High quality journalism is expensive to produce. The American Prospect, a political news magazine, estimates that it costs $1965.58 to produce an average story.

When an organization such as The New York Times or Wall Street Journal publishes an article, it is the result of many hours of labor by journalists, fact checkers, editors, photographers, software engineers, and many other contributors. Even for individual bloggers, many hours of labor are required to create posts on travel itineraries or cooking recipe ideas.

Many creators recoup the costs of media production primarily through digital advertising. Showing digital ads on websites allows the content producers to monetize their work without charging subscriptions or receiving grants.

However, even the placement of digital ads itself has marginal costs associated with it. Digital advertising has a virtual “supply chain” of Supply Side Platforms (SSPs) that work with publishers, and Demand Side Platforms (DSPs), which aggregate ad buying demand from media agencies and brands.

How much do these ad tech intermediaries charge for the service of connecting advertisers with digital publishers?

This preliminary Adalytics study on programmatic media supply chain fees reproduces and builds upon several previous industry studies. This study discusses the following empirical observations:

- There is a high level of variability in the supply fees charged by SSPs and DSPs, on a per impression basis. In some cases, even when controlling for media buyer (advertiser), supply path, and publisher domain, the revenue share of these middlemen can vary by up to 80% (e.g, 5% fee on one ad impression, 85% fee on another ad impression);

- For some impressions, DSPs and SSPs receive up to 98% of a media buyer’s bid; with the publisher receiving only ~2% of of the advertiser’s spend bid;

- SSPs with non-standard native or proprietary ad unit formats can have especially high supply fees;

- SSP fees vary by publisher and do not appear to correlate with the quality of the publication or audience. For example, it was observed that publishers with niche but high value audiences (such as pharmaceutical executives or Congressional staffers) were being charged higher SSP fees than a clickbait, ‘made-for-advertising’ site that auto-refreshes ad slots and employs other questionable tactics

- Some SSPs appear to subsidize individual ad impressions; this may be done to improve their aggregate win rates so that they appear more effective (to either the publisher or the advertiser)

- Background

- Possible methodologies for analyzing supply fees

- Results

- A significant but variable proportion of media buyer’s spend goes to vendors; not publishers

- Some ad exchanges appear to have highly variable supply fees

- SSPs have different supply fees for different publishers

- Conclusion

Background

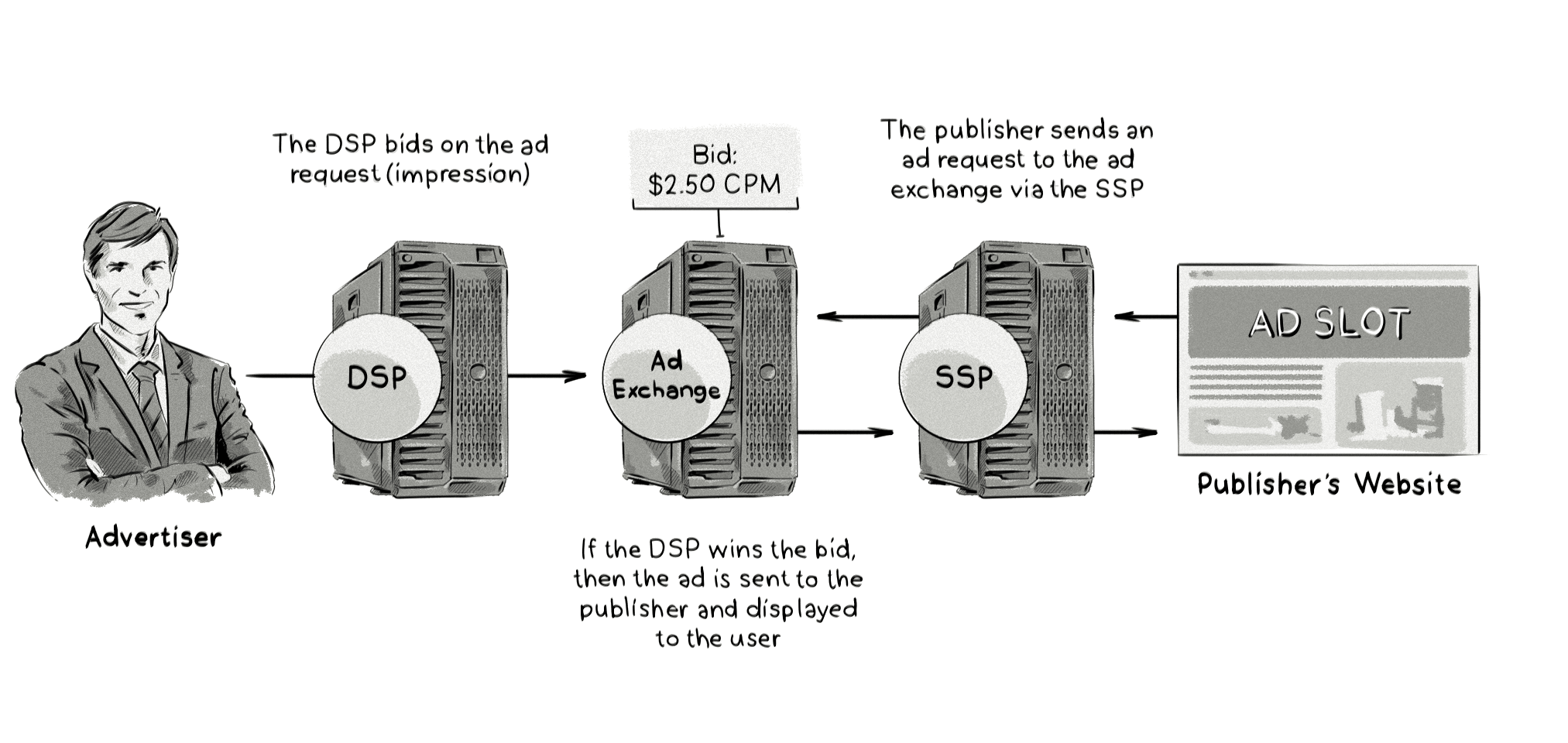

In a present-day, 1st price ad auction, there is a sequence of events that take place. When a reader visits a website, the website will communicate with several Supply-side platforms (SSPs) that aggregate ad inventory from many different publishers, ranging from tiny blogs to 100+ year old national papers-of-record.These SSPs will present information about the ad auction to a number of Demand-side platform (DSPs), which are used by media agencies or brands to bid and purchase ads across large swathes of inventory.

Image source: Clearcode.cc

Image source: Clearcode.ccMedia buyers who work on behalf of agencies or brands place bids to try to win the opportunity to render their ad on the consumer’s computer, phone, or connected TV. Generalizing for the sake of simplicity, if a media buyer bids more than other advertisers bid for that ad slot, it will win the ad auction (similar to how art auctions are run by Sotheby's and Christie's). It then pays a fee to the DSP, which takes a fee from the SSP or ad exchange, which in turn takes a fee from the publisher (in the form of a revenue share). In addition, the media buyer may elect to pay fees for audience data, brand safety, or measurement.

The amount that DSPs and SSPs charge to advertisers and publishers is not totally transparent. Several industry studies have tried to explore this issue previously.

In 2014, the World Federation of Advertisers published a guide to programmatic media supply chains. In 2016, The Guardian purchased its own ad inventory to try and assess where the money was spent across the entire supply chain and saw, in some instances, that only 30 percent was making it back to the publisher. In 2017, the US Association of National Advertisers (ANA) published a study called “Programmatic: Seeing Through the Financial Fog", which inspected “how advertiser budgets were actually spent along the digital supply chain with insights around costs and fees incurred for media, technology, service and data.” The study was based on “16 billion in-market programmatic transactions” from participating advertisers. In 2019, marketing intelligence unit WARC analyzed ad spend data from Magna Global and concluded that: "over $30 billion of the $63.4 billion spent on programmatic advertising worldwide last year wound up in the hands of tech vendors".

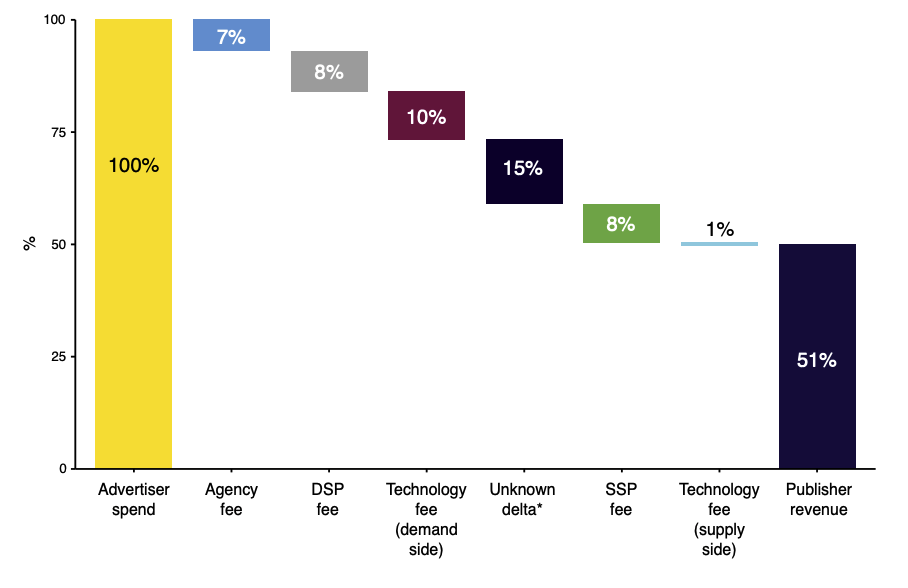

In May 2020, the Incorporated Society of British Advertisers (ISBA) & PwC released the findings of a comprehensive and forensic study of the programmatic supply chain for 15 advertisers and 12 Publishers in the UK. “The intention was to provide a more transparent view of the UK programmatic supply chain, for the benefit of all participants and the industry as a whole.” The key findings were “that 51% of advertiser spend reaches the end publisher, 15% of the spend is unaccounted for (labeled the ‘unknown delta’)”.

Image source: Source: ISBA Programmatic Supply Chain Transparency Study, May 2020

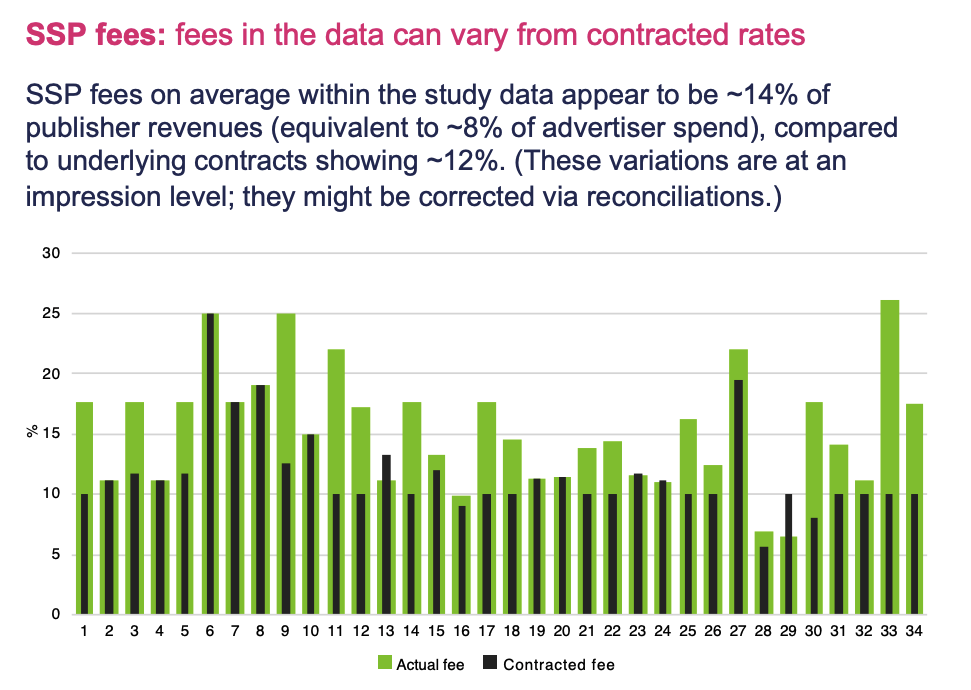

Image source: Source: ISBA Programmatic Supply Chain Transparency Study, May 2020Notably, data from the ISBA & PwC study suggested that “There are variances between the contracted and actual fees charged by DSPs (to Advertisers/Agencies) and SSPs (to Publishers).”

Possible methodologies for analyzing supply fees

There are many ways in which one can assess ad tech vendor supply fees, some of which are discussed in greater detail in the aforementioned studies. Some of those studies relied on log files provided by large media agencies and/or publishers. Many ad tech platforms generate detailed log files for each individual ad auction, bid, and impression served.

For example, the demand-side platform Trade Desk has a service called the Raw Events Data Stream (REDS), which gives media buyers hourly updates on their bidding activity. REDS can generate up to 10 gigabytes of data per day for an advertiser. Google Display & Video 360 (DV360), another DSP platform, also generates comma-separated files every hour for each impression, click, and conversion in ad campaigns, through its Data Transfer 2.0 service. Many other DSPs, such as Beeswax, Xandr and MediaMath, have their own log file services. Some of these log files, such as Beeswax’s Antenna, offer a lot of insight on auctions where the advertiser may not have bid or won the auction.

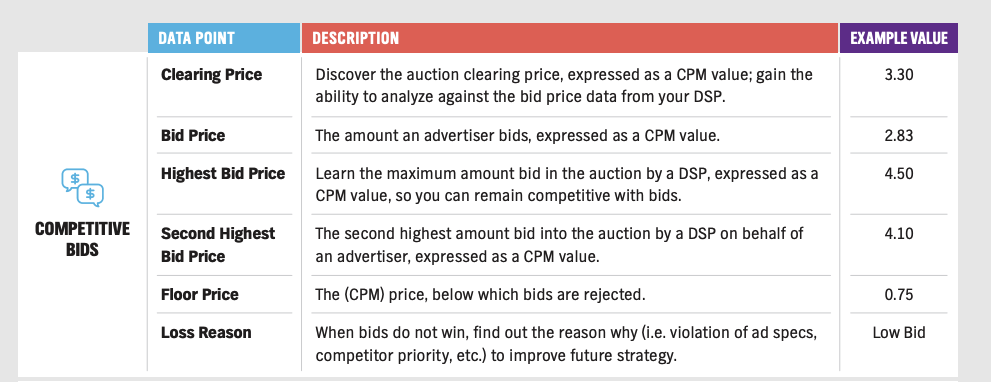

Supply-side platforms (SSPs) such as OpenX also make log-files available, such as OpenX’s Bids service. These SSP-derived log files can contain certain attributes or data fields that are not readily accessible in DSP log files.

Source: Pubmatic SSP-Log-Level-Data.pdf

Source: Pubmatic SSP-Log-Level-Data.pdfSophisticated publishers or media orgs also generate log files, either through Google Ad Manager 360 (GAM360) Data Transfer reports or via custom logging through services like Confiant, whic have custom client-side scanning and logging capabilities that allow them to measure and capture certain data that are not made readily accessible by GAM360.

Ad servers like Google’s Campaign Manager 360 (CM360) also have log file export capabilities, as do measurement vendors such as Oracle Moat.

The most authoritative study, done by ISBA and PwC, noted a lack of standardization amongst log file formats that can make it difficult to connect the data from different sources. One technical innovation that can allow data scientists to circumvent this issue is enrichment with orthogonal, 3rd party data. This data enrichment process can yield high-entropy join keys that allow a data scientist to pull together data from different log files, even when those log files did not have a field that would normally allow merging.

Results

A significant but variable proportion of media buyer’s spend goes to vendors; not publishers

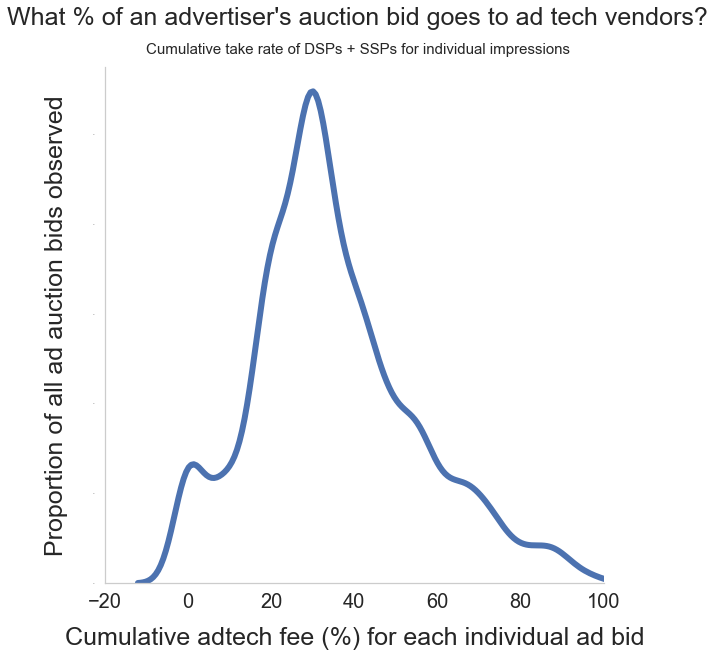

It appears that when a media buyer bids $10.00 for an ad slot, on average, up to 35% (on average) of that bid will go to the DSP and the SSP. For half of ad impressions, the cumulative middlemen fee (going to DSP and SSPs) will range from 22% to 45%.

When looking at the range of impressions, for 1 out of 4 ad impressions, 46% of the media buyers ad spend goes to either the DSP and/or the SSP. This subset of the distribution appears to be enriched with certain SSPs or platforms that sell native-like or “proprietary” ad formats on various sites.

Important methodological note: For a subset of ad impressions and auction bids, it is not possible to (immediately) determine if the recorded amount that was bid by the DSP accounts for any possible clawbacks, make goods, bid shading, and/or price reduction. Therefore, there may be some variability in the take rates reported in this section from the DSP.

This variability is consistent with what the 2020 ISBA study observed: Both DSP and SSPs fees “in the data can vary from contracted rates”. “DSP actual fees and contracts both averaged ~8%, but with individual variations.” “SSP fees on average within the study data appear to be ~14% of publisher revenues (equivalent to ~8% of advertiser spend), compared to underlying contracts showing ~12%.”

Unexpectedly, in some cases, a publisher was observed receiving a payment for a given ad impression that exceeded what the media buyer bid for that impression. For example, the media buyer bids $9.00 for an ad slot, but the publisher was observed being paid (net) $10.17. These situations, where the effective cumulative ad tech fee is less than 0% (e.g. the publisher receives more than 100% of the media buyer’s bid) appear to happen with specific SSPs that have highly variable take rates. In these cases, it appears that the SSP is subsidizing the media buyer’s bid, possibly in order to improve the SSP’s aggregate win rate (discussed in further detail below).

On the other hand, in certain other contexts, the publisher only receives “pennies on the dollar” - for example, if the advertiser paid a DSP $10.00, only $0.50 ends up being paid to the publisher. In these cases, the effective cumulative ad tech fee is between 80 and 98%. According to one media buyer who reviewed these results: “The high percentage of non-working media means that, for some advertisers, they could achieve greater media efficiency and performance by optimizing their supply path contracts.”

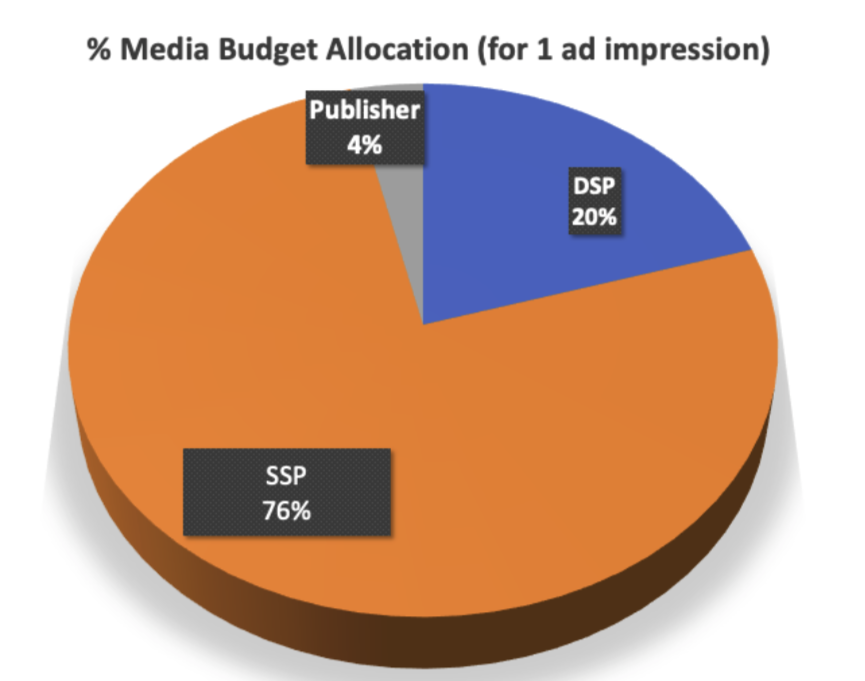

In one instance, the trading desk of a global agency holding company was observed bidding $8.04 (exclusive of brand safety, measurement, and audience data broker costs) via their DSP to place ads on behalf of their automotive industry client. Of this, only $0.29 (4%) ended up being paid out to the publisher, a major news and culture site. The DSP and SSP may have taken up to a collective 96% revenue share (not accounting for any possible clawbacks, make goods, bid shading, or price reduction).

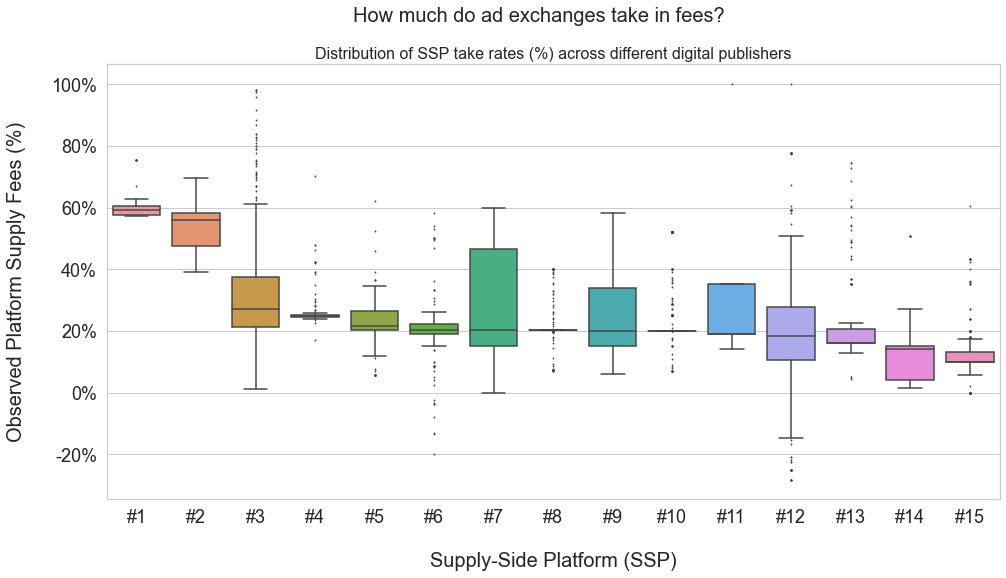

Some ad exchanges appear to have highly variable supply fees

By analyzing the clearing prices of individual ad auctions against the revenue per impression received by the publisher, one can identify the take rates of the SSP and the publisher, respectively. For example, if the winning bid in ad auction resulted in a clearing price of $5.00, and the publisher received $4.00, while the SSP received $1.00, the publisher’s revenue share for that impression is 80%, while the SSP supply fee (relative to the clearing price) is 20%.

For the majority of SSPs where data was available for this study, the median supply fee observed was indeed approximately 20%. There were two SSPs with significantly higher observed supply fees (>50%) - one of these has a custom auction bidding technology, and the other has a unique yield management solution. While one may assume that ad tech vendors negotiate fixed fees with specific publishers, the data suggests that in many cases, SSPs have highly variable revenue share or supply fees.

For example, for one SSP, the SSP was observed charging between a 7 and 42% supply fee from different impressions served for a specific publisher (a website that covers biotech industry news). This variability in take rates occurred for that specific SSP, even when controlling for the specific media buyer and DSP. Furthermore, this SSP was observed charging variable supply fees from both relatively small publishers, as well from several national papers of record and international media conglomerates.

Another SSP appeared to have more consistent fee structures - they would charge either 7% or 20% supply fees, depending on which specific ad unit slot was presented by the publisher in the ad auction (the top banner masthead, or smaller ad slots loading on the sides of an article on the website).

As alluded to previously, an unexpected phenomenon was observed wherein some specific SSPs appear to take a loss on certain ad impressions. In these cases, the amount paid to the exchange is lower than the amount paid to the publisher. The SSPs that engage in this phenomenon also occasionally charge very high supply fees, in some cases nearly 99%.

Why might these SSPs be taking a loss on certain individual ad impressions, whilst charging the publisher and media buyer a lot more for others?

It is possible that these SSPs are dynamically re-adjusting supply fees to maximize their chances at being the winning supply path in an auction. Improving their aggregate win rates could incentivize other stakeholders to transact through them more, particularly when using algorithmic ad buying strategies. This could allow the SSPs to recoup their expenses from subsidizing individual ad auctions.

When shown these results, one senior adtech professional offered additional explanations: “SSPs want to build insight into a valuable publisher by winning and getting visibility on to the page, they want to prove that they can get inventory. Also, sometimes they over promise a buyer and need to get more supply to keep a deal. There are a bunch of reasons why this might happen and we've long suspected that it gets juiced for a variety of reasons”.

The variability in observed SSP supply rates is consistent with the 2020 ISBA study. Wherein that study observed average SSP fees of ~14%, this present Adalytics study notices a higher average fee of ~23%. This discrepancy might be due to several methodological differences, such as the fact that the ISBA study was primarily focused on UK ad impression data and the media buys of several sophisticated agencies.

Image source: Source: ISBA Programmatic Supply Chain Transparency Study, May 2020

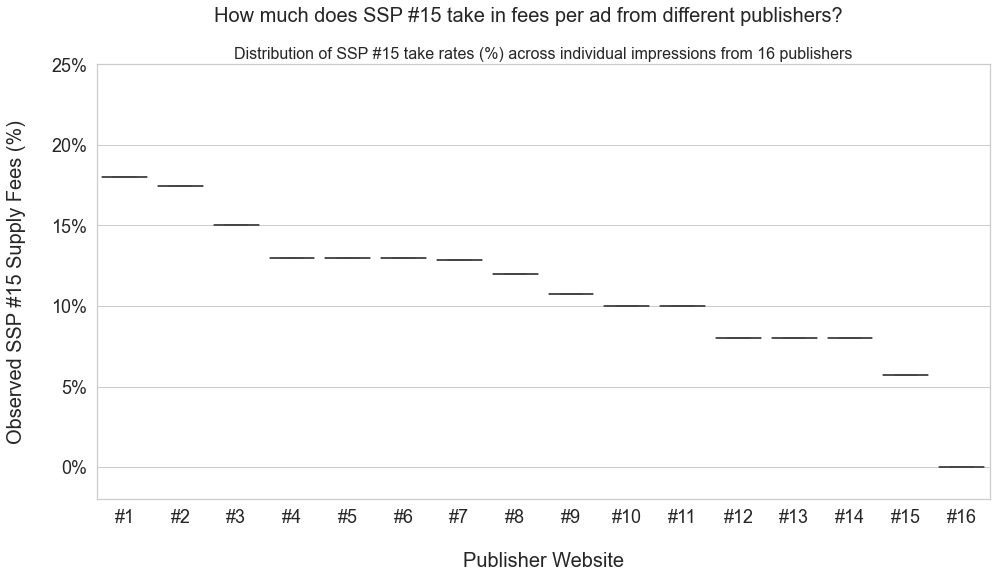

Image source: Source: ISBA Programmatic Supply Chain Transparency Study, May 2020SSPs have different supply fees for different publishers

Some SSPs have relatively fixed supply fees for individual publishers. For example, for one SSP, the amount of revenue share they charge is consistently 15% for one large US media organization that runs multiple different websites. However, even these SSPs appear to charge different rates to different publishers. In the chart below, one can observe the distribution of take rates across a sample of impressions from one specific SSP. Supply fees for this specific vendor were observed on 15 different websites. For website #1, this vendor was consistently charging a 18% supply, irrespective of which section or ad slot a given impression serves on. For websites #4, 5, 6, and 7, all owned by the same global mass media company, the vendor charges a consistent 13% supply fee. For websites #10 and 11, both owned by another media conglomerate, the specific ad exchange is charging a consistent 10% across all observed ad impressions.

Websites #12, 13, and 14 are owned by the same media conglomerate, and all impressions served via this SSP on these sites have a consistent 8% SSP fee.

Website #15, a well-known business news site that hired an industry-respected ad revenue executive a few years ago, appears to have negotiated a 5.7% exchange fee with this specific vendor.

Lastly, website #17 appears to have a consistent 0% supply fee with this specific SSP. This is likely due to a well known, unique business arrangement.

One of the websites that works with this specific SSP, publisher #9, is what some industry experts refer to as a “Made-for-advertising” site. These types of websites attract virtually 100% of their audience traffic through clickbait chumboxes and ads placed on social sites, and they serve hundreds of ad impressions within the duration of a page view session by covering the user’s viewport in 8-10 ad slots that are set to auto-refresh on a 10-second interval timer. Publisher #9 has a consistent 10.75% fee rate with this specific SSP.

Some media executives might find this surprising - how is it possible that a clickbait, ‘made-for-advertising’ site is able to get better supply fee rates with a major SSP relative to other publishers? For example, the following publishers and websites were observed to have a higher supply fee with this SSP than 10.75%, the rev share fee that Publisher #9 receives:

- a reputable news source read by Congressional staffers, US government officials, and Beltway think tank policy wonks

- a leading industry news site for the defense and arms sector

- a marquee arts and literature brand

Similarly, another ad platform, SSP #7, was observed charging a 20% supply fee to a leading biopharmaceutical industry news site read by many executives, as well as to a leading digital advertising publication. SSP #7 consistently charged only a 13% supply fee to the aforementioned ‘made-for-advertising’ site.

Adalytics reviewed the observed exchange fees from this study with several publishers and media organizations. The publishers were able to confirm some of the observed exchange rates were those they had agreed upon in their contracts; however, they also confirmed (without quantifying) that some of the observed exchange fees in this study were markedly different than those written in their contracts. These publishers are generally not at liberty to publicly disclose their contracted rates.

Conclusion

Caveats & Limitations

The data analysis and insights from this study have to be interpreted with a large degree of nuance and caution.

The study was not able to control for many factors, such as instances where there was missing data or data corruption. The study also excluded all instances of “explicit anomalies”, such as when the pricing data reported to the DSP and to the exchange was markedly inconsistent for a specific ad impression, or where the auction bid URL was different from the actual page URL on which an ad loaded upon.

The study was also limited in geographic scope, time range, and device type. For example, this study did not include or analyze any data from CTV ad campaigns. The study also did not account for direct sold ads.

Lastly, this study did not account for post-ad auction financial reconciliations, clawbacks, ‘make-goods’, or certain specific types of DSP bid shading or price reductions that can materially affect how much a advertiser effectively paid for an impression or how much a publisher actually received.

Some of these limitations could be mitigated with access to more data, and generate more accurate and representative estimates.

Discussion

The data analyzed in this study, from a range of DSP and SSP platforms, ad exchanges, and publishers, shows the high levels of variability in ad vendor supply fees. Even when controlling for factors like publisher domain, ad slot position, ad size, and auction type, there still appears to be a high level of variability in how much certain ad tech vendors take in revenue share. This is particularly accentuated in cases of SSPs that offer proprietary or native-like ad formats.

Large premium media organizations and small-scale publishers were observed paying very high (more than 60%) supply fees to SSPs on some individual ad impressions.

Some SSPs appear to even take a loss on certain impressions by paying out more to the publisher than they were paid in total for that ad impression. This may be related to some kind of dynamic win rate optimization or capital reallocation mechanism.

Certain ad exchanges, such as Google AdX, allow publishers to configure their revenue share. Google AdX has a setting, which allows publishers to “enforce your contracted revenue share for each ad request”, which makes it so that “Ad Exchange pays a contracted revenue share which is based on an average over the course of the billing period.” Some publishers privately reported to Adalytics that they feel “frustration with the inability to test this feature, it is an all or nothing setting". Previous studies organized by the ANA and ISBA observed some similar supply fees from various ad tech vendors, as well as variability in the supply fees. The ISBA study noted that oftentimes, the impression level fees deviated from the contractually-agreed upon fees.

In this present-day study, Adalytics reviewed the observed exchange fees from this study with several publishers. The publishers confirmed (without quantifying) that some of the observed exchange fees in this study were markedly different than those written in their contracts.

The ANA is in the process of initiating another such study with PricewaterhouseCoopers (PWC). Given the variability in supply fees and take rates observed in Adalytics study, it may be the case that future analyses cannot make simple assumptions about average or fixed supply fees. These studies will likely need to pull in log files from multiple sources in the ad tech supply chain, and develop unique capabilities relying on orthogonal data augmentation and enrichment to enable joining log files that may not necessarily share direct join keys.

Lastly, this study raises broader questions for policy makers in Brussels and Washington, D.C., CMO's, and ad tech industry executives when considering the future of how the Open Web is funded through a digital ads model. The UK’s Cairncross Review on “challenges facing high quality journalism” asked: “Has the programmatic advertising system placed publishers in a worse position in terms of advertising revenue? The number of companies involved in a transaction means that revenue that once went only to the publishers is now split with other parts of the supply chain”.

In this study, there was an interesting juxtaposition. On one hand: a clickbait, ‘made-for-advertising’ site with auto-refreshing ad slots that attracts 100% of its audience traffic through chumbox widgets. On the other hand, several publishers with unique and high value audiences, such as sites that attract Congressional staffers, biopharmaceutical executives, or defense industry businesspeople. The clickbait site was able to negotiate better supply fees with ad exchanges than the specialist news sites. This suggests that raw volume of ad impressions offers stronger bargaining power for publishers than coveted audiences or premium content. If the programmatic ad tech ecosystem creates financial incentives that prioritize volume of impressions over all else, then one may begin to question whether advertisers’ business goals are truly being served, and whether premium publishers will continue to be able to invest in activities like investigative journalism and content production.

Take-away points

- Ad tech vendors can charge highly variable supply fees, some ranging as high as 98% of what an advertiser is paying for an ad slot. This can significantly cut into the revenues received by publishers or content creators.

- Some ad tech vendors appear to provide better terms to high volume but less premium publishers.

- Publishers, media agencies, and advertisers (including US government agencies and political parties running ad campaigns) should regularly monitor log files from their programmatic ad campaigns, and verify whether the supply fees charged to them are in fact the supply fees that are in their contracts with vendors.

- Contact Adalytics if you want help with these log file analyses.