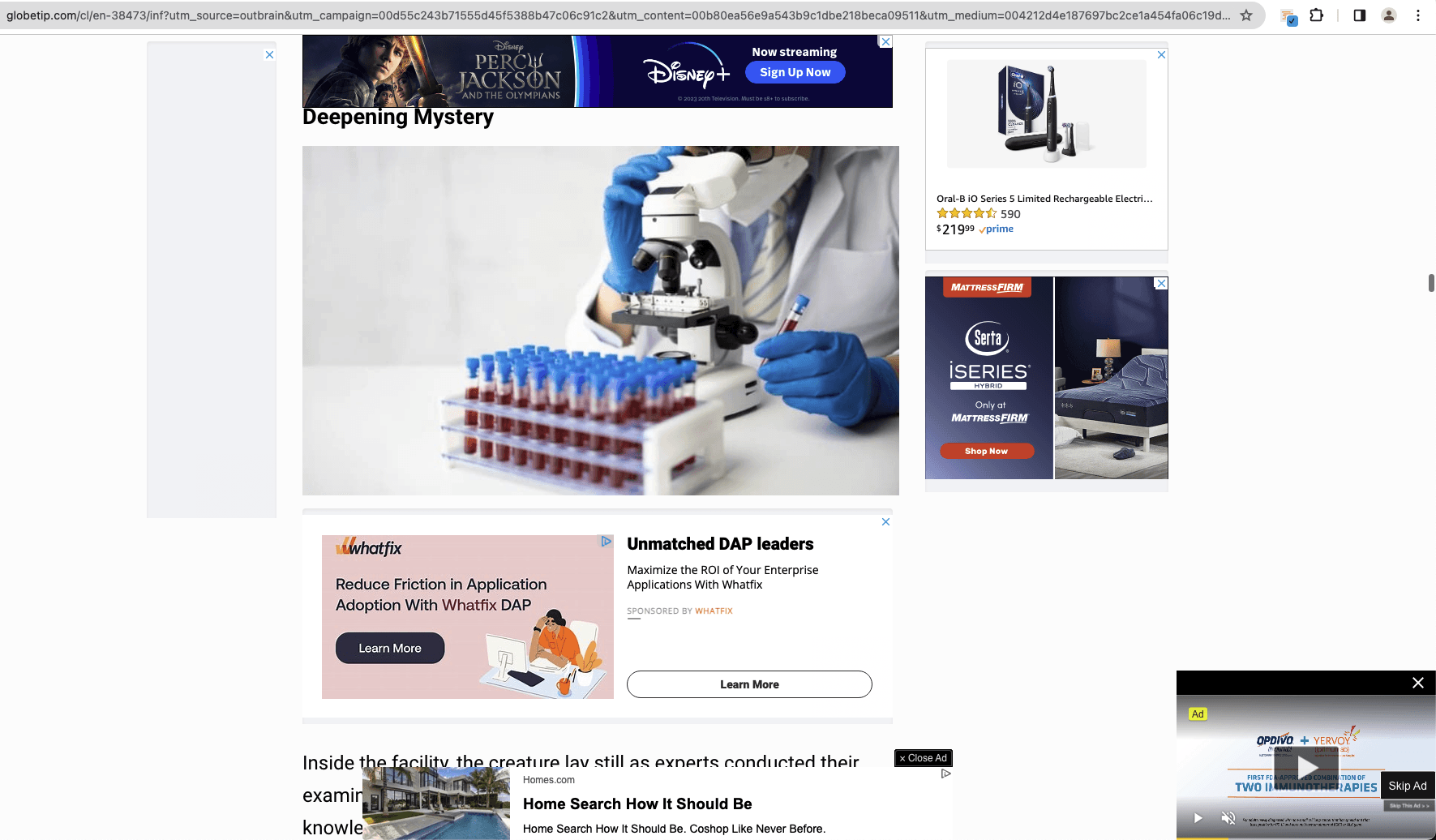

Screenshot from 2024 of a Disney+, MattressFirm, Bristol Myers Squibb (Opdivo) and Procter & Gamble (Oral-B) ad observed on a website which meet’s the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website.

Screenshot from 2024 of a Clorox, YouTube TV, and other ads observed on a website which meets the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website.

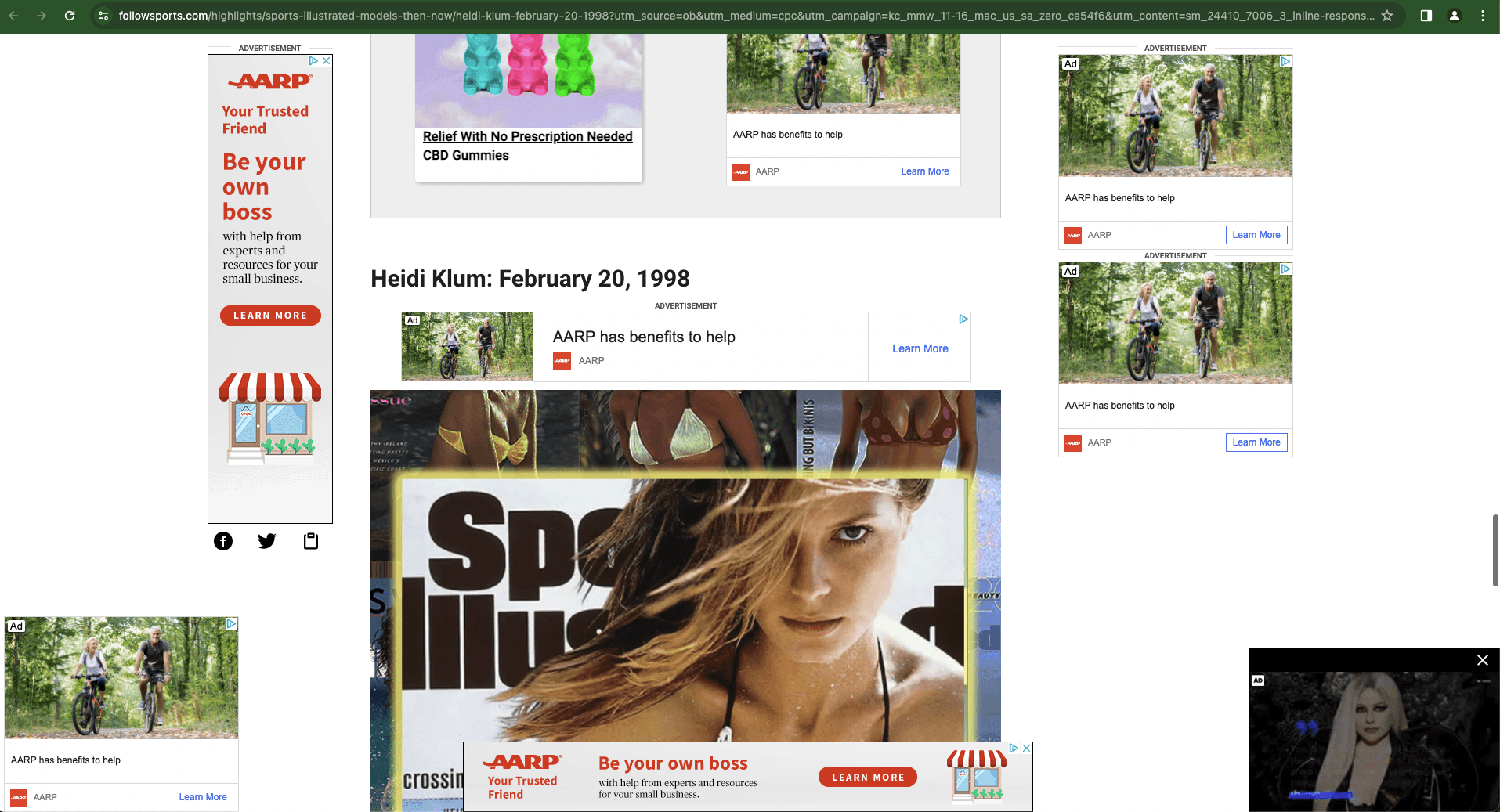

In addition to large brands, various non-profit organizations were observed to have their ads served on the aforementioned sample of websites in 2024 which meet the criteria for “Made for Advertising”. These include the AARP, Planned Parenthood, the UK National Trust, Unicef USA, Leukemia & Lymphoma Society, Salvation Army, Sydney Children's Hospitals Foundation, Moffitt Cancer Center, Alzheimer’s Association, American Heart Association, the Red Cross, and others.

Screenshot from 2024 of six AARP ads observed on a website which meets the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website not affiliated with Sports Illustrated.

Screenshot from 2024 of four Planned Parenthood ads observed on a website which meets the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website.

Various government and military organizations were also observed to have their ads served on the aforementioned sample of websites in 2024 which meet the criteria for “Made for Advertising”. These include the US Federal Trade Commission (FTC), US Federal Bureau of Investigation (FBI), UK MI5 Security Service (UK’s domestic counterintelligence agency), US Drug Enforcement Administration (DEA), UK GCHQ’s (UK’s signals intelligence agency), US Social Security Administration (SSA), the SUS Intelligence Community, US Department of State, US Department of Transportation, US CDC, US Department of Health & Human Services, US Treasury, US Internal Revenue Service (IRS), US Department of the Interior, US Department of Agriculture, US Department of Veterans Affairs, US Air Force, US Army, US Coast Guard, US Navy, New York City Police Department, the Australian Defence Force, the Australian Department of Social Services, the Australian Sports Commission, and many state, provincial and municipal government entities.

Screenshot from 2024 of four US Air Force ads observed on a website which meets the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website.

Screenshot from 2024 of a Federal Trade Commission (FTC) ad observed on a website not affiliated with Maxim which meets the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website. The ad was transacted via Zeta Global DSP, Magnite SSP (seller ID 17960), and Sovrn SSP. Two Verizon ads (one stacked on the second one) are visible below.

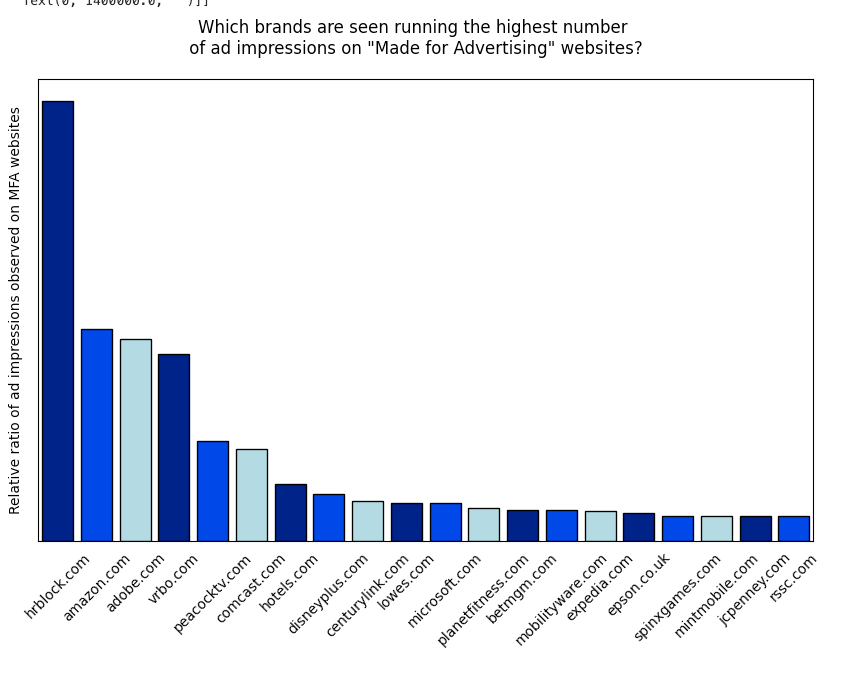

In the data table below, one can observe which advertisers’ ads were observed most frequently on the sample of aforementioned “Made for Advertising” websites in January 2024. For example, H&R Block ads were seen far more frequently than any other individual brand’s ads on “Made for Advertising” sites.

Bar plot illustrating which advertisers’ ads were observed most frequently in January 2024 on a sample of websites which meet the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website.

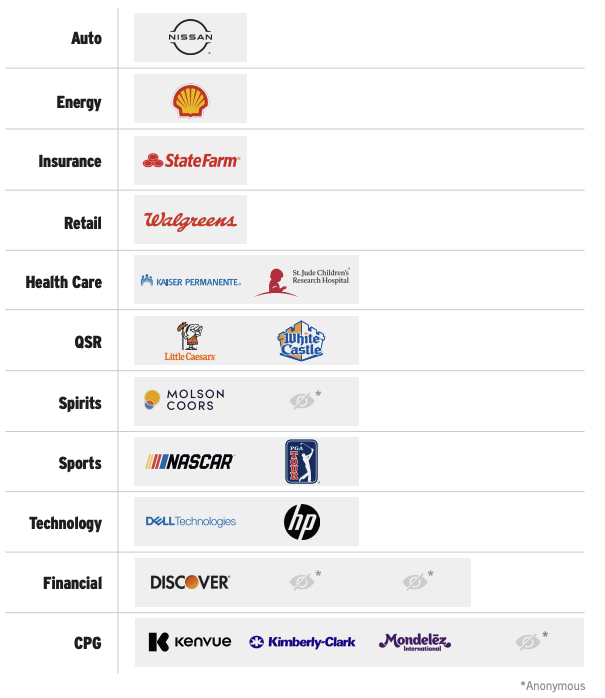

16 out of 17 disclosed brands who participated in the ANA’s Programmatic Transparency study were observed having ads served on “Made for Advertising” sites in 2024

The Association of National Advertisers (ANA)’s 2023 Programmatic Media Supply Chain Transparency Study sourced data and worked with “21 marketer participants include a range of big, mid-size, and smaller companies and there was representation from 11 categories.” 17 out of the 21 participants allowed their identities to be publicized; these included:

Nissan

Shell

StateFarm

Walgreens

Kaiser Permanente

St Jude Children’s Research Hospital

Little Caesars

White Castle

Molson Coors

Nascar

PGA Tour

Dell Technologies

HP

Discover

Kenvue

Kimberly-Clark

Mondelez International

Twenty-one marketers participated in the ANA’s 2023 Programmatic Transparency Study. The 21 marketer participants include a range of big, mid-size, and smaller companies and there was representation from 11 categories. 17 of the 21 brands allowed themselves to be publicly cited in the ANA’s report. Of these 17 brands, 16 were observed to have had their ads served on “Made for Advertising” websites in January 2024.

Of these seventeen disclosed participants in the ANA’s 2023 study, sixteen were observed to have ad impressions served in January 2024 on the aforementioned sample of websites which meet the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising”.

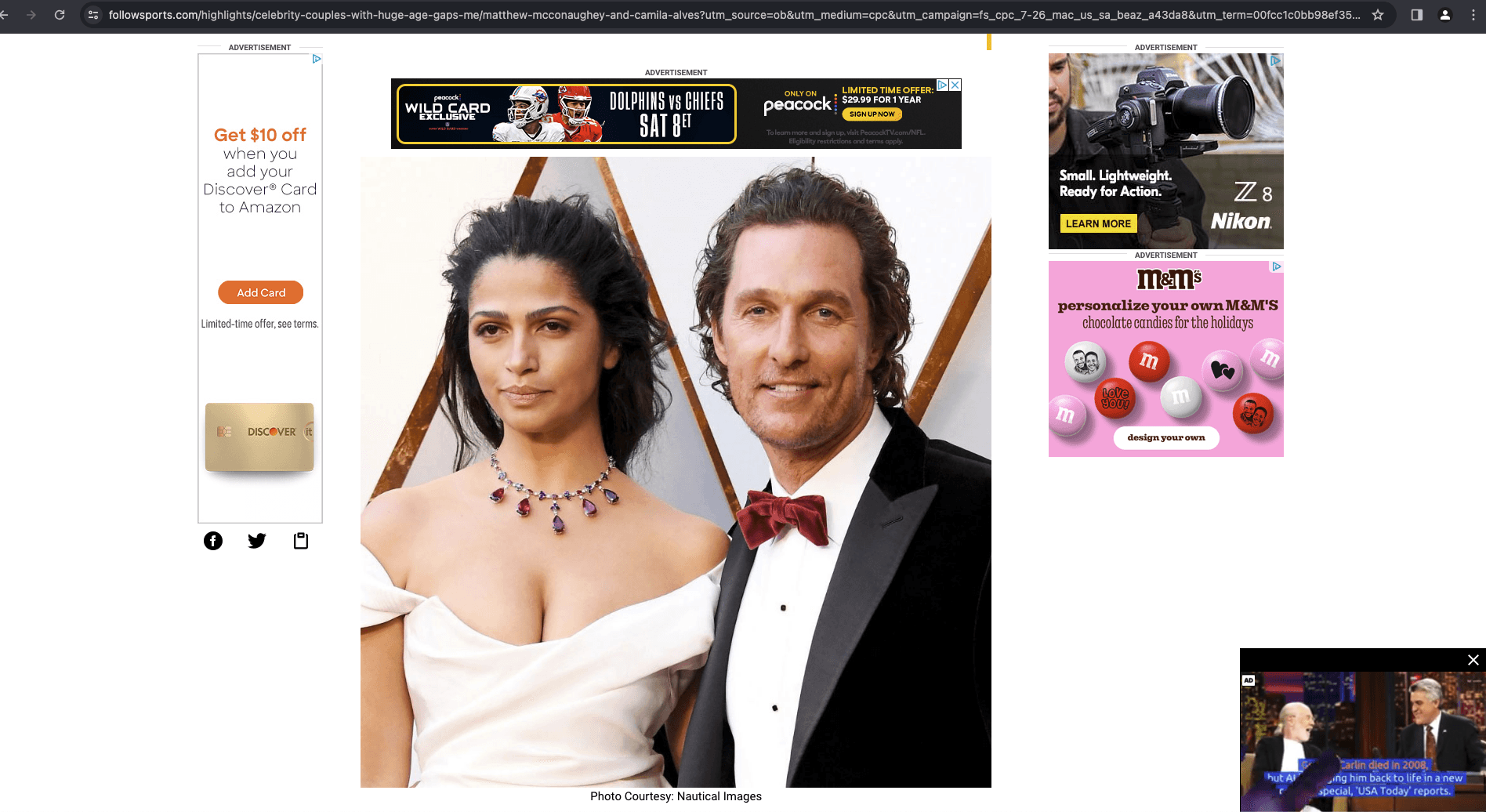

For example, in the screenshots from 2024 below, one can observe ads for Molson Coors, Discover, Kenvue, Dell Technologies, Mondelēz International, and State Farm observed on various websites described in the aforementioned “Methodology” section of this report.

Screenshot from 2024 showing two Molson Coors ads observed on a website which meets the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website. Molson Coors was one of 17 disclosed participants in the ANA’s 2023 Programmatic Transparency Study. Visible on the page also is an ad from Bayer (Nubeqa).

Screenshot from 2024 showing a Discover ad observed on a website which meets the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website. Discover was one of 17 disclosed participants in the ANA’s 2023 Programmatic Transparency Study. Visible on the page also are ads from Nikon, NBCUniversal's Peacock, and Mars’ M&M’s.

Screenshot from 2024 showing a Kenvue (Tylenol) and a Dell Technologies ad observed on a website which meets the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website. Kenvue and Dell Technologies was two of 17 disclosed participants in the ANA’s 2023 Programmatic Transparency Study.

Screenshot from 2024 showing a Mondelēz International’s belVita ad observed on a website which meets the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website. Mondelēz was one of 17 disclosed participants in the ANA’s 2023 Programmatic Transparency Study.

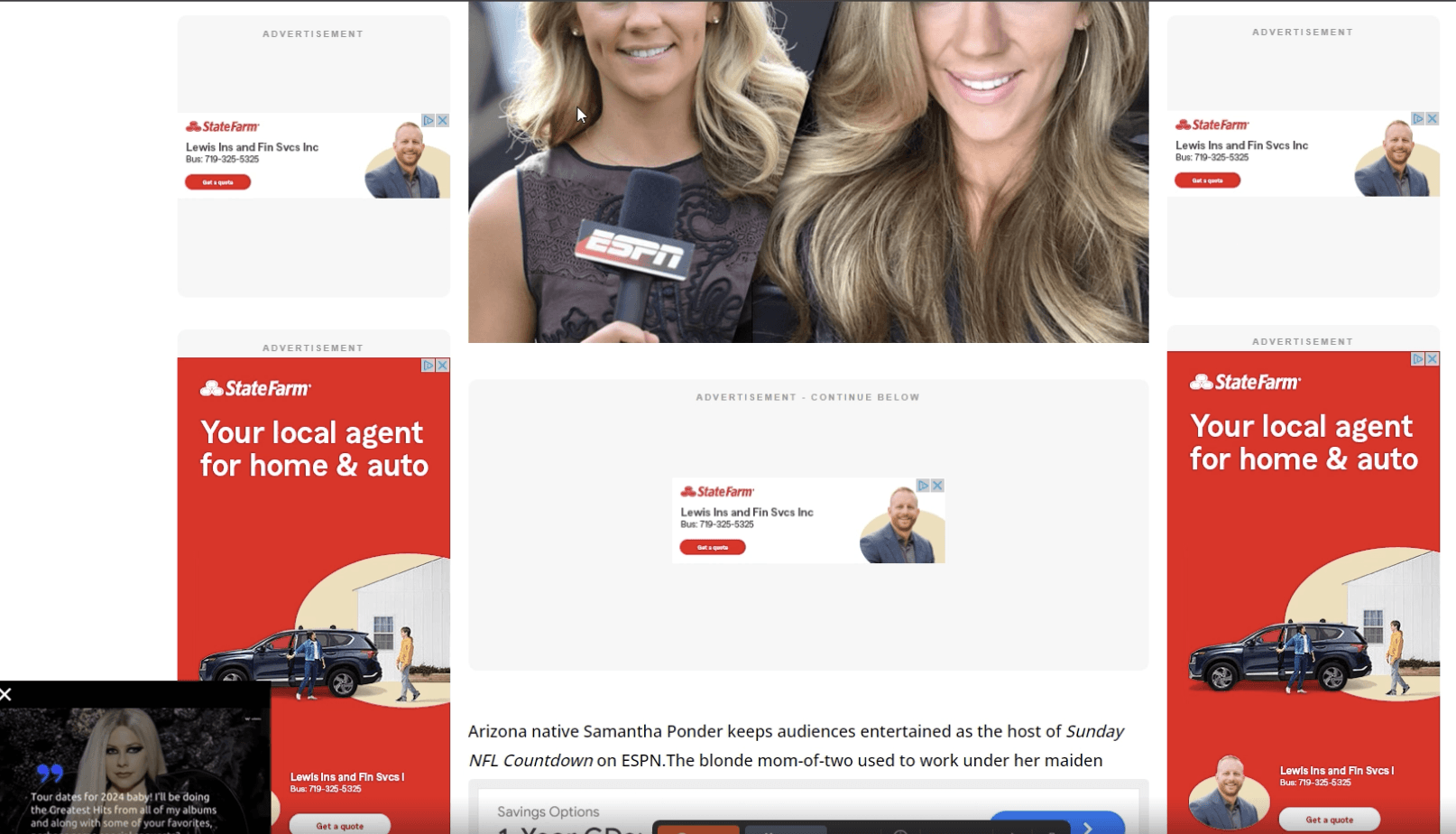

State Farm, which was one of the 17 disclosed participants in the ANA’s Programmatic Transparency Study, was cited in a January 2024 Digiday article as having adopted “the shared standards and best practices from both ANA and its own initiative.” The article further mentions: “As a State Farm partner, Omnicom Media Group has been a game-changer for our programmatic media strategy,” said Alyson Griffin, head of marketing at State Farm. “Understanding where our ads are delivered and how they’re purchased are a key part of proving the effectiveness of our advertising.””

Source: Digiday

Screenshot showing five State Farm ads served on a website which meet’s the ANA’s, WFA’s, ISBA’s, 4A’s, and DeepSee.io’s definition of “Made for Advertising” website. State Farm was one of 17 disclosed participants in the ANA’s 2023 Programmatic Transparency Study.

In addition to companies which participated in ANA’s 2023 Programmatic Transparency Study as advertisers, PricewaterhouseCoopers (PwC) participated in the study as a service provider.

Screenshot from the ANA’s 2023 Programmatic Transparency Study, showing that PwC US was listed as a vendor.

Digiday reported that: “In December 2021 The Association of National Advertisers confirmed PricewaterhouseCoopers as lead partner for a landmark study geared toward bringing further transparency into the programmatic media-buying landscape. Although, 18 months later, the pairing has run its course after the ANA ended the relationship over dissatisfaction with PwC’s performance.”

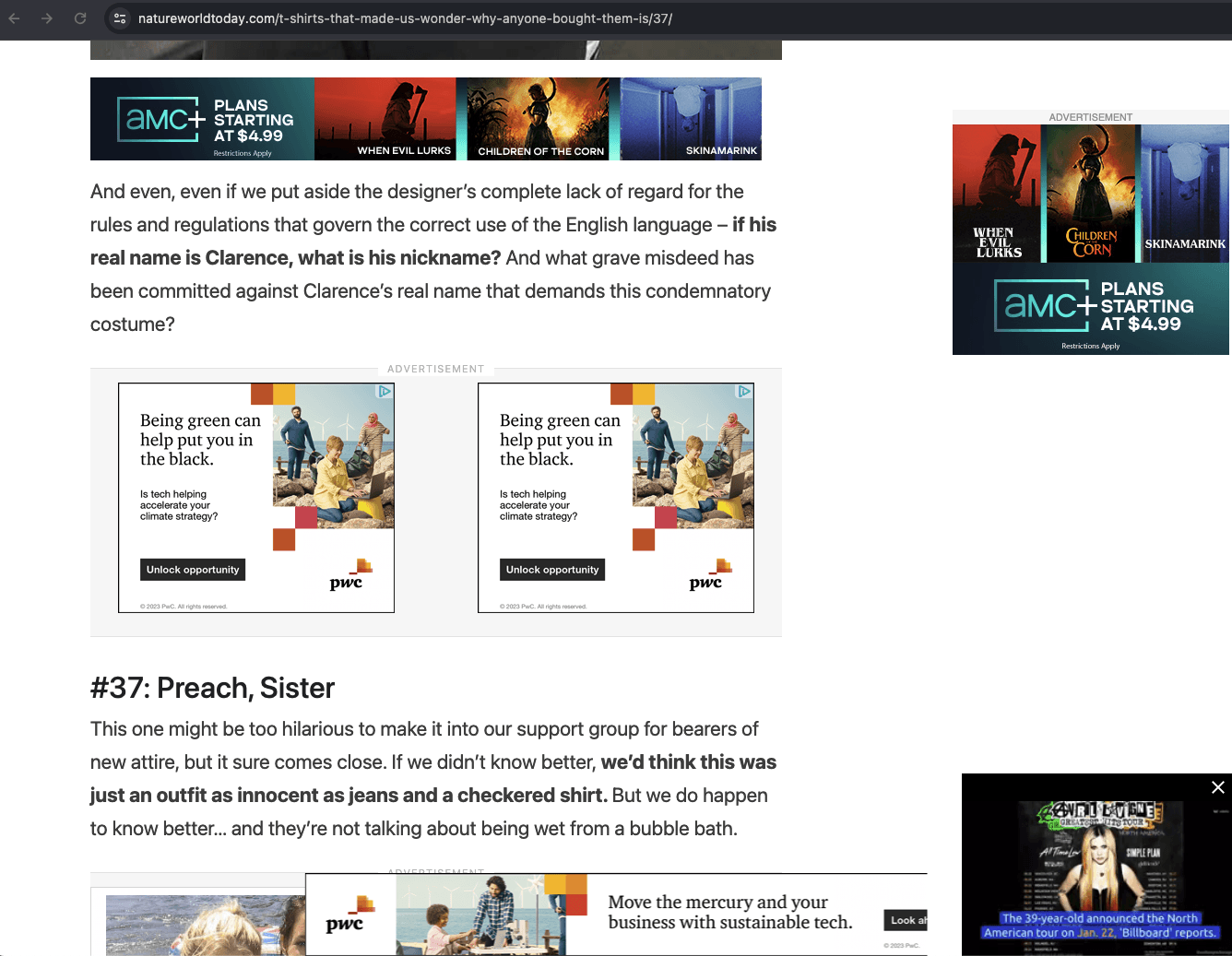

Ads promoting PwC were also observed on the aforementioned sample of “Made for Advertising” websites in January 2024. For example, in the screenshot below one can observe three simultaneous ad for PwC served on a website which meet’s the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website.

Screenshot from 2024 showing three PwC ads observed on a website which meet’s the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website. PwC was “awarded the job” of executing the ANA’s 2023 Programmatic Transparency Study.

Ad tech vendors observed transacting brands’ ads on “Made for Advertising” websites in 2024

As described in the “Methodology” section of this report earlier, when ads were observed serving on the sample of websites which meet the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website, the source code and meta-data of each ad was stored, processed, and analyzed. This digital forensics analysis allowed determination of which Supply Side Platforms (SSPs) or ad exchanges, Demand Side Platforms (DSPs), verification vendors, and data providers were involved in transacting a given brand’s ads on a “made for advertising” website.

Ad exchanges and supply side platforms observed transacting brands’ ads on “Made for Advertising websites in 2024

Annotated screenshot of the Association of National Advertisers (ANA’s) “Meet the SSPs” showcase event on March 7th, 2024. Eighty percent of the SSPs invited to present at the ANA event were confirmed to serve multiple ANA members’ ads on websites which meet the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website.

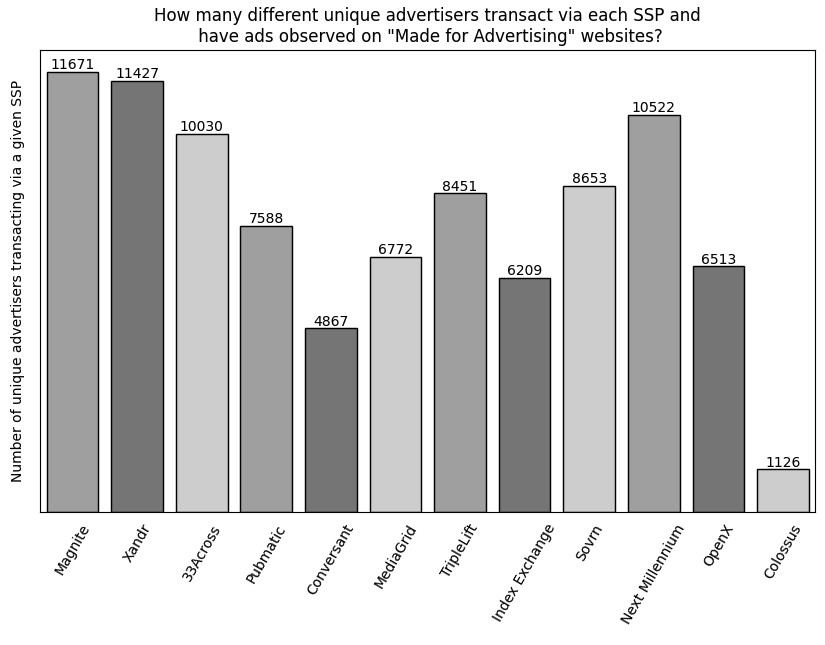

Many SSPs or ad exchanges were observed to serve thousands of different brands’ ads on the sample of MFA websites.

This includes SSPs, ad networks, ad exchanges, publisher yield optimization services, or other types of ad delivery platforms, including:

Google Ad Manager (GAM) and related ad delivery or bidding systems

Magnite

Xandr

33Across

Pubmatic

Conversant

MediaGrid

TripleLift

Index Exchange

Sovrn

Next Millennium

OpenX

Colossus

Media.net

Yieldmo

Rise Codes

AdaptMX-AMX

Microsoft Audience Network

Sharethrough

Criteo

Sonobi

PulsePoint / ContextWeb

Nativo

Unruly-Termor International-Nexxen

Teads

ADYOULIKE-OpenWeb

Smart AdServer-Equativ

RichAudience

OneTag

Minute Media

GumGum

LoopMe

Brightcom

Ogury

Seedtag

Qortex AI

Adagio

Disqus-Zeta Global

Vidazoo

For example, Magnite was observed transacting ads for 11,671 different brands on the sample of MFA websites in 2024, including ads for brands such:

United States Federal Trade Commission (FTC)

Procter & Gamble

State Farm

US Army

Hershey’s

American Express

H&R Block

Nestle

Comcast

Sanofi

Expedia

Disney

Johnson & Johnson

Lowes

Dell

Pfizer

NBCUniversal

Toyota

USAA

Ford

Paramount

Southwest airlines

Coca-Cola

Verizon

Clorox

Haleon

Discovery

Screenshot from 2024 of a Federal Trade Commission (FTC) ad observed on a website which meets the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website not affiliated with Maxim. The ad was transacted via Zeta Global DSP, Magnite SSP (seller ID 17960), and Sovrn SSP. Two Verizon ads (one stacked on the second one) are visible below.

Pubmatic (which appears to have deleted or removed its June 2023 announcement “Advancing Responsible Media By Removing MFA Inventory From Auction Packages”) was observed transacting ads for 7,588 different brands on the sample of MFA websites in 2024, including ads for brands such:

State Farm

InterContinental Hotels Group

Ford

Hershey’s

American Express

Sanofi

Gerber Life

MI5 / UK Security Service (the UK government’s domestic counterintelligence agency)

Planet Fitness

Vrbo

Comcast

H&R Block

Dell

Disney

Microsoft

United airlines

Pfizer

Kroger

US Bank

ESPN

Home Depot

TripleLift was observed transacting ads for 8,451 different brands on the sample of MFA websites in 2024, including ads for brands such:

Procter & Gamble

Mars

Hershey’s

Mondelez International

Clorox

US Centers for Disease Control (CDC

JMorgan Chase

American Express

Apple

Disney

Planet Fitness

Dell

US Army

Nestle

Microsoft

Sanofi

Haleon

NBCUniversal

Pfizer

Charles Schwab

Samsung

Nike

Paramount

Bar graph illustrating the number of distinct “adomains” (advertisers) observed transacting ads via a given SSP on the websites in the sample of websites which meet various definitions of “Made for Advertising”.

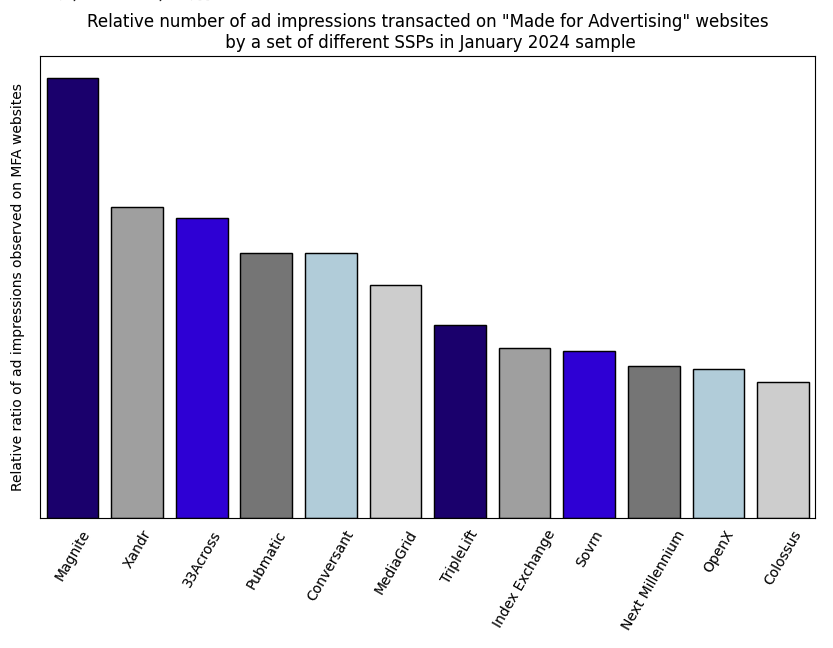

In the histogram below, one can observe the relative abundance or frequency of ads transacted via various SSP or ad delivery platforms on the sample of websites which meet various definitions of “Made for Advertising” in January 2024.

Histogram illustrating the relative number of ad impressions transacted by various SSPs or ad serving platforms in a January 2024 sample of various websites which meet various definitions of “Made for Advertising”.

Many brands appear to be transacting on the sample of “Made for Advertising” websites dozens of different supply paths or via reseller chains. It is unclear whether or how the decision to transact via so many distinct supply paths is consistent with media buyers’ Supply Path Optimization (SPO) efforts.

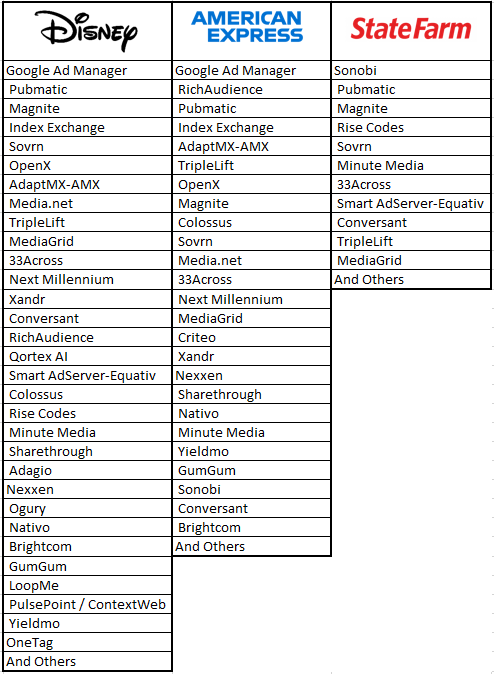

For example, American Express was observed transacting MFA ads via: Google Ad Manager, RichAudience, Pubmatic, Index Exchange, AdaptMX-AMX, TripleLift, OpenX, Magnite, Colossus, Sovrn, Media.net, 33Across, Next Millennium, MediaGrid, Criteo, Xandr, Unruly-Termor International-Nexxen, Sharethrough, Nativo, Minute Media, Yieldmo, GumGum, Sonobi, Conversant, Brightcom, and others.

Disney was similarly observed transacting through several dozen different supply paths on “Made for Advertising” websites, including Google Ad Manager, Pubmatic, Magnite, Index Exchange, Sovrn, OpenX, AdaptMX-AMX, Media.net, TripleLift, MediaGrid, 33Across, Next Millennium, Xandr, Conversant, RichAudience, Qortex AI, Smart AdServer-Equativ, Colossus, Rise Codes, Minute Media, Sharethrough, Adagio, Unruly-Termor International-Nexxen, Ogury, Nativo, Brightcom, GumGum, LoopMe, PulsePoint / ContextWeb, Yieldmo, and OneTag.

State Farm was observed transacting on “Made for Advertising” websites via Sonobi, Pubmatic, Magnite, Rise Codes, Sovrn, Minute Media, 33Across, Smart AdServer-Equativ, Conversant, TripleLift, MediaGrid and a few others.

Some brands were observed transacting through a relatively smaller number of distinct SSPs on “Made for Advertising” websites, though one must be careful drawing conclusions from this due to inherent sampling biases and stochasticity. Procter & Gamble was observed transacting on “Made for Advertising’ websites through a relatively smaller number of ad exchanges, including Index Exchange, Sovrn, Pubmatic, and Triplelift. Similarly, Unilever was observed transacting on MFA websites through Pubmatic, Sovrn, Magnite, Media.net, MediaGrid, and Unruly-Tremor International-Nexxen.

Demand side platforms observed transacting brands’ ads on “Made for Advertising” websites in 2024

In addition to evaluating which specific SSPs or ad exchanges were involved in transacting a given brands’ ads on the sample of websites which meet various definitions of “Made for Advertising” in January 2024, each ad impression was also examined to infer what Demand Side Platform or ad buying network was involved in transacting a given ad.

The list of demand side platforms (DSPs), ad buying platforms or networks, bidders, or managed buy vendors who were observed transacting ads on the aforementioned of “Made for Advertising” websites in January 2024 includes:

Google DV360

Amazon

Conversant

Xandr

Quantcast DSP

Yahoo DSP

StackAdapt

Zemanta

molocoads DSP

Beeswax

Adelphic

Genie by Media Force

Adobe Advertising Cloud

InMobi DSP

Appier

Smadex DSP

Cognitiv DSP

Amobee DSP

Criteo

DeepIntent Healthcare DSP

Zeta Global

Exponential

PulsePoint

Kayzen

Loopme

Roku Oneview (DataXu)

Simpli.fi

RTB House

MaxPoint-Valassis Digital

Cox Automotive DSP

Cluep

Travel Audience GmbH

AdTheorent

GroundTruth

Samsung DSP (AdGear)

Sift Media

InMarket/ThinkNear

MediaGo DSP

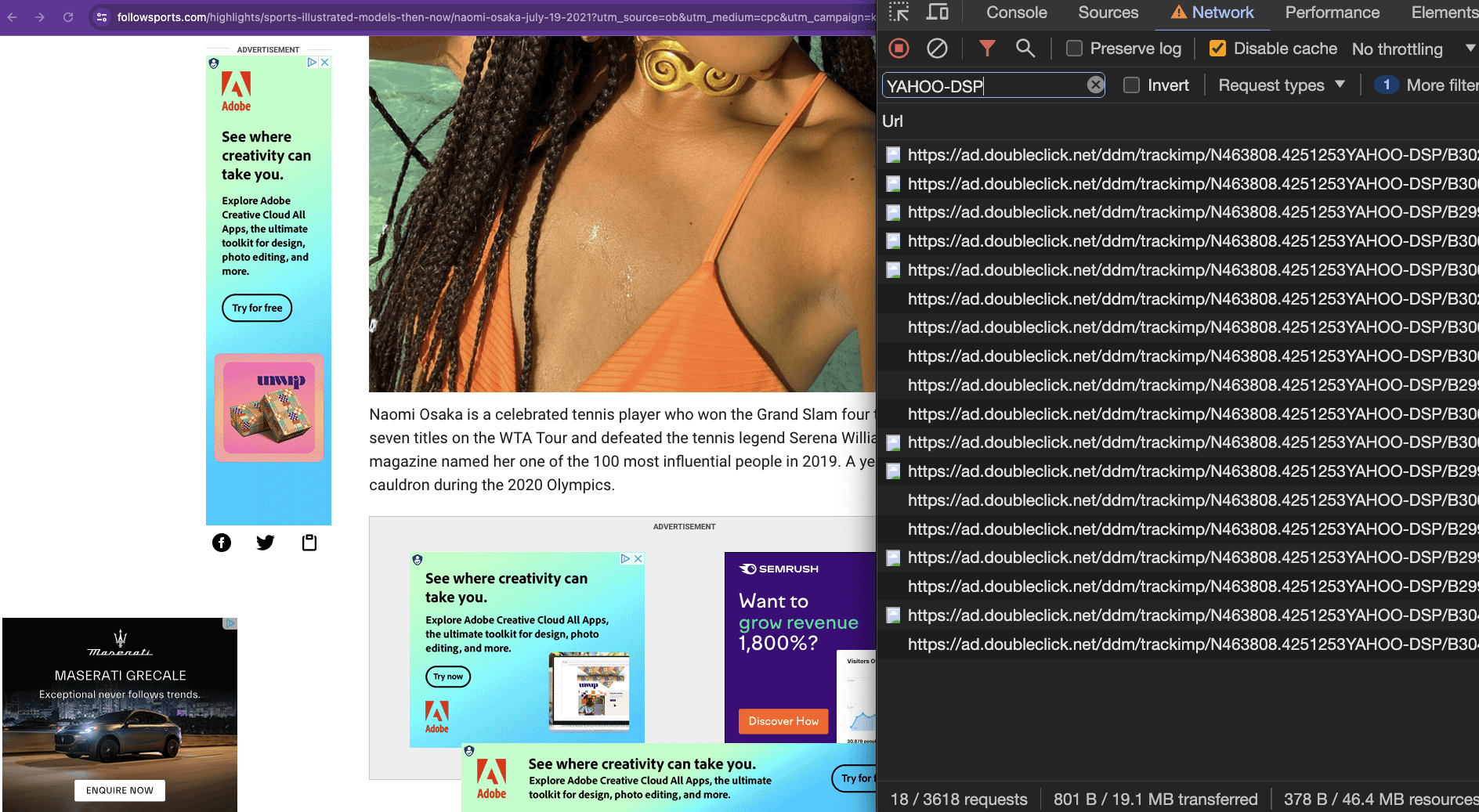

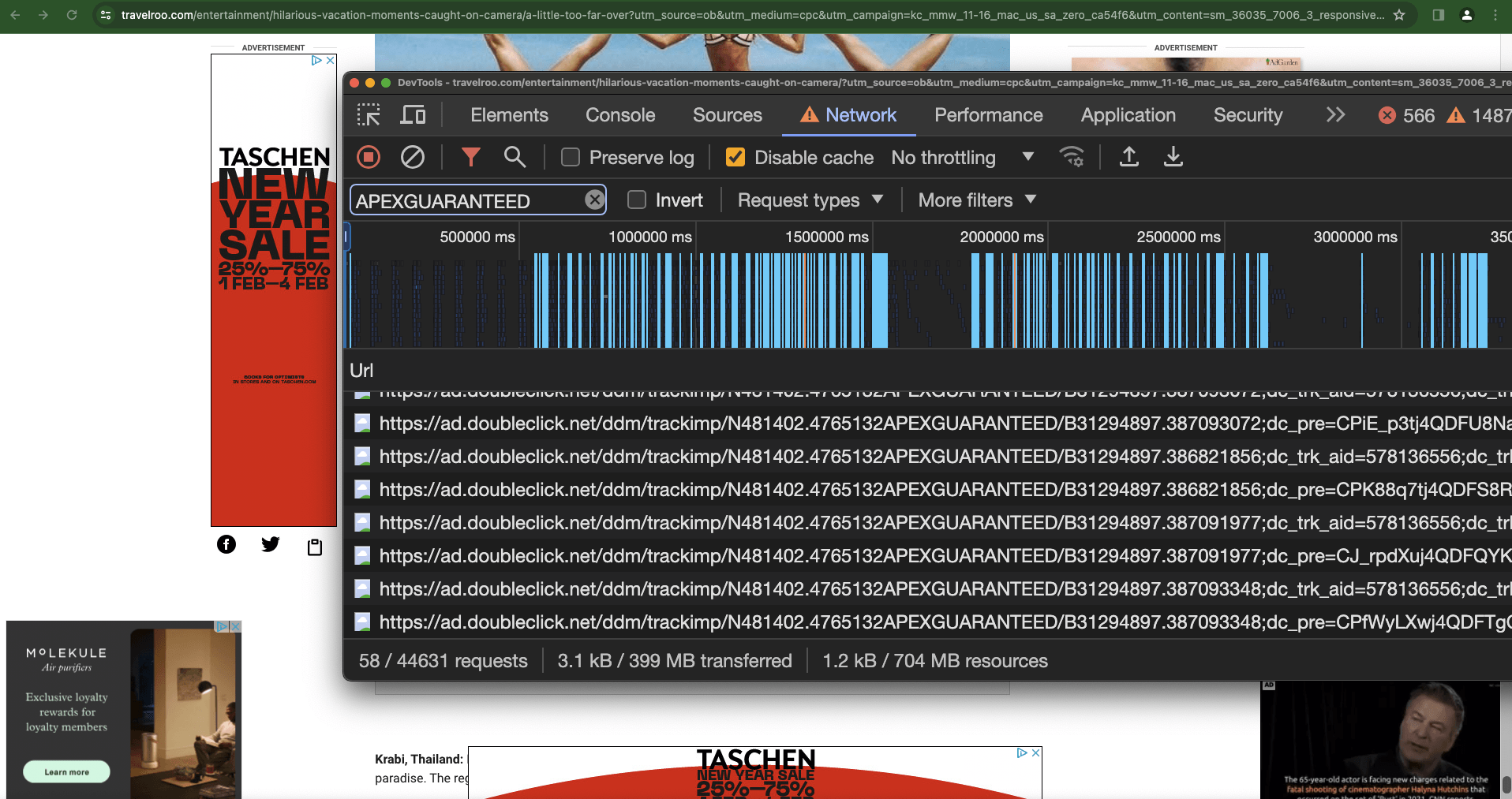

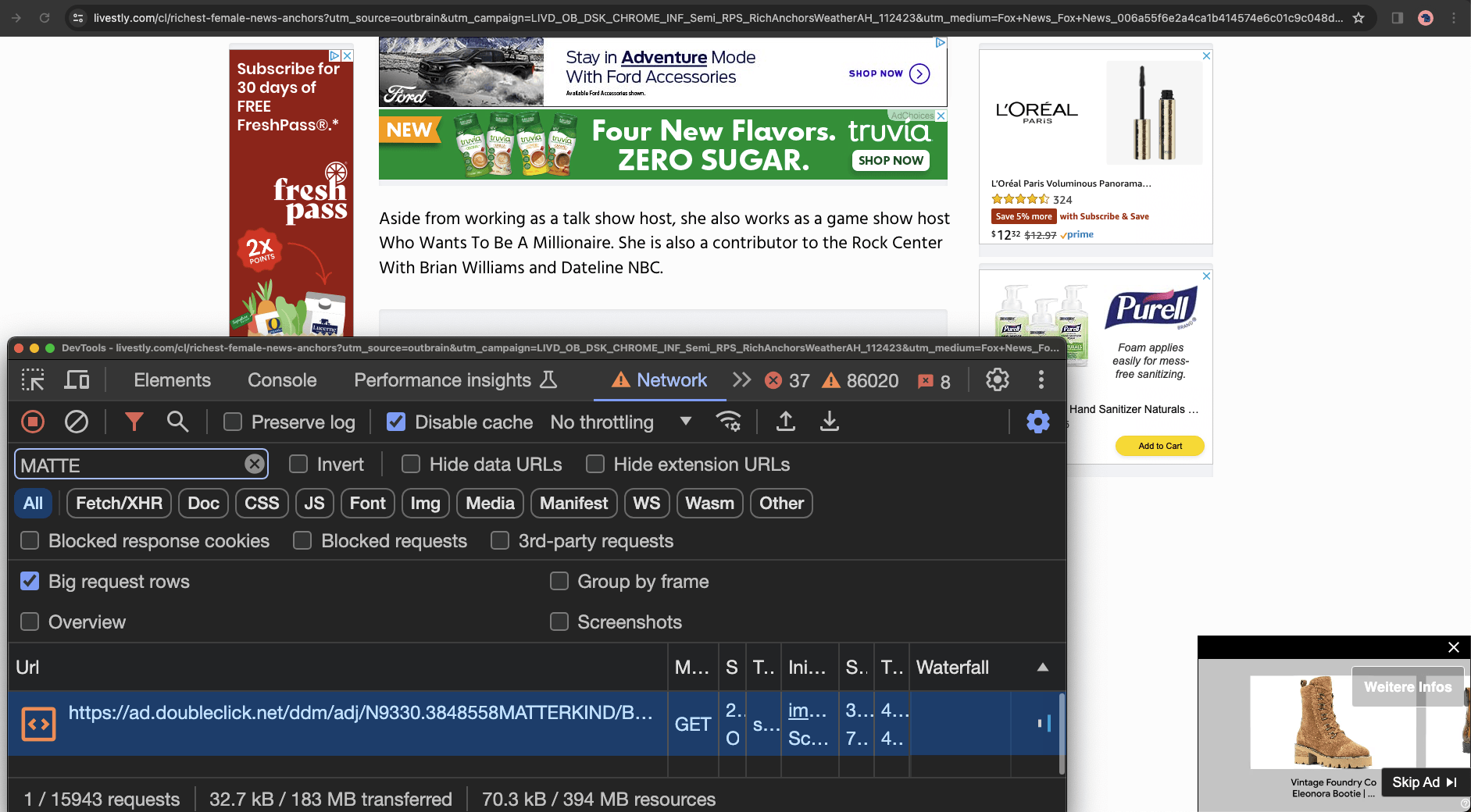

Screenshot of a website which meets various definitions of “Made for Advertising”. Chrome developer tools is open on the right side, showing 18 distinct HTTPS requests to Campaign Manager 360 (360), which contain the string “YAHOO-DSP”.

Screenshot showing two FTC ads served simultaneously on a website on a website which meets the ANA’s, WFA’s, ISBA’s, 4A’s, Jounce Media’s, and DeepSee.io’s definition of “Made for Advertising” website. The ads were transacted via Zeta Global DSP.

For example, Google DV360 or Google Ads was observed transacting ads for 7,272 different brands on the sample of MFA websites in 2024, including ads for brands such as:

H&R Block

Vrbo

NBCUniversal

Comcast

Mint Mobile

Sephora

IHG

Google

Lowe’s

Kenvue

JPMorgan Chase

American Express

Nestle

Disney

Amazon DSP was observed transacting ads for 2,601 different brands on the sample of MFA websites in 2024, including ads for brands such as:

Hershey’s

Disney

Amazon

Clorox

Conagra Brands

Nestle

Energizer

Haleon

PepsiCo

Discovery

Mars

Coca Cola

Warner Bros Discovery

Colgate Palmolive

Meta

Google

Sanofi

Kenvue

StackAdapt DSP was observed transacting ads for the Canadian Armed Forces and other brands on the sample of MFA websites in 2024.

Comcast owned Beeswax DSP was observed transacting ads for 1,352 different brands on the sample of MFA websites in 2024, including ads for brands such:

Indeed (careers network)

Draft Kings

Kaiser Permanente

Navy Mutual

Grainger Industrial Supply

FanDuel

Bet MGM

Centennial Bank

Many different hospital, medical device, and pharmaceutical brands were observed transacting ads on the sample of MFA websites using two “specialist DSPs” that describe themselves as being “purposefully for the healthcare industry” or a “healthcare marketing technology”. These were PulsePoint and DeepIntent Healthcare Advertising DSP. DeepIntent won “Best Demand-Side Technology” in the 2023 AdExchanger Awards for helping to “improve audience quality.”

Brands whose ads were observed to transact via Pulsepoint, a healthcare marketing focused ad platform, on the sample of “made for advertising” websites, included:

Aadi Bioscience

AbCellera

AbbVie

Abbvie

Acacia Pharma Group Plc

Acetaminophen Awareness Coalition

Acorda Therapeutics

Alcon

Alexion

Alkermes Pharma

Almatica

Amgen

Arcutis Biotherapeutics

Argenx

Ascendis

Ascendis Pharma

Astellas Pharma US

AstraZeneca

Atrius Health

Averitas

Axogen

Azurity Pharmaceuticals

BD Biosciences

Bausch + Lomb

Bayer

Bayer Pharmaceuticals

Becton, Dickinson and Company

BioCryst

Biogen

Biomarin

Bioventus

Blueprint Medicines

Bristol Myers Squibb

Brookwood Baptist Health

CHG Healthcare

CSL Behring

CTI Biopharma

Calliditas

Catalyst Pharmaceuticals

Children's Hospital Association

Cincinnati Children's Hopsital Medical Center

Click Therapeutics

Daiichi Sankyo

Dermavent

Edwards Lifesciences

Edwards Lifesciences Corporation

Eisai Inc

Esperion

Exact Sciences

Exelixis

Exeltis

Ferring Pharmaceuticals

Fresenius Medical Care

G1 Therapeutics

GSK

Genentech USA (part of Roche)

Genentech USA Inc

HB Harmony Biosciences

Harmony Biosciences

Harvard Medical School Teaching Hospital

Immunogen Inc

Indivior

Insmed

Inta-Cellular Therapies

Ionis

Janssen (part of Johnson & Johnson)

Jazz

Karyopharm

Kowa

Kyowa Kirin

Leo

Lexicon

Lilly

Mallinckrodt

Mallinckrodt Pharmaceuticals

Mass General Brigham

MedStar

Meranini

Merck

Merus

Moffitt Cancer Center

Mölnlycke Health Care AB

NS Pharma

Neurocrine Biosciences

Novartis

Novo Nordisk

Novocure

On24

Orphalan

Ortho Dermatologics

Otsuka America Pharmaceutical, Inc

Paratek

Passage Bio

Pfizer

Pharmacosmos Therapeutics

Radius Health

Reata Pharmaceuticals

Regeneron

Salix Pharmaceuticals

Sandoz

Sanofi

Seres Therapeutics

Servier

Sprycel

Stemline

Storysoft

Sumitomo Pharma

Sun Ophthalmics

Sun Pharmaceutical Industries

TG Therapeutics

TH Medical

Takeda

Tarsus

Temple University Health System

Tersera Therapeutics

Teva

Think Surgical

Thinking Huts

UCB

University of Kansas Health System

University of Pennsylvania

University of Texas MD Anderson Cancer Center

Vericel Corporation

Vertex

Viatris

W. L. Gore & Associates, Inc

WebMD

X4

scPharmaceuticals

Healthcare and pharmaceutical brands whose ads were observed to transact via DeepIntent on the sample of “made for advertising” websites in January 2024, included:

Johnson & Johnson (Janssen)

lynparzahcp.com - AstraZeneca - source code of the ad contains references to “interpublic.com”, suggesting the ad was also transacted on MFA by IPG media agency

merckvaccines.com - Merck - source code of the ad contains references to “interpublic.com”, suggesting the ad was also transacted on MFA by IPG media agency

ALkermes

AXS

Abbott

Abbott

Abbvie

Agios Pharmaceuticals

Alexion Pharmaceuticals

Alkermes

Amazon

Amgen

AstraZeneca

Ballad Health

Biogen

Boehringer Ingelheim

Boston Scientific

Bristol Myers Squibb

CSL Behring

Centers for Disease Control and Prevention

Chiesi

Children's Health

Deciphera Pharmaceuticals

Endo

Error

Esperion Pharmaceuticals

Exeltis

Gilead

Halozyme

Huntsman Mental Health Institute

Indivior

Inizio

Intercept

Kenvue

Kyowa Kirin

Laboratory Corporation of America Holdings

Madrigal Pharmaceuticals

Merck

Mirum Pharmaceuticals

My Health Team Inc

New York Presbyterian Hospital

Novartis

Otsuka Holdings Co

Otter Pharmaceuticals

Pfizer

Sanofi

Seagen

Smith Nephew

Spectrum Pharmaceuticals

Sun Dermatology

Sun Pharma

Sun Pharmaceutical Industries

Syndax Pharmaceuticals

Taiho Oncology

Takeda Pharmaceuticals America, Inc.

UPMC Health Plan Inc

Viatris

Zarbees

myNEURELIS

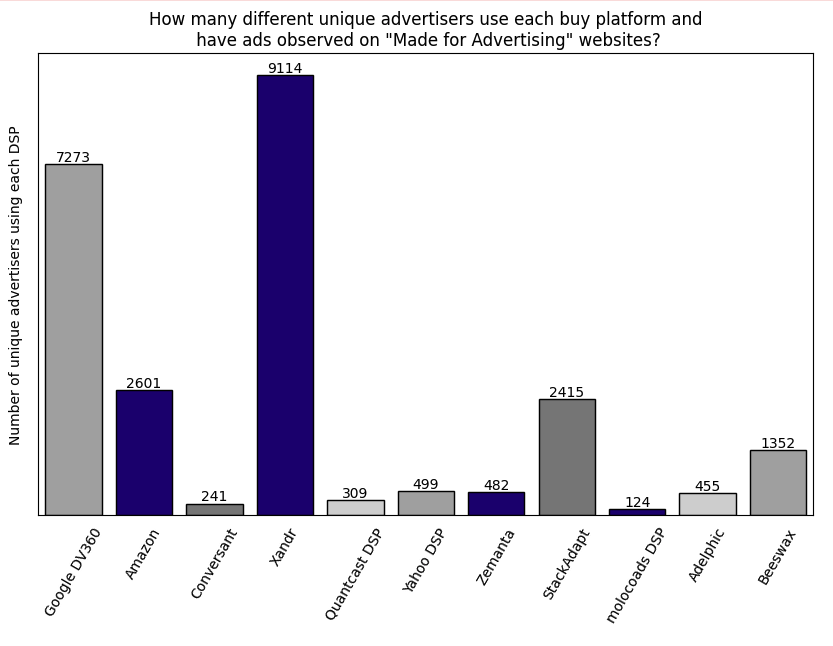

Barplot showing how many different brands were observed transacting via a given ad buying platform on a sample of websites which meet various definitions of “Made for Advertising”.

In the histogram below, one can observe the relative abundance or frequency of ads transacted via various SSP or ad delivery platforms on the sample of websites which meet various definitions of “Made for Advertising” in January 2024.

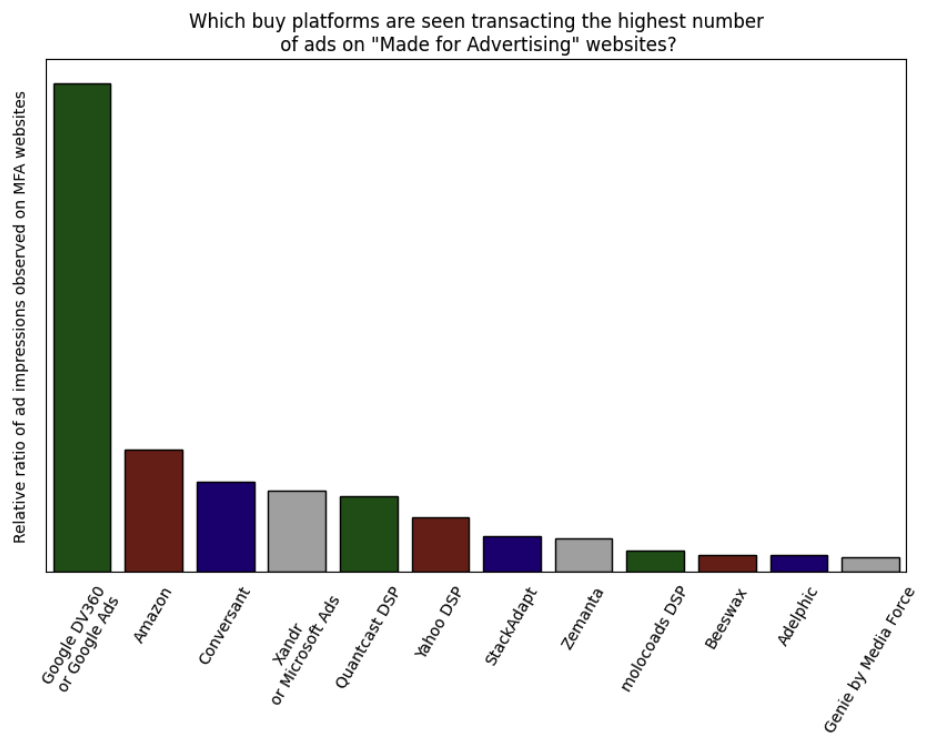

In the histogram below, one can observe the relative abundance or frequency of ads transacted via twelve DSPs, bidders, or managed buying platforms in the sample of websites which meet various definitions of “Made for Advertising” in January 2024. These were the twelve most prevalent or commonly observed DSPs transacting on MFA in the sampleset. Otherwise DSPs were observed transacting less frequently, whilst certain DSPs - such as the Trade Desk and Walmart DSP - were not observed transacting ads on MFA at all.

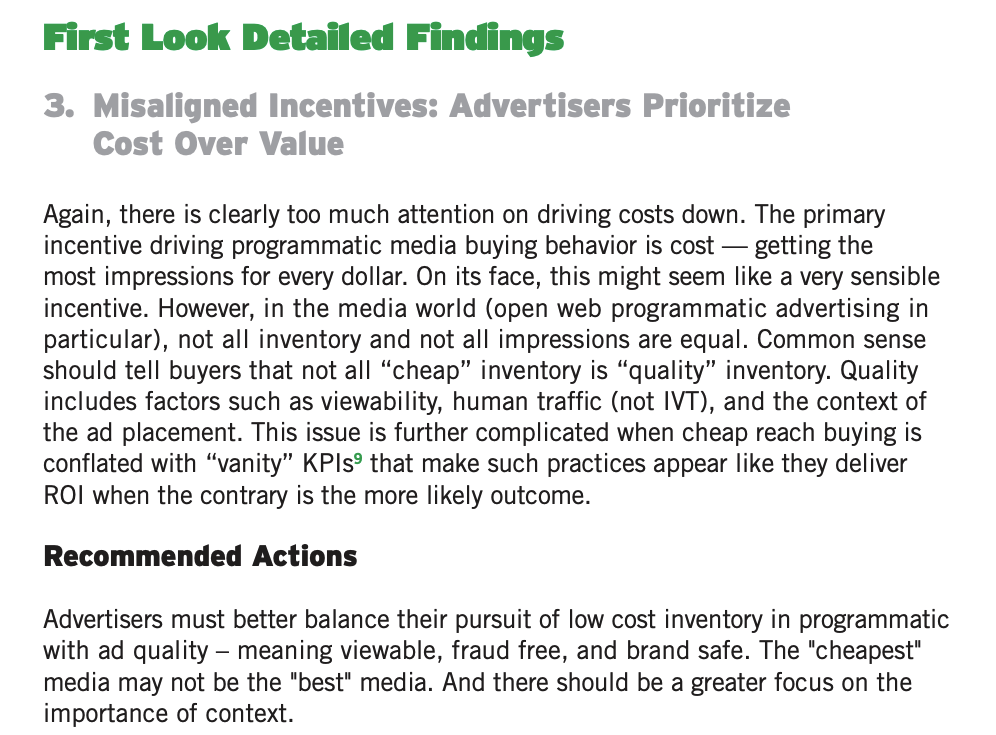

Some DSPs which have publicly stated they partner with Jounce Media to block “Made for Advertising” ad inventory were observed apparently transacting ads on sites which meet the Jounce Media, DeepSee.io, and others’ definition of “Made for Advertising”. For example, Horizon Therapeutics, Amgen (tepezza.com), and Hallmark Channel ads were observed transacting on the sample of websites described in the Methodology section via AdTheorent. Centro Basis was observed transacting a very small number of impressions on the sample of websites which meet the aforementioned definitions for “Made for Advertising”.

One must note that vendors might provide media buyers the option of disabling MFA filters or guardrails, while successfully filtering out MFA inventory for other buyers by default. For example, AdTheorent specifically states on their website that their partnership with Jounce Media is designed to “ensure that AdTheorent’s campaigns remain MFA-free, unless affirmatively elected by an advertiser.”